In 2018, Facebook announced that it was putting its VP of Messaging Products, David Marcus, in charge of an experimental blockchain unit at the company.

Two months ago, a little more than a year later, Facebook unveiled Libra: a permissioned cryptocurrency backed by a basket of fiat currencies and Treasury securities.

In Marcus’s words, “Libra’s mission is to enable a simple global currency and financial infrastructure that empowers billions of people.”

Given Facebook’s recent history with privacy, the Libra announcement was met with nearly universal skepticism. Lawmakers in Congress almost immediately called in David Marcus for hearings. Jerome Powell, Chair of the Federal Reserve, made a statement that expressed the Fed’s “serious concerns” with Libra, stating that issues regarding “money laundering, consumer protection, and financial instability” would need to be addressed before the project moved forward.

While cryptocurrencies like Bitcoin and Ethereum run on an ethos of decentralization, where anyone with a computer can run a node and join the network (at least theoretically), Libra proposes a more centralized cryptocurrency, with nodes run by a consortium of large companies — Uber, PayPal, Visa, Mastercard, and more.

But in spite of all the criticisms that have arisen since the Libra announcement, one thing is clear: Libra is good news for the cryptocurrency ecosystem.

Libra may be permissioned and more centralized than Bitcoin, but that’s okay. The utility of Libra isn’t in upholding the purity of blockchain as a concept: rather, its primary utility is in bringing it to the masses and forcing crypto to evolve to its next stage of development.

As BlockStack CEO Muneeb Ali observed, “Facebook’s Libra looks more like AOL than the open internet.” Like AOL, Libra has the potential to introduce Facebook’s billions of users to cryptocurrency. Like AOL, Facebook’s involvement will force government entities to create greater regulatory clarity around cryptocurrency. And, like AOL, big companies with broad reach will be the ones that benefit the most from Libra.

In this article, we’ll explain what Libra is, before diving into some of the ways that it may serve as an unexpected boon to digital currencies.

What is Libra?

Libra is a digital asset that uses a cryptographic system to validate transactions, confirm them, and add them to a ledger of transactions. In this regard, Libra is like Bitcoin.

However, unlike Bitcoin and other proof-of-work cryptocurrencies, which rely on miners solving a difficult puzzle to verify transactions, Libra will rely on a trusted group of validators to achieve consensus through a system of voting.

This will make Libra more centralized than Bitcoin — as the protocol is essentially controlled by these validators — but it also means that Libra will be faster and more efficient than Bitcoin.

This falls in within one of the primary goals of Libra, as enumerated in the whitepaper:

[The ability] to scale to billions of accounts, which requires high transaction throughput, low latency, and an efficient, high-capacity storage system.

Bitcoin has a throughput of roughly seven transactions per second; Libra aims to achieve 1,000 transactions per second. This makes Libra more suited than Bitcoin to work as a fast and cheap medium-of-exchange for everyday transactions — but this speed comes at a cost.

As technology analyst Ben Thompson points out, there’s a fundamental trade-off between decentralization and efficiency: “Whereas anyone can ‘rebuild the spreadsheet’ in the case of a cryptocurrency like Bitcoin, normal users have to trust Libra’s validators.”

Omitting miners makes Libra faster and more efficient, but it also means that validators running nodes essentially control the protocol. Libra attests to being committed to privacy, but skeptics point out that companies running validator nodes would have financial data from Libra users in the form of transactions on the ledger.

While Libra will begin as a permissioned network, Libra wants to become more decentralized and permissionless over time. In the short term, however, Libra’s relative (compared to Bitcoin) centralization serves the project’s main aim: building a base of users around the world quickly and providing them with a product they can actually use.

Libra can open global access to crypto

America Online (AOL) introduced millions of Americans to dial-up internet, providing many with their first taste of the internet. AOL bundled together multiple internet-based services into one easy-to-use package, including everything from an email client, to an instant messaging service, to a web browser in one closed ecosystem.

While the open internet ultimately won — people wanted to choose their own browsers, messaging services, and email — AOL played a key role in introducing people to the possibility of the internet.

Libra has the potential to do the same for crypto.

Like AOL, Libra will be a closed and permissioned ecosystem — but it has the potential to create a user-friendly cryptocurrency already plugged into products that people use. Facebook alone has 2.4 billion daily active users, and Libra’s founding association reads as a who’s who of consumer internet giants, from Booking.com and Spotify to Uber and PayPal.

While it’s too early to say which of these platforms will actually support Libra as a valid method of payment, the potential here is to solve one of the major adoption problems that cryptocurrency has faced over the last decade: the lack of integration with the tools that most people use in everyday life.

As Union Square Ventures’s Nick Grossman wrote:

As of today, there is still no mainstream web browser with crypto built-in, no mainstream phone with crypto built-in, and relatively few mainstream applications with crypto built-in. As that changes, crypto assets have the potential to move from being curiosities for enthusiasts to being default internet and financial infrastructure.

