Few cryptocurrencies have as storied a history as the one that inspired The Flippening: a countdown to the moment at which this cryptocurrency will overtake Bitcoin as most valuable by market cap.

In December of 2013, Vitalik Buterin wrote a white paper proposing Ethereum: a decentralized, global computer run on a blockchain.

Since that initial proposal, Ethereum has evolved from a theoretical network into an ecosystem of developers, investors, and entrepreneurs, sporting the second largest cryptocurrency in the world by market cap.

There’s been:

- 📈Mass rallying around Buterin’s idea: Ethereum got off the ground with an $18M crowdfunding campaign in the summer of 2014. It was this community support that gave Ethereum the momentum to become a network that people actually wanted to develop on.

- 📉Fear about the network’s security and the tyranny of the majority: the now-infamous DAO hack of June 2016 revealed to many the underlying risks of a global, decentralized network that can be hacked and whose trajectory can be determined by a fairly centralized entity.

- 📈Fever-pitch excitement as ICOs proliferated and Ethereum’s value exploded: as ether became the second biggest cryptocurrency in the world, ICOs provided a clear use case for Ethereum, inspiring confidence in the network’s utility.

- 📉Increased awareness of Ethereum’s fundamentals in the context of the current cryptorecession: with countries like South Korea and China tightening requirements around cryptocurrency exchanges, people have become more aware of the potential underlying value that Ethereum offers as a decentralized network.

Ethereum’s story — and price history — has been one of bullish excitement tempered by the growing pains of an entirely new kind of computer maturing over time.

📈 July 22, 2014, to April 29, 2016: Rallying around Buterin’s idea as Ethereum moves from concept to reality

he launch of Ethereum was an experiment to test the value of Vitalik Buterin’s proposal for a decentralized computing platform on a blockchain. It ended up becoming the third largest crowdfunding project to date. The early days were focused on showing that Ethereum could be a real platform instead of a mere concept.

📈 July 22, 2014

Ethereum presale opens, raising 3700 Bitcoin for $7.2M ETH (~$0.30USD/1ETH) in the first 12 hours

The developers at Ethereum have big plans, and they need money to execute those plans. Hitting the presale’s financial goals will keep them on pace to releasing the Ethereum platform sometime this upcoming winter.

📈 May 9, 2015

Olympic, Ethereum’s final proof-of-concept testnet, is released

The purpose of Olympic is to reward people who try to test the limits of the Ethereum blockchain during the pre-release period, spamming the network with transactions and doing crazy things with the state, so that we can see how the network holds up under high levels of load. Olympic will feature a total prize fund of up to 25,000 ether.

📈 July 30, 2015

Frontier, Ethereum’s first public release, is launched

The launch of the Ethereum mining network and the ability to execute contracts happened earlier today, following eight proof-of-concepts and a barrage of stress tests in the last release, Olympic. Though it’s publicly available, Frontier — which comes in a “bare bones” command line format — is aimed squarely at developers as a live testing environment.

📈 March 14, 2016

Ethereum undergoes a hard fork and upgrades to Homestead

The introduction of Homestead follows Frontier, Ethereum’s inaugural release, which was released to developers in July 2015. Further, it comes on the heels of escalating interest in the open, public platform, which is attracting the interest of major financial institutions, in part due to its support for self-executing smart contracts.

Ethereum depended on community support to move from concept to reality. Its presale, which lasted from July 22, 2014 to September 2, 2014, ended up raising $18M, making it the third-largest crowdfunded project in history.

