In the Bitcoin whitepaper, the pseudonymous Satoshi Nakamoto described Bitcoin as a “peer-to-peer version of electronic cash.” But as the Bitcoin network grew over time, so did transaction fees and confirmation times, making it harder to actually use Bitcoin for everyday transactions.

Since then, a number of alternative cryptocurrencies have emerged to challenge Bitcoin for the mantle of electronic cash. The two biggest contenders by market cap and by popularity are Bitcoin Cash and Litecoin.

In 2011, a Google software engineer named Charlie Lee cloned Bitcoin’s code base in his free time and made some small but significant tweaks to the code, including a new hashing algorithm, faster block times, and a larger total supply. The result was Litecoin, which emerged as a “digital silver” to Bitcoin’s digital gold. Litecoin was intended for use in small, everyday transactions.

Six years later, as transaction fees on the Bitcoin network spiked to new heights and confirmation times slowed to a crawl, a contentious hard fork split the network into two — leading to the creation of Bitcoin Cash. Like Litecoin, Bitcoin Cash aimed to create a currency suitable for digital transactions. Bitcoin Cash increased the block size limit of Bitcoin from 1MB to 8MB, allowing the forked currency to process between four to eight times Bitcoin’s transaction volume. Bitcoin Cash saw itself as fulfilling Bitcoin’s promise of a borderless, frictionless, electronic cash.