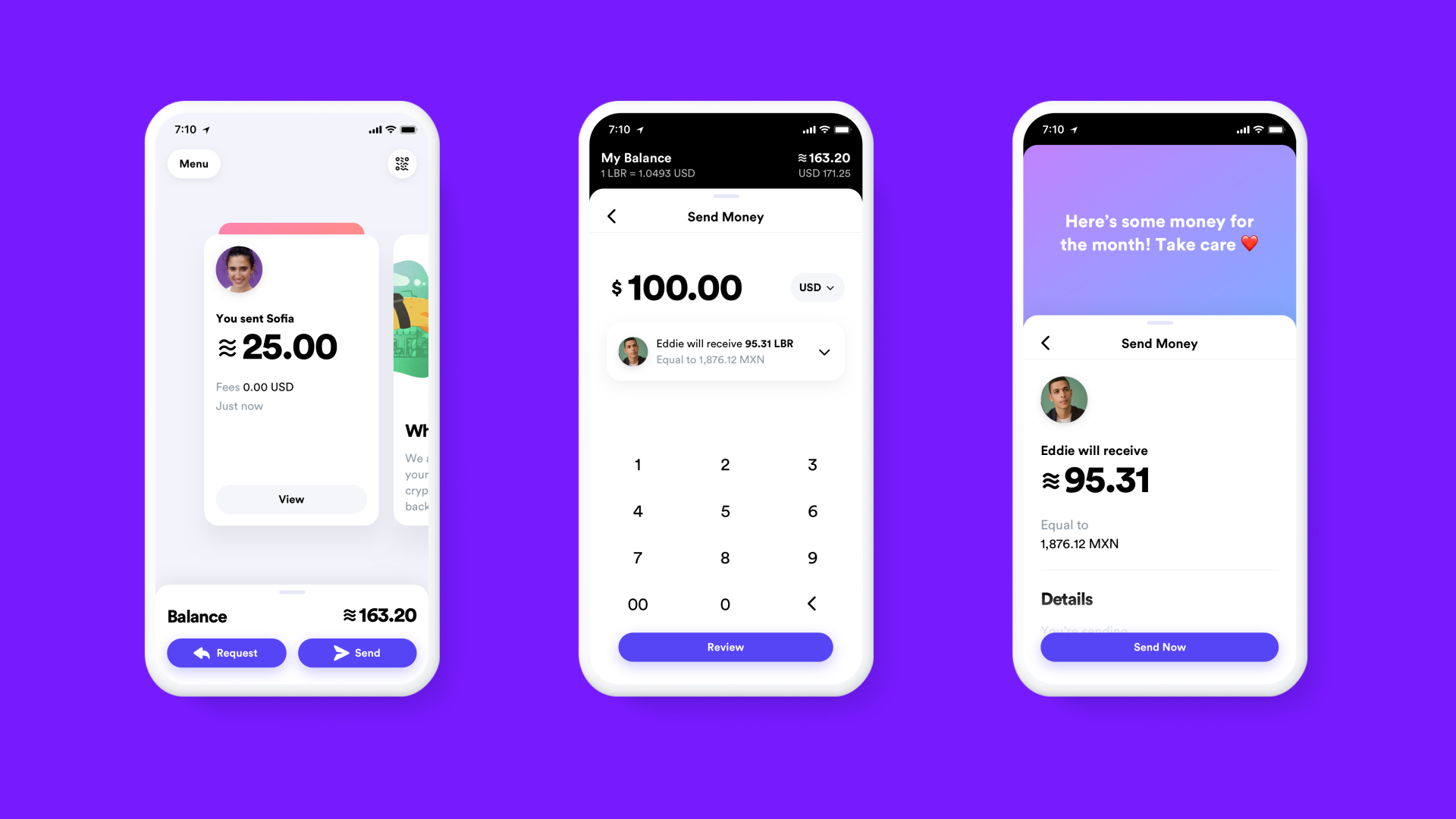

Much like AOL did with its portal of internet services, Facebook is building out the infrastructure for users to send and receive digital assets, beginning with the Calibra digital wallet. Calibra will be tightly integrated with other Facebook products such as WhatsApp, Messenger, and Instagram — and likely with products from other members of the Libra Association.

Consider the following hypothetical scenario: Uber, a member of Facebook’s Libra Association, currently pays 2% to a payment processing company per ride. Using Libra, they could reduce fees significantly — and perhaps even offer a 1% rebate to users as an incentive to use Libra. If one were a driver for Uber, the rebate might be worth it for one to accept all payments in Libra. Once one had a significant portion of one’s savings in Libra, one might decide to use Calibra to diversify and invest in other digital assets.

In the history of the internet, closed ecosystems like AOL ultimately lost to the open internet — but those closed systems provided a jumping-off point for adoption. We could be seeing history repeating itself with Libra.

Libra will help clarify regulations around crypto

Cryptocurrency is a global phenomenon, but it can be difficult to use. Part of the problem has been the lack of mainstream applications for using digital assets. Another big challenge around this, however, is the lack of regulatory clarity around cryptocurrency.