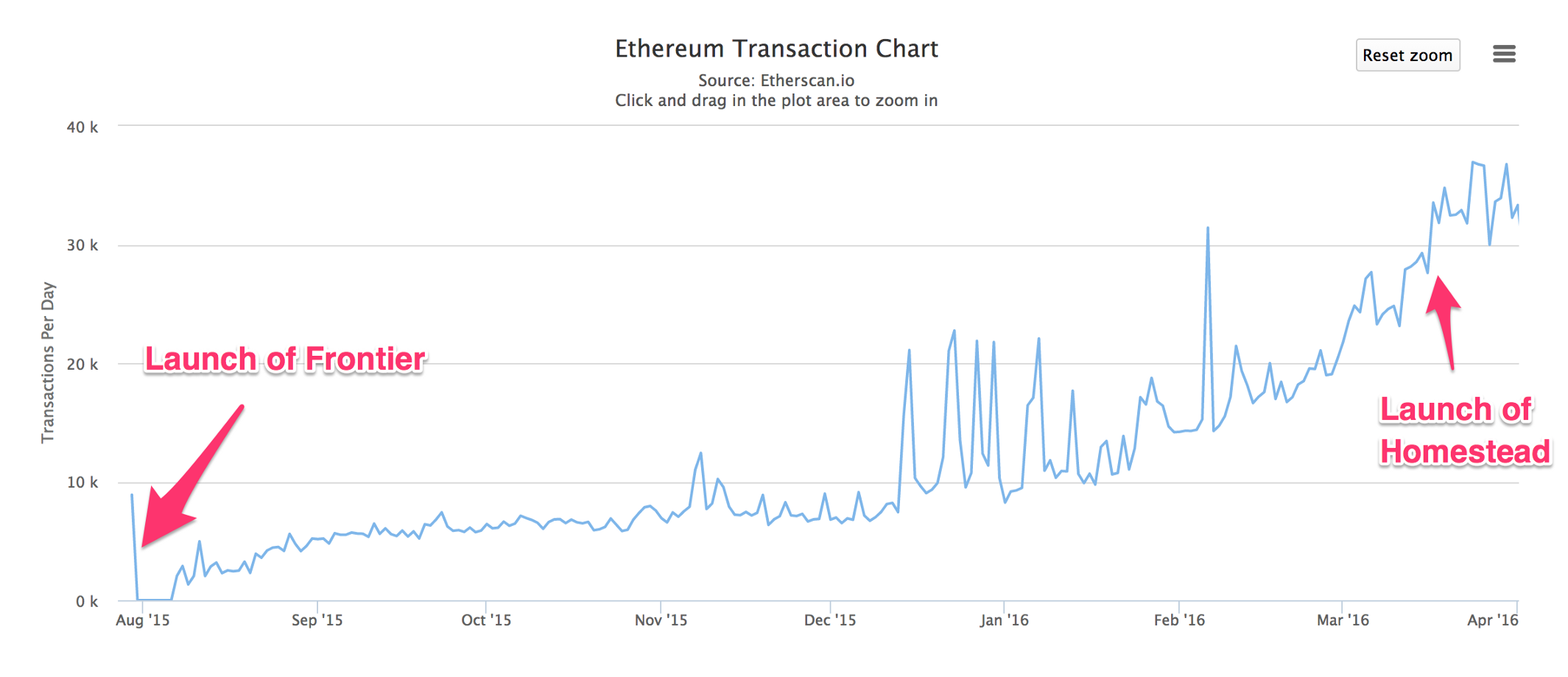

After the initial funding, each subsequent release of Ethereum increased people’s confidence that Ethereum could actually be built on as a decentralized computer.

- Proof-of-concept releases, of which Olympic was the last, allowed Ethereum to receive a thorough battery of testing and debugging. This set the tone for the series of future releases and forks that continue to characterize Ethereum’s gradual improvement over time.

- Frontier, Ethereum’s first public release, was intended only for serious developers. It gave them a minimum viable product with which to begin engaging and developing on the network.

- Homestead, Ethereum’s second public release, was the first “production release” of the network: it was easier for those without a highly technical background to use and included a network change that increased transaction speeds and allowed for future protocol revisions.

At each step in this initial process of getting Ethereum running, the price of ETH increased, perhaps as a result of people being able to do more with the network.

- In the proof-of-concept releases, people couldn’t actually use the network at all.

- With the release of Frontier, it became possible to mine ETH, and developers — but only the most technically advanced — were able to start developing dApps.

- Homestead significantly lowered the technical barrier-to-entry for developers to build dApps on the network.

During the presale, you could have bought 1 ETH for about 30 cents; by the time Homestead launched, the price of 1 ETH was about $12.50.

📉 April 30, 2016, to January 31, 2017: The DAO hack brings an existential crisis for Ethereum

When the DAO was hacked, the Ethereum community was shaken to its core: how secure was the network? How “decentralized” was Ethereum, in practice? In the wake of the hack, the ETH market remained bearish through the end of the year and into the start of 2017. Many people continue to hold up the DAO hack as a cautionary tale of the risks associated with a decentralized computing network.