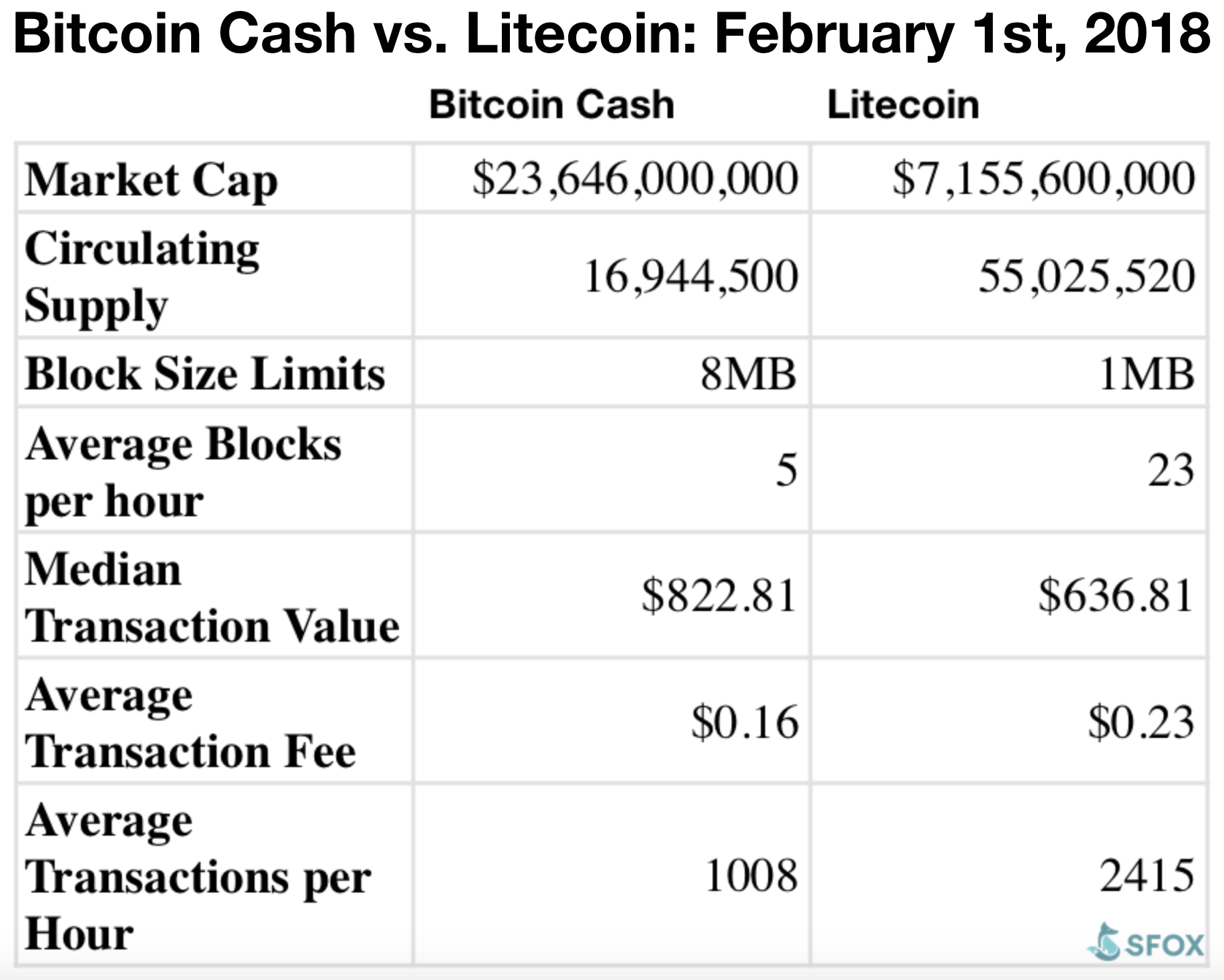

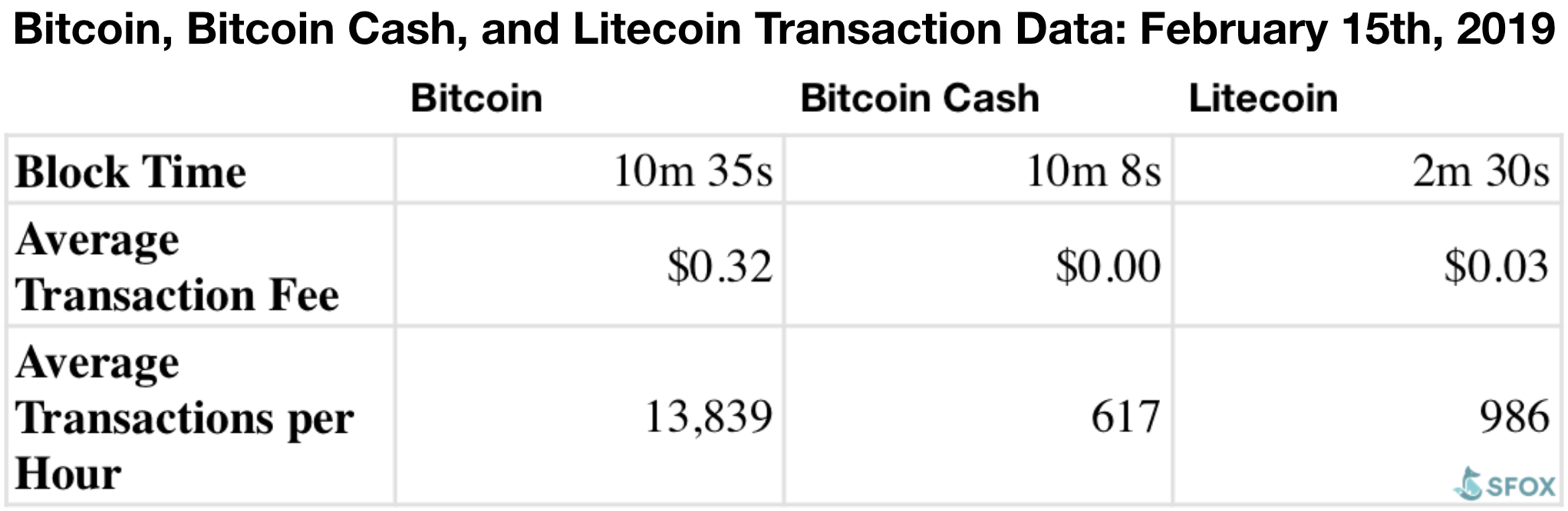

Here’s how Bitcoin Cash compared against Litecoin on February 1, 2018, six months after the Bitcoin Cash hard fork.