In the early days of the internet, centralized internet providers such as AOL forced a lot of early legislation and regulation, including Section 230 of the Communications Decency Act, which prevents ISPs from being liable for illegal actions committed online by their users. Libra may do something analogous for crypto.

Currently, lack of regulatory guidance is one of the big things that are holding the industry back, especially in the U.S. For example, the Commodity Futures Trading Commission (CFTC) regulates Bitcoin as a commodity, but the Internal Revenue Service (IRS) treats it as property.

If you’re using Ethereum as a utility token to play games, for example, according to the IRS, you may be liable for taxes on a per-transaction basis. Meanwhile, crypto businesses, such as exchanges, face uncertainty over which assets can be traded in the U.S. — driving some overseas.

Fidelity Digital Assets recently conducted a study of over 450 institutions on digital assets, and while the research showed that 20% of institutions plan to allocate funds toward digital assets, lack of regulatory certainty was one of the most commonly cited blockers for entering the space.

Within weeks after Facebook’s announcement, Libra had already provoked responses from Congress, the Federal Reserve, and the U.S. Treasury Secretary. Whether or not it will ultimately succeed is unclear, but it is forcing the issue of regulation for crypto — and that can only be good for the sector.

Libra will be an on-ramp for big companies into crypto

AOL was immensely beneficial to a number of large companies, such as Verizon and AT&T, which owned the infrastructure necessary to power broadband internet. Similarly, Libra appears as though it will also benefit large companies with the resources to run validator nodes.

While this again creates a closed ecosystem, it remains a net positive for cryptocurrency — bringing some of the biggest companies in the world into the crypto industry. Just as Libra may serve as a user-friendly bridge between consumers and cryptocurrency, it may help tip the scales and grow adoption across businesses giving, people more places and ways to use crypto.

SFOX CEO Akbar Thobhani envisions a future in which this new B2C crypto bridge could give birth to an entirely new ecosystem of apps—provided that the Libra Association plays its cards right:

While Project Libra may not have an immediate impact on the average person, it may invite a new app economy, similar to what we saw when smartphones first came to market. Major financial and fintech institutions may contribute to this app economy as a way of innovating new ways for their products to interact with current and future customers. The biggest risk of this enterprise could be the role of the centralized gatekeeper: the future of crypto and finance lies in open solutions, and Facebook may risk alienating many users if they try to turn their crypto ecosystem into a walled garden.

The companies that form the Libra Association are a list of heavyweights across multiple industries, from crypto to consumer applications and payments.

Here are just a few of the companies in the Libra Association, broken down by industry:

- Cryptocurrency: Xapo, Anchorage, Bison Trails

- Consumer applications: Facebook, Spotify, Uber, eBay

- Payments: Visa, Mastercard, Stripe, PayPal

- Venture Capital: a16z, Union Square Ventures

- Telecommunication: Vodafone, Iliad

Joining the association and running a validator node isn’t easy. Organizations that wish to qualify must meet at least two of the three following criteria:

- Greater than $1 billion market capitalization, or greater than $500 million in customer account balances.

- Reach more than 20 million people per year.

- Recognition as a top 100 company by an institution such as Forbes or S&P.

Running a validator node also means paying a minimum investment of $10 million to Libra’s Association; further, it’s estimated to cost $280,000 to run a validator node. Given these constraints, it’s likely that the growth of Libra will primarily benefit companies that are able to buy in, which they may do for a variety of reasons, from a vote on Libra’s Association board to the promise of a faster global payment system.

As Spotify’s Chief Premium Business Officer Alex Norström remarked:

One challenge for Spotify and its users around the world has been the lack of easily accessible payment systems — especially for those in financially underserved markets. This creates an enormous barrier to the bonds we work to foster between creators and their fans. In joining the Libra Association, there is an opportunity to better reach Spotify’s total addressable market, eliminate friction and enable payments in mass scale.

Libra, together with the weight of Facebook’s name behind it, is pushing companies like Spotify to explore and invest in cryptocurrency. Companies that form the Libra Association may benefit the most directly from Libra, but their very involvement within cryptocurrency is a boon to the broader industry.

Libra: A Net Positive for Cryptocurrency

At Libra’s Congressional hearing, U.S. Representative Patrick McHenry made the following statement:

Change is here. Digital currencies exist. Blockchain technology is real. Facebook’s entry into this new world is just confirmation — albeit at scale. The world that Satoshi Nakamoto envisioned and the others are building is an unstoppable force. We should not attempt to deter this innovation.

McHenry acknowledged concerns around regulating and governing digital assets — but he also explicated the need for financial innovation and the importance of the digital asset space. Facebook’s Libra has already managed to shine a national spotlight on cryptocurrencies.

Critics of Libra argue that it’s centralized, permissioned, and potentially a massive user privacy risk. It’s too early to tell which of these concerns are justified, and whether Libra will actually be allowed to operate in the U.S. So far, however, even its mere possibility appears to be a net positive for the crypto industry.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.