📈 April 30, 2016

The DAO, a totally new type of distributed autonomous organization, has started a paradigm shift in how resources and people can work together without trust to build new things.

📉 June 17, 2016

CRITICAL UPDATE Re: DAO Vulnerability

An attack has been found and exploited in the DAO, and the attacker is currently in the process of draining the ether contained in the DAO into a child DAO. The attack is a recursive calling vulnerability, where an attacker called the “split” function, and then calls the split function recursively inside of the split, thereby collecting ether many times over in a single transaction.

📉 July 20, 2016

Ethereum Executes Blockchain Hard Fork to Return DAO Funds

At approximately 14:30 UTC today, China-based Ethereum miner BW.com mined the Ethereum blockchain’s 192,000th block. Seconds later the mining pool also mined the first block on the new blockchain, which returned funds lost in the collapse of the DAO to an account available to its original investors.

But the hard fork also marks the launch of a spin-off project: Ethereum Classic. Ethereum Classic continues on the existing Ethereum blockchain and has not implemented the hard fork code to “undo” the DAO. According to the project’s website, this is because “Ethereum Classic intends to keep the original censorship-resistant Ethereum going” and “provide an alternative for people who strongly disagree with DAO bailout.”

📉 August 28, 2016

How a $64M hack changed the fate of Ethereum, Bitcoin’s closest competitor

In the wake of the hack, Buterin decided to turn back the clock through a software update and reset the entire system to its previous state — i.e., before the hack. The reset created a so-called hard fork, which split Ethereum into two parallel systems. Buterin assumed most users would move to the reset platform, but the fork proved divisive and a small group of users continued using the old system, dubbing it Ethereum Classic and arguing Buterin had no right to reset the platform. That has confused cryptocurrency investors and cast a pall over the future of Ethereum.