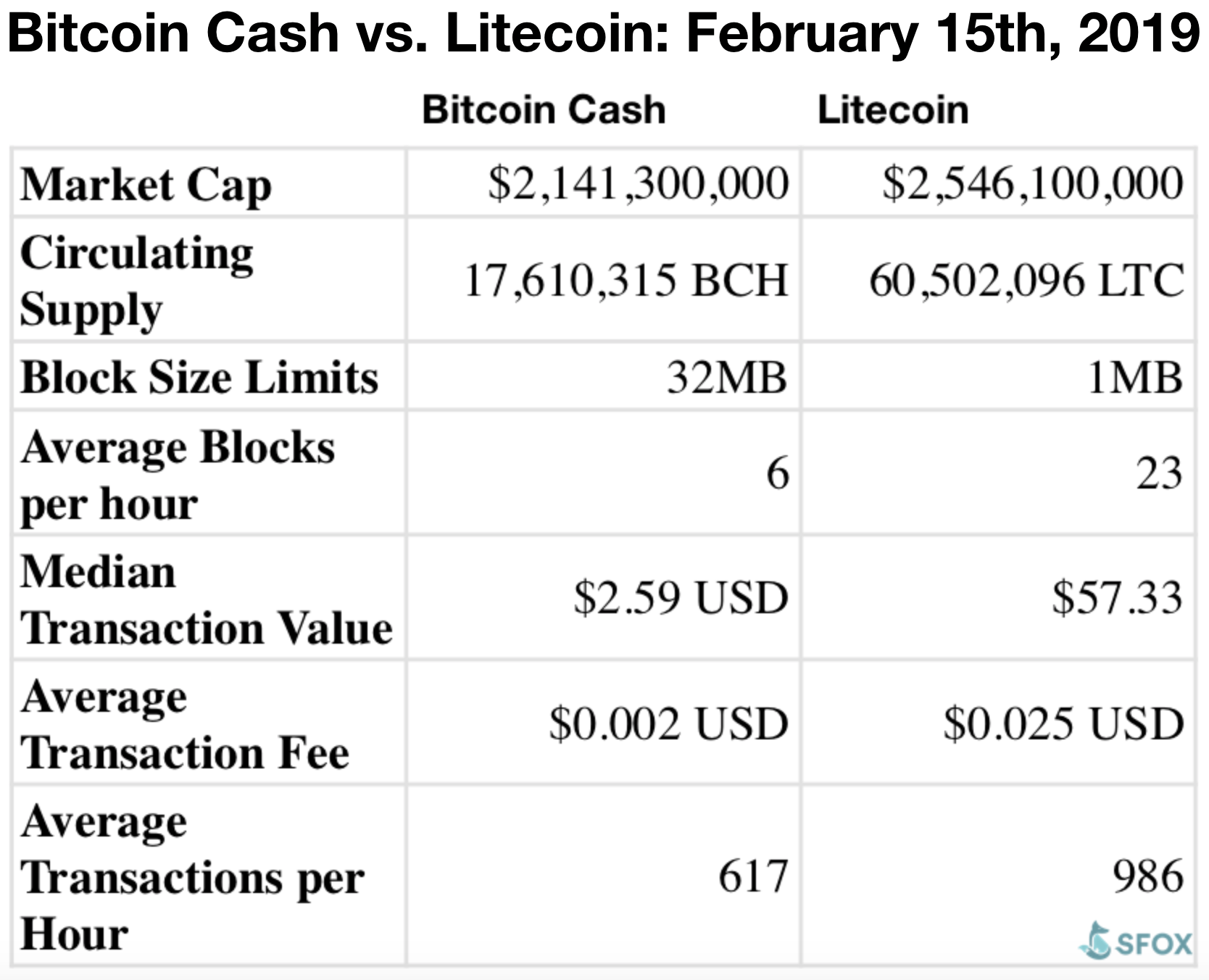

Here’s how they compared a year later, on February 15, 2019:

To evaluate how each lives up to its mission replacing Bitcoin as a useable, spendable, electronic cash, we’ll compare them across three key axes:

- Scalability: How do Bitcoin Cash and Litecoin compare in terms of scaling transaction throughput?

- Transaction volume: Are more people using Bitcoin Cash or Litecoin, measured in real transaction volume?

- Mining: How do Litecoin and Bitcoin Cash compare when it comes to mining centralization?

Digging into these differences makes it clear that while Bitcoin Cash and Litecoin hold different philosophies when it comes to scaling their networks for everyday transactions, these differences haven’t actually made a huge difference to date. Both have seen transaction volumes decline over the past year, putting into question whether the market needs or even wants digital cash right now.

