Intelligent architecture for the future of trading

sFOX’s sophisticated platform equips trading professionals with the tools and technology needed to secure their edge in crypto.

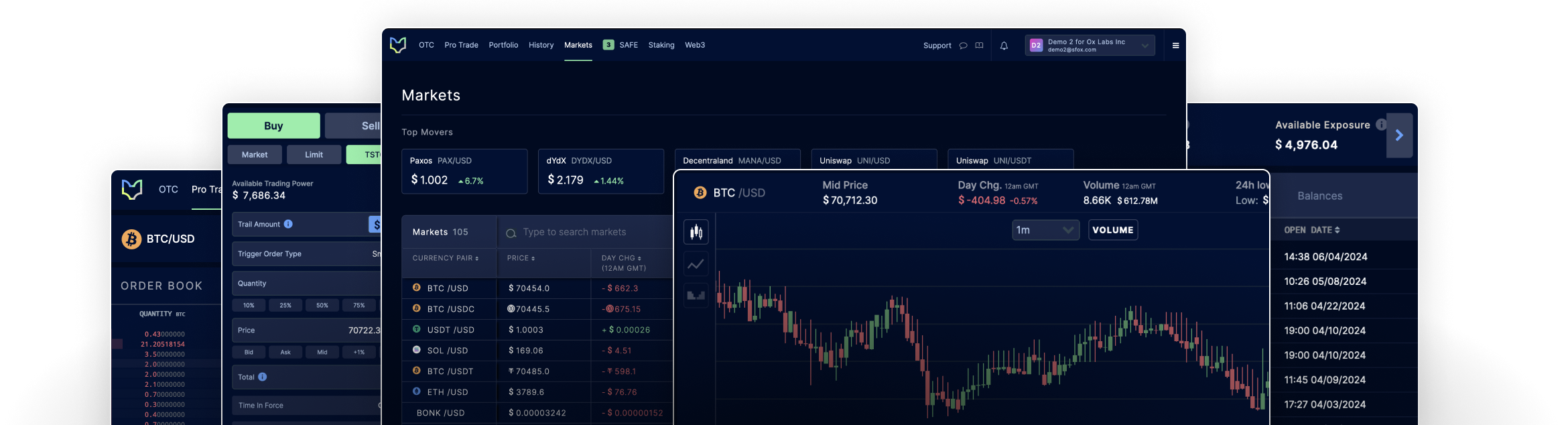

The ultimate aggregated orderbook

Trade on a centralized orderbook of the world’s top exchanges—including institutional markets inaccessible outside sFOX—from one easy-to-manage account.

One counterparty,

one workflow

No need to have multiple accounts across multiple exchanges and liquidity providers.

10x deeper liquidity

sFOX aggregates global exchanges to provide the best prices

Transparency at scale

See where and how your trade will be executed with full orderbook visibility.

Best execution that aligns with your trading

Our incentives ensure that you always execute at the best prices globally.

Advanced smart order routing passes price improvements directly to you, so you can outperform on every trade.

Agnostic agent

sFOX offers unbiased access to the best prices in crypto across 80+ markets.

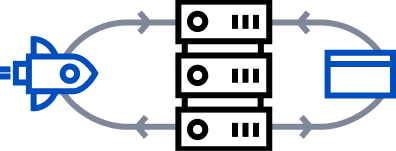

Architected for 99.99% uptime

Our entire tech stack is built in-house allowing for seamless integrations,

greater efficiency, and full control.

Microservice architecture

Provides unique resilience against downtime.

Hot deployments

Enable platform upgrades without any interruption to trading or downtime, not seen in any other major exchange

Targeted scaling

Provides efficiency and ability to scale horizontally

5 microsecond order matching

One of the fastest times in the market.

2.25 millisecond average API response time

Multiple times faster than any other major exchange.

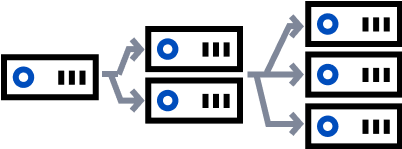

Scale your advantage with advanced order types

Capitalize on every opportunity with proprietary execution algorithms and order types, built by sFOX to enable scalable and customizable trading.

Designed for discreet trades

Smart order routing, dark pool, and sFOX being your counterparty enable you to trade large quantities without alerting the market to your intentions.

Outperform the market

Spend less time optimizing execution and more time optimizing your trading strategy with advanced algorithms including TWAP, Sniper, Smart Routing, and more.

Manage risk

Automate take profits and stop losses with Stop, Trailing Stop, and other orders.

Designed to give institutions the upper hand

Low

latency

Avg. 2.25ms response

High throughput

5x updates per sec than any exchange

Zero points of failure

99.99% uptime

Maximize performance with robust analytics

sFOX’s advanced post-trade analytics suite offers superior insights into how your trade performed against industry benchmarks and market conditions, informing more intelligent trades.

A collaborative platform for large teams

sFOX offers scalable solutions for teams, wealth managers and investment advisors.

Secure front and back-office access to sFOX through one account. Easily grant and change user permissions to maintain visibility and control.

Seperately Managed Accounts

Customize and manage multiple client portfolios or trading strategies with SMAs.

import requests

data = requests.post(

"https://api.sfox.com/v1/orders/buy",

headers={

"Authorization":"Bearer <API_KEY>",

},

data={

"quantity": 10.25,

"currency_pair":"btcusd",

"algorithm_id": 307, #TWAP Order

"price": 40000.01,

"total_time": 3600, #1-Hour

"continuous": true

#Execute Continuously

}

)

print(data)

Optimize any workplace or trading operation

Responsive platform is accessible from anywhere

Trade securely on any desktop or mobile configuration.

Integrate sFOX into your existing platform

sFOX supports low-latency REST, WebSocket and FIX APIs.

You’re serious about crypto. We’re serious about security.

- Zero security incidents in company history

- No hot wallets or outside ledgers

- Deposits housed in encrypted cold storage

-

Industry-leading

encryption standards - Patented custody technology

- SOC2 Certified

- $200MM of insurance of physical destruction of cryptocurrency private keys*

*Provided by various syndicates at Lloyd’s of London, led by Arch Syndicate 2012. Certificate of insurance available upon request.

Slow and steady wins nothing

Accelerate your advantage with access to more opportunities in the digital asset class.