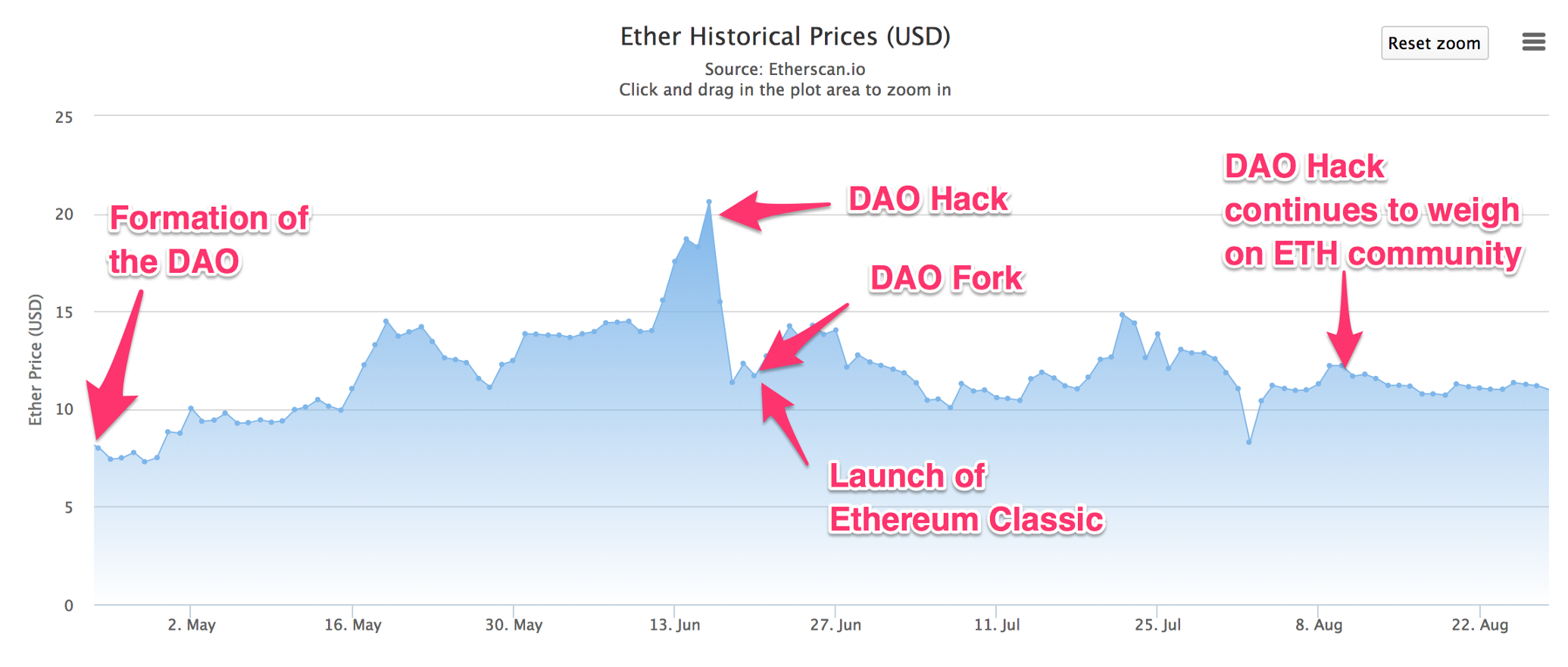

The DAO was meant to be revolutionary: it would be the first decentralized, automated, investor-direct venture capital fund, run through smart contracts on Ethereum. It raised $150M worth of ether in its May 2016 crowdsale. During that same period, the price of ETH climbed to a peak of about $20.

Then, on June 17th, the DAO was hacked.

A hacker exploited a recursive calling vulnerability in the smart contracts — not in Ethereum itself — to steal 3.6M ETH. At the time, that was the equivalent of about $64M, taken in an instant. ETH’s price was effectively cut in half overnight, from $20 to $10.

The Ethereum team had the choice to either let the stolen ether remain in circulation, or else to execute a hard fork and refund the DAO’s investors. They put it up to a community vote.

While the community was divided, the majority opted for the fork. 90% of the network’s hash power migrated to the new blockchain, while a small — but vocal — minority stayed behind on the network that became known as Ethereum Classic.

This minority saw the DAO fork as an existential crisis for Ethereum. To them, the fork established a dangerous precedent: they worried that the “majority” of Buterin and his allies could erase transactions arbitrarily by electing to fork the network whenever they pleased.