Block Sizes Still Don’t Matter Yet

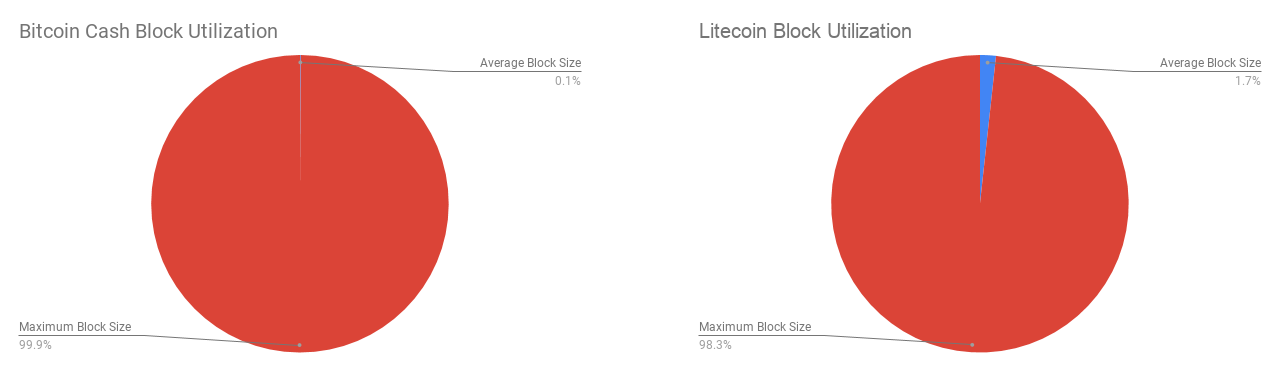

Currently, Bitcoin Cash’s 32-MB block size is thirty-two times as large as Litecoin’s 1-MB block size. However, new Litecoin blocks are added every 2.5 minutes, compared to ten minutes for Bitcoin Cash. That means that over the same period of time, Bitcoin Cash’s blocks have around eight times the space of Litecoin’s.

The average transaction size for a Bitcoin Cash transaction is around 250 bytes. With 32-MB blocks generated every ten minutes, this means that Bitcoin Cash is theoretically capable of supporting 768,000 transactions per hour or upwards of 18,000,000 transactions per day.

Meanwhile, the average transaction size for a Litecoin transaction is around 443 bytes. With 1-MB blocks generated every 2.5 minutes, this means that Litecoin is theoretically capable of supporting 54,144 transactions per hour or 1,299,000 transactions per day.

While transaction volume on Bitcoin Cash and Litecoin isn’t close to what either network can support, the difference in block size shows how the two different networks are thinking about scaling. Bitcoin Cash advocates supported raising Bitcoin’s block size from 1 MB to 8 MB at first, and subsequently increased the block size limit further to 32 MB. They believed that increasing the block size would allow Bitcoin Cash to become the default currency for small, everyday transactions. The Litecoin developers have instead focused on experimenting with Layer-2 solutions to scale — although they haven’t ruled out increasing the block size if blocks become 50% or more full.

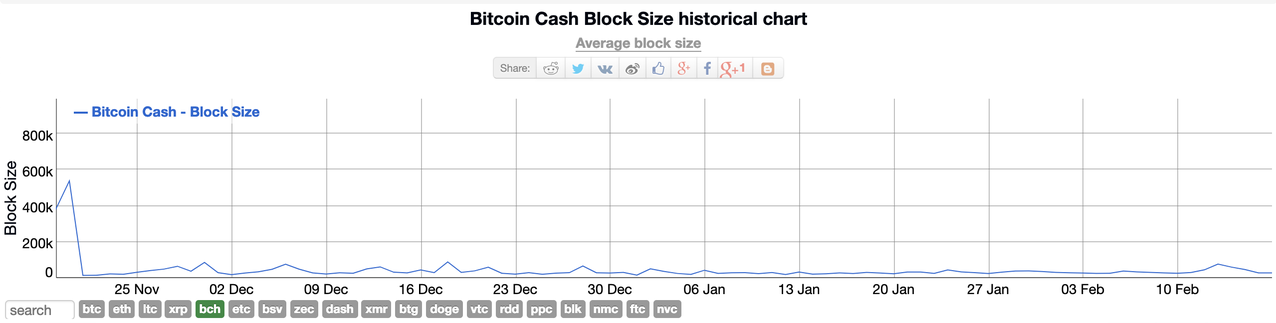

So far, Bitcoin Cash’s massive block size limit hasn’t mattered at all, as the average Bitcoin Cash block size is just 28 kilobytes. If Bitcoin Cash adoption grew exponentially, the network could process a higher transaction throughput than Litecoin today — but so far, the level of usage on the network simply isn’t there.

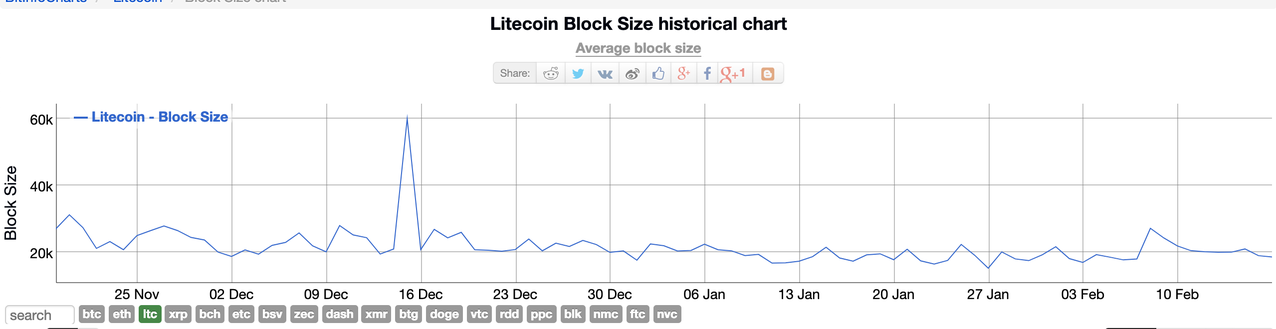

Despite the contentious nature of the block size debate, the truth is that bigger blocks simply haven’t mattered yet. Bitcoin Cash and Litecoin have adopted different approaches to scaling — the former seeks to scale transaction volume with bigger blocks, and the latter with Lightning and other Layer-2 solutions. Currently, however, that conversation may be premature, as transaction volume on each network is below what those networks can sustain.

Transaction Volume is Higher on Litecoin, but Neither Currency Is as Ubiquitous as Cash Yet

Bitcoin Cash and Litecoin both were born out of a desire to create a digital currency that was easy and fast to spend. So far, actual usage measured by transaction volume hasn’t caught up. Both are capable of confirming transactions faster than Bitcoin, with cheaper fees — but transaction volume for both networks has lagged substantially behind Bitcoin’s.

Bitcoin Cash and Litecoin both share a number of properties that make them easier to use for everyday transactions than Bitcoin. With an average transaction fee of $0.002 USD, Bitcoin Cash is cheaper to send and use than Litecoin, which has an average transaction fee of $0.025. But because Litecoin blocks are generated faster, transactions are confirmed around 4x faster than Bitcoin Cash, taking 2.5 minutes compared to ten minutes for Bitcoin Cash.