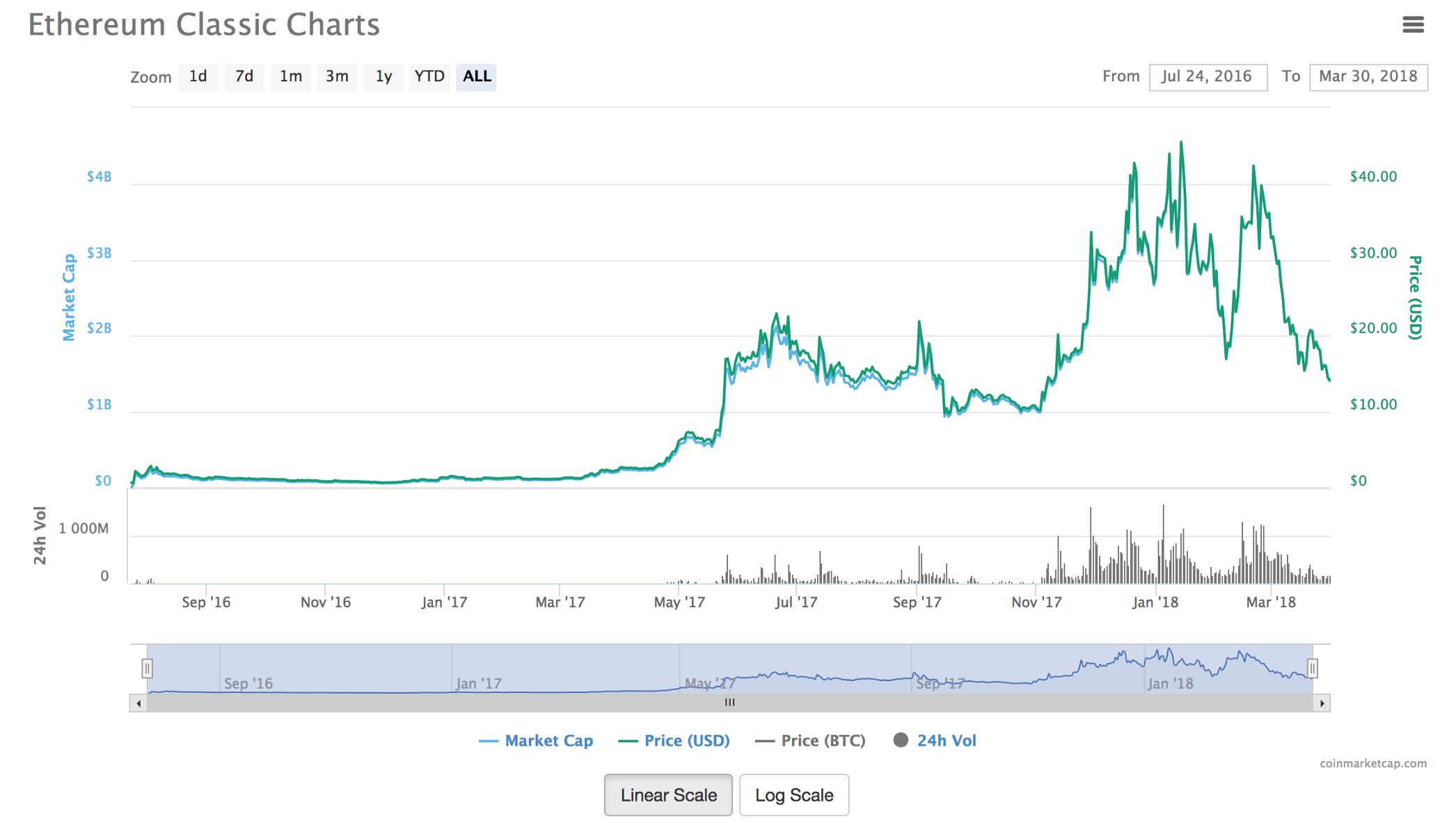

Many expected that Ethereum Classic would just be a symbolic gesture with no real value behind it, since 90% of the hash power had left with Ethereum proper. Yet the price of Ethereum Classic climbed to about $20 by mid-2017, and peaked at just over $45. This suggests that there may actually be value to the kind of immutable Ethereum network that DAO-fork dissenters envisioned.

The DAO hack’s challenge to Ethereum’s security and governance shook the community for months. A bearish market followed, with the price of ETH hovering at between $7 and $13 for the rest of the year. By late November, the price of ETH was back at about $9.50 — the same price it had been at back in early March.

📈 February 1, 2017, to January 14, 2018: ICOs Proliferate and Ethereum’s Value Explodes

2017 was the Year of the ICO. The price of ether proceeded to climb as people bought ETH in order to purchase the latest tokens. Major exchanges began listing ether as more organizations dedicated to the advancement of Ethereum and the development of dApps formed.

📈 June 1, 2017

$35 Million in 30 Seconds: Token Sale for Internet Browser Brave Sells Out

Overall, the sale for Brave’s Ethereum-based Basic Attention Token (BAT) generated about $35m and was sold out within blocks, or under 30 seconds. One buyer went so far as to purchase 20,000 ETH (or about $4.7m) worth of tokens — designed to monetize online attention and create a new revenue source for publishers. Another buyer paid more than $6,000 in Ethereum mining fees to almost guarantee their place at the top of the line.

📈 June 15, 2017

Ethereum unleashed the “initial coin offering” craze, but it can’t handle its insane success

The latest craze in the cryptocurrency markets just got crazier. An outfit called the Bancor Foundation raised $153 million worth of ether (the coin of the cryptocurrency Ethereum) by selling its digital tokens (the equivalent of shares) for three hours on June 12, making it the largest token sale ever.

📉 June 16, 2017

ICOs “High On Radar” Of US SEC — Regulator Source

Quoted by Reuters on Wednesday, a regulator who asked to remain anonymous confirmed the Commission was eyeing the wildly popular fundraising instrument. “I know that this is something that’s high on their radar,” the source confirmed. The speed and unprecedented success of ICO campaigns have brought both joy and sorrow to cryptocurrency and Blockchain investors. Such are the sums involved in the now $90 bln market that many began fearing early on that it would not be long before regulators became involved. “It’s like painting a target on yourself. Because, what does an organization like the SEC regulate? They regulate IPOs,” Coin Center’s Peter Van Valkenburgh told a recent conference panel.