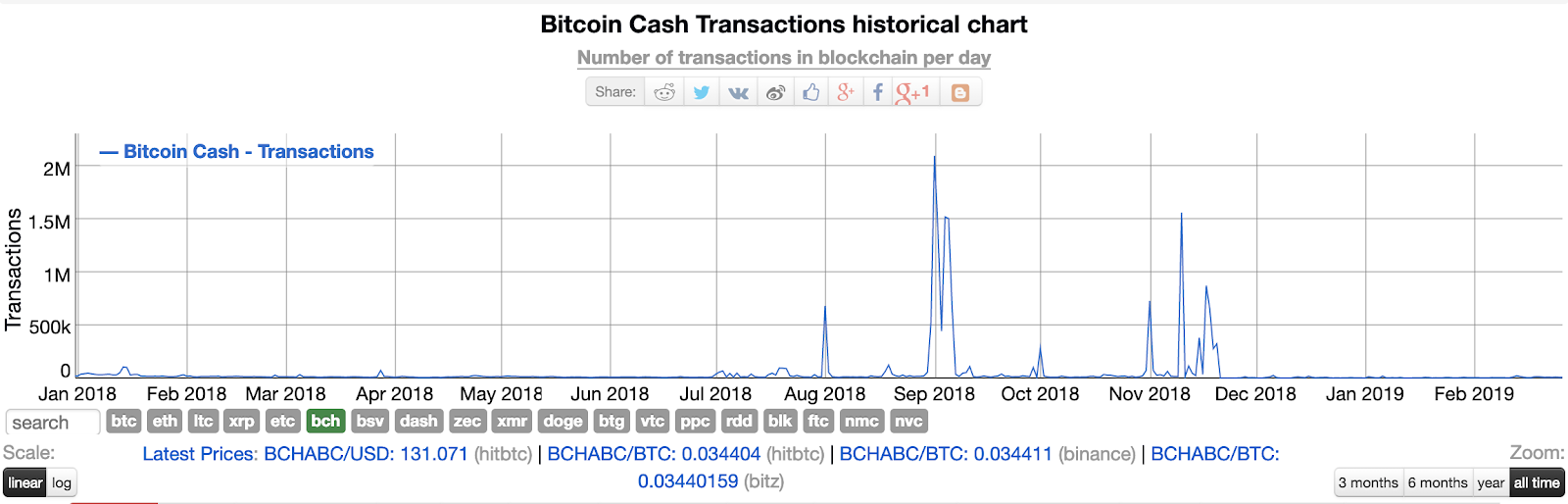

A little over a year following the Bitcoin Cash hard fork in September 2018, Bitcoin Cash reached an all-time-high transaction volume of two million. Since then, Bitcoin Cash transactions have fallen by around 99% to 10,000 transactions per day today.

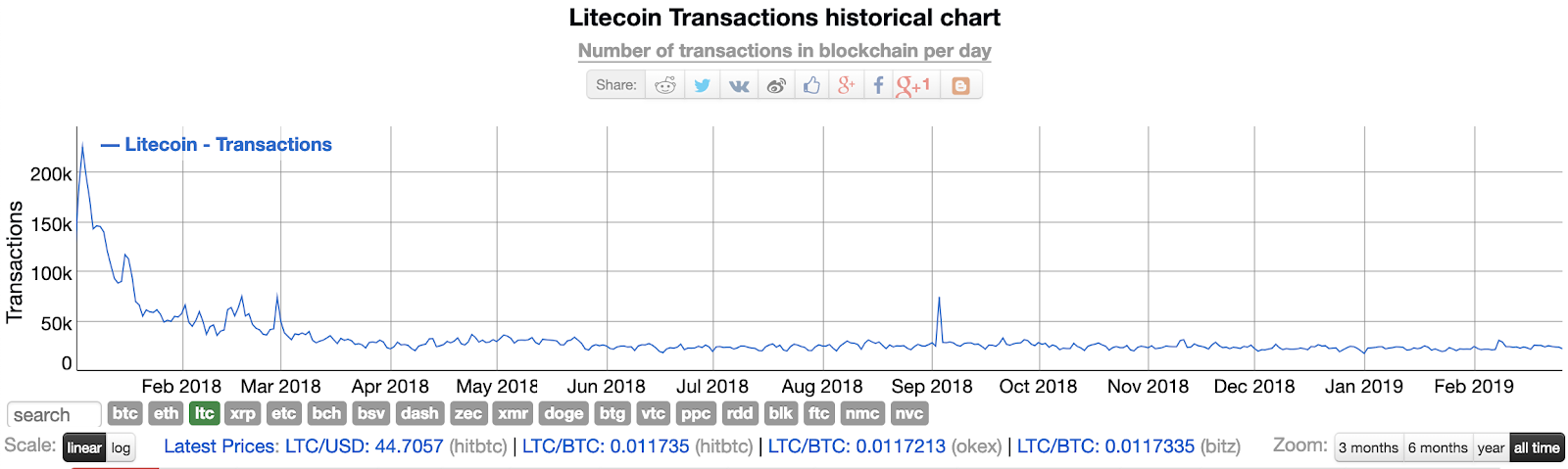

Litecoin transaction volume, meanwhile, peaked in January 2018 at 225,000 transactions per day, before falling down to 22,000 transactions per day currently.

In terms of overall transaction volume, Litecoin has been the winner in the past couple of months, with between twenty thousand to thirty thousand transactions per day. In contrast, Bitcoin Cash has hovered around the ten-thousand-transactions-per-day mark.

A couple of factors might explain higher transaction volume on Litecoin compared to Bitcoin Cash. While a number of services—such as Lite.im, built on top of Litecoin—make it easy to send and receive LTC transactions via mobile phone, there aren’t many equivalent services for Bitcoin Cash. Another factor might be that last year, Bitcoin Cash saw a hard fork of its own, splitting into Bitcoin Cash and Bitcoin SV. Following the fork, the combined market cap of Bitcoin Cash and Bitcoin SV has declined below the market cap of Bitcoin Cash prior to the fork. This suggests that the hard fork may have damaged confidence in Bitcoin Cash.