📈 January 10, 2018

Ethereum hits a fresh record high and is up over 13,000% in a year

“Ether’s price rally is a testament to the growing popularity of Ethereum as a platform for decentralized applications. Over the last year and a half, we’ve seen that the majority of tokens issued during ICOs and traded on exchanges, have been coded to run on the Ethereum network,” Thomas Glucksmann, head of APAC business development for cryptocurrency exchange Gatecoin, told CNBC by email.

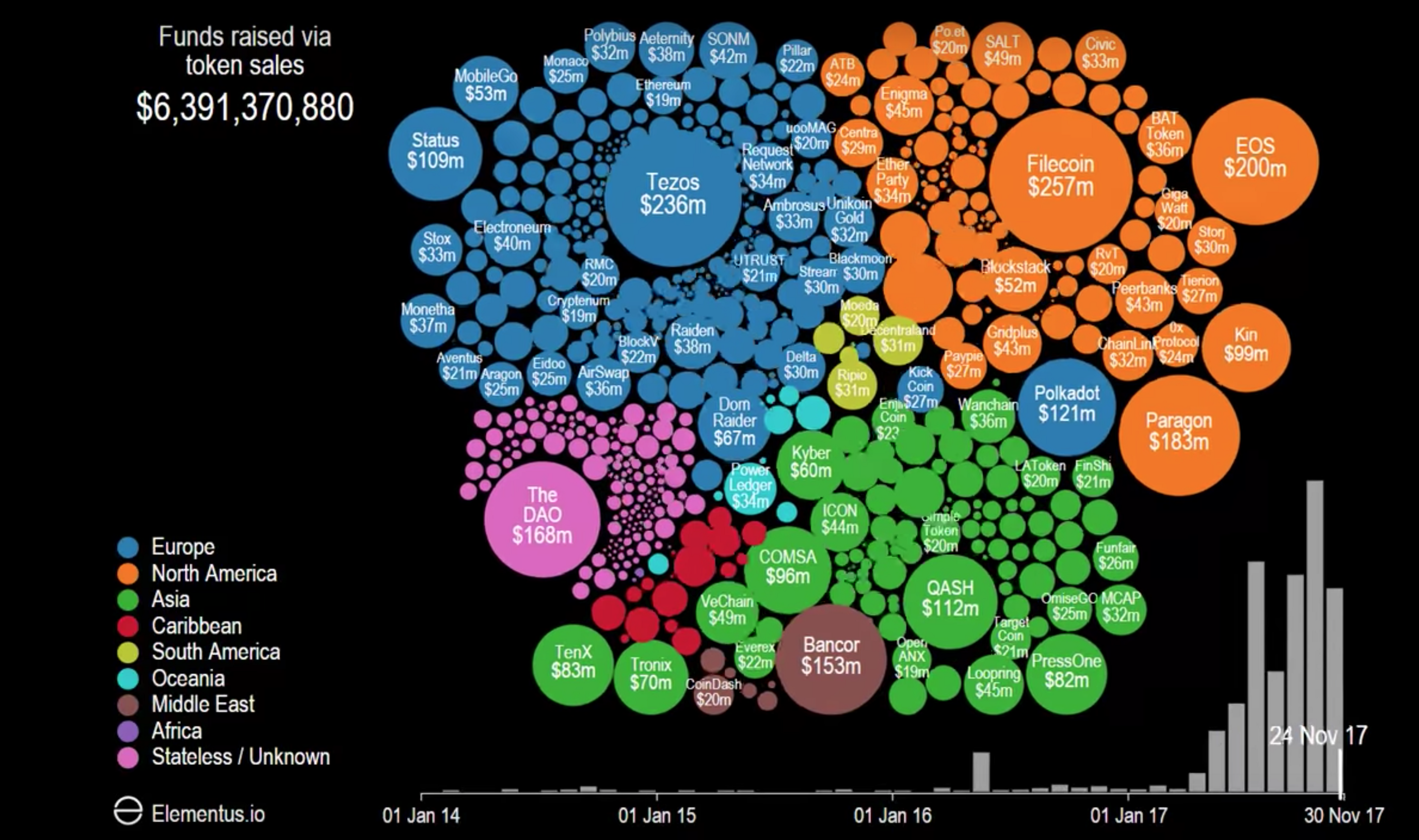

ICOs were the headliners for Ethereum news in 2017: they found a product-market fit that drove up ETH’s price exponentially.

Investors bought a huge amount of ETH, ostensibly to participate in ICOs. So, for instance, the price of ETH climbed from about $300 to about $390 during the ICO for Filecoin, a file-sharing dApp that had the highest grossing ICO all year. BAT, one of the earliest ICO success stories, drew in $35M worth of ether in 30 seconds.

With the manner in which ICOs continued to grow they predictably drew the attention of regulatory bodies like the SEC, which brought up the underlying anxiety of how regulation would impact this use case of Ethereum. ICOs continued to happen, though: almost $3B was raised for ICOs in October and November.

ICOs demonstrated one of Ethereum’s underlying sources of value: the network’s smart contracts, married with a standard that made it easy for anyone to create a new token, empowered new companies to collect money from investors in a way that afforded more security to investors than traditional, paper-issued shares in a company. But the low barrier-to-entry for token creation also made it easy for scammers to abuse the ICO system and make off with huge sums of money while delivering no good or service in return — something the SEC has been at the forefront on.

When cryptocurrency started penetrating the mainstream media in November of 2017, ETH’s price was amplified along with Bitcoin’s: ETH’s price at the start of November was about $290, and it steadily increased until reaching $1385 on January 13, 2018. We added ETH trading to SFOX on January 11 as a way to add liquidity to this burgeoning ecosystem of ICOs: both by making it easier for investors to buy ETH and participate in ICOs, and for companies that conducted ICOs to convert some of that ETH into fiat currencies.

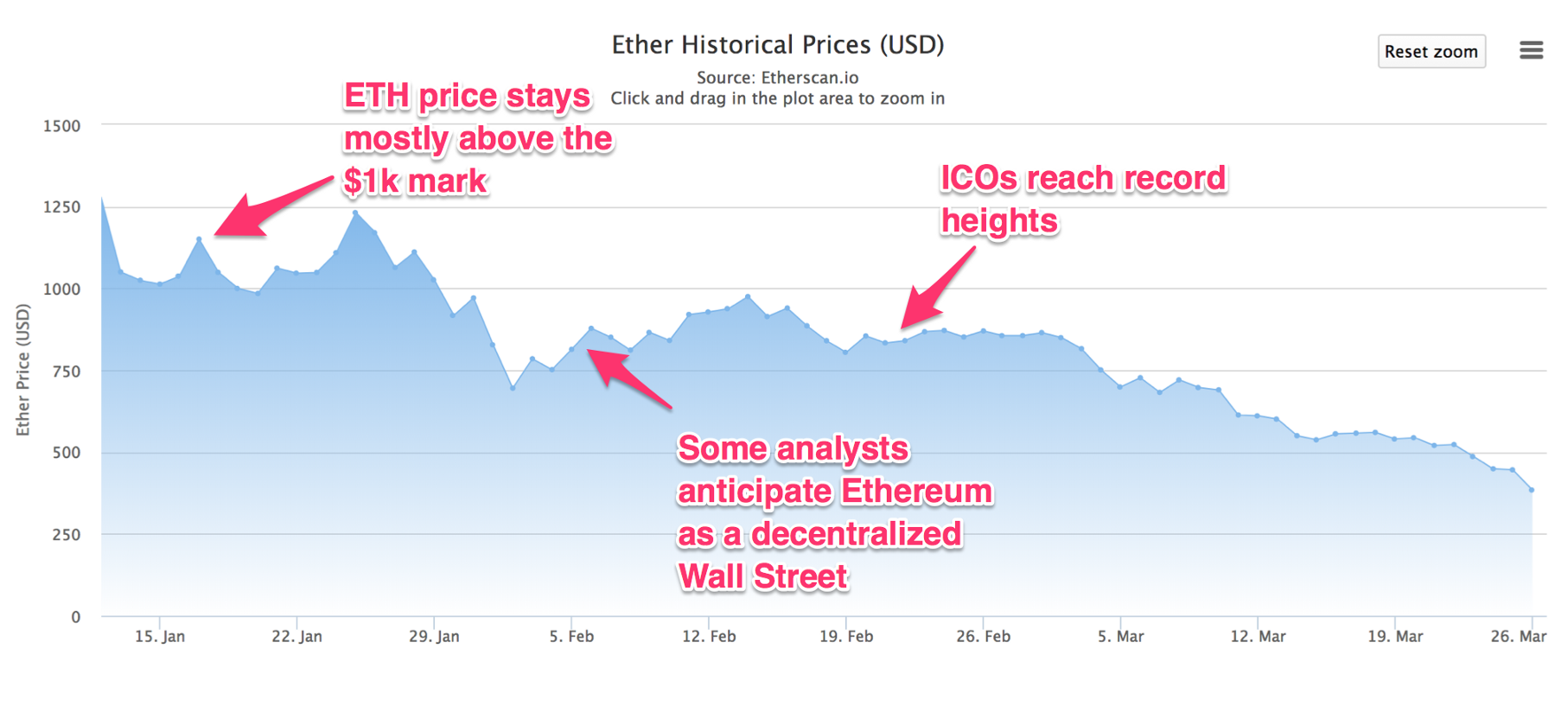

📉 January 15, 2018, to the Present: Reinforcing Ethereum’s underlying value in the current cryptorecession

Following ether’s all-time-high price on January 13, 2018, the promised of increased cryptocurrency regulations in Asia led to a crash. But Ethereum’s price, until recently, was more resilient than other cryptocurrencies’, demonstrating that the cryptocurrencies that will last are those that have strong fundamentals underpinning them.

📈 January 19, 2018

After Dip to $799, Ethereum Price Bounces Back to $1,050

Although most people are keeping a close eye on what is happening to Bitcoin right now, it is evident that the worthwhile altcoins are recovering a lot quicker. For instance, it seems Ethereum is moving up in value rather quickly, even though Bitcoin is still struggling to surpass US$12,000.Although most people are keeping a close eye on what is happening to Bitcoin right now, it is evident that the worthwhile altcoins are recovering a lot quicker. For instance, it seems Ethereum is moving up in value rather quickly, even though Bitcoin is still struggling to surpass US$12,000.

📉 February 8, 2018

The Ethereumization Of Wall Street Is Inevitable: Expert Take

The genius of the Ethereum Blockchain was making fundraising so incredibly easy: all you have to do is create a smart contract to do an ICO. Every time ETH (Ethereum tokens) are sent to the contract address, the contract issues newly minted tokens that are automatically sent back to the sender. Wall Street should be terrified because Ethereum has just made investment banks redundant.

📉 February 21, 2018

Ethereum Price Analysis — ICOs reach record heights

According to CoinSchedule, ICOs raised over US$1 billion in December, the highest month on record. Less was raised in January, but with Telegram’s expected US$2 billion raise, including a US$850 million pre-sale, and Venezuela’s Petro ICO raising a reported US$735 million in pre-sale, February 2018 will surpass December 2017. The record-setting ICOs will likely bring increased transactions and fees throughout Q1 2018, as well as increasing interest in the ICO as a funding model. For comparison, Google raised US$1.9 billion during its IPO, while Twitter raised US$2.1 billion.

South Korea and China have been big players in the mining and trading of a wide range of cryptocurrencies, including ETH. This has impacted ETH’s price adversely since the middle of January, when the South Korean and Chinese governments started aggressively shutting down and regulating cryptocurrency exchanges, preventing people from doing things like trading ETH or participating in ICOs.

But in the face of this cryptorecession, Ethereum is proving to be more resilient than many other cryptocurrencies. That Ethereum has a robust community of developers behind it, with many ideas for dApps and real use-cases of the network, makes its potentially attractive, even as investor fervor brings price fluctuations.

This recent trend has reinforced that ETH isn’t something that’s meant to store value in the way that gold or Bitcoin is: rather, it’s fuel for a network that developers and entrepreneurs actually use for things like dApps and ICOs. It even has the potential to act as a decentralized NASDAQ in the future.

As the developer community continues to grow, then, it stands to reason that the fundamental value of ETH will only increase.

The future of ETH in the face of increased regulation

Now, for reasons that aren’t yet clear, the price of ETH has been decreasing sharply, with ETH just under $400 at the time of writing. But the fundamental value Ethereum has demonstrated, through its growing developer ecosystem and litany of ICOs, provides reason to remain optimistic about the cryptocurrency. We’re excited to support Ethereum as it continues to evolve.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.