Despite cheaper fees and faster confirmation times, transaction volumes on Bitcoin Cash and Litecoin are an order of magnitude lower than transaction volume on Bitcoin. This might be because there simply isn’t that much interest in a digital, electronic cash yet. For everyday transactions on the internet, most people might find their debit cards and credit cards convenient enough. Another reason might have to do with the fact that transaction fees on Bitcoin have dropped significantly over the past year. In the event of higher activity on Bitcoin — and higher corresponding fees — we may see more volume switch over to Bitcoin Cash and Litecoin.

Mining on Both Chains is Fairly Centralized

Litecoin was designed specifically to avoid mining centralization. Meanwhile, the Bitcoin Cash fork was supported by some of the largest Bitcoin miners, including Jihan Wu, then-CEO of Bitmain. In practice, however, mining on both Litecoin and Bitcoin Cash is pretty centralized nowadays.

Litecoin uses the Scrypt proof-of-work algorithm, which is more memory-intensive than Bitcoin’s SHA-256. This decision was intended to spare Litecoin from miner centralization, which was already commonplace on Bitcoin in 2011 through the use of ASIC chips.

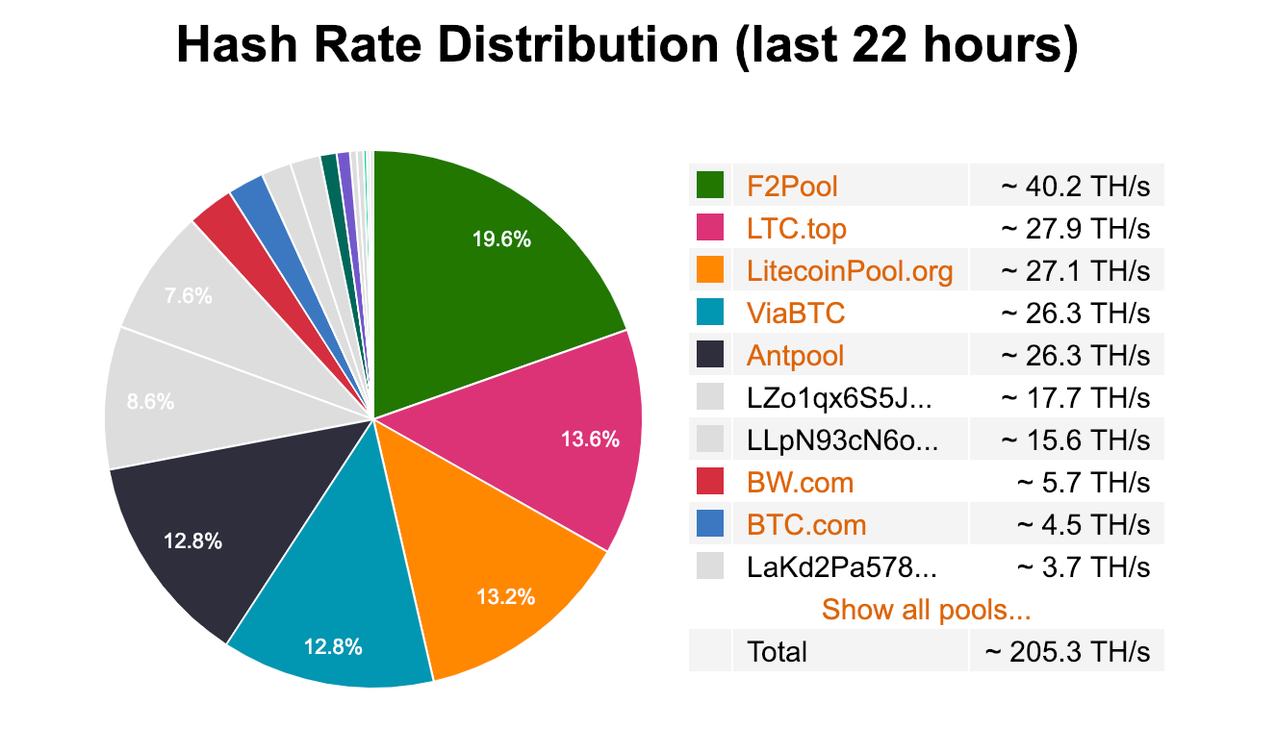

In the time since Litecoin launched, however, improvements in ASIC chips have rendered this initial difference between Scrypt and SHA-256 inconsequential. Today, the majority of hash power on Litecoin comes from ASICs, and mining on Litecoin is relatively centralized — Litecoin’s top four pools control 58.4% of hash power on the entire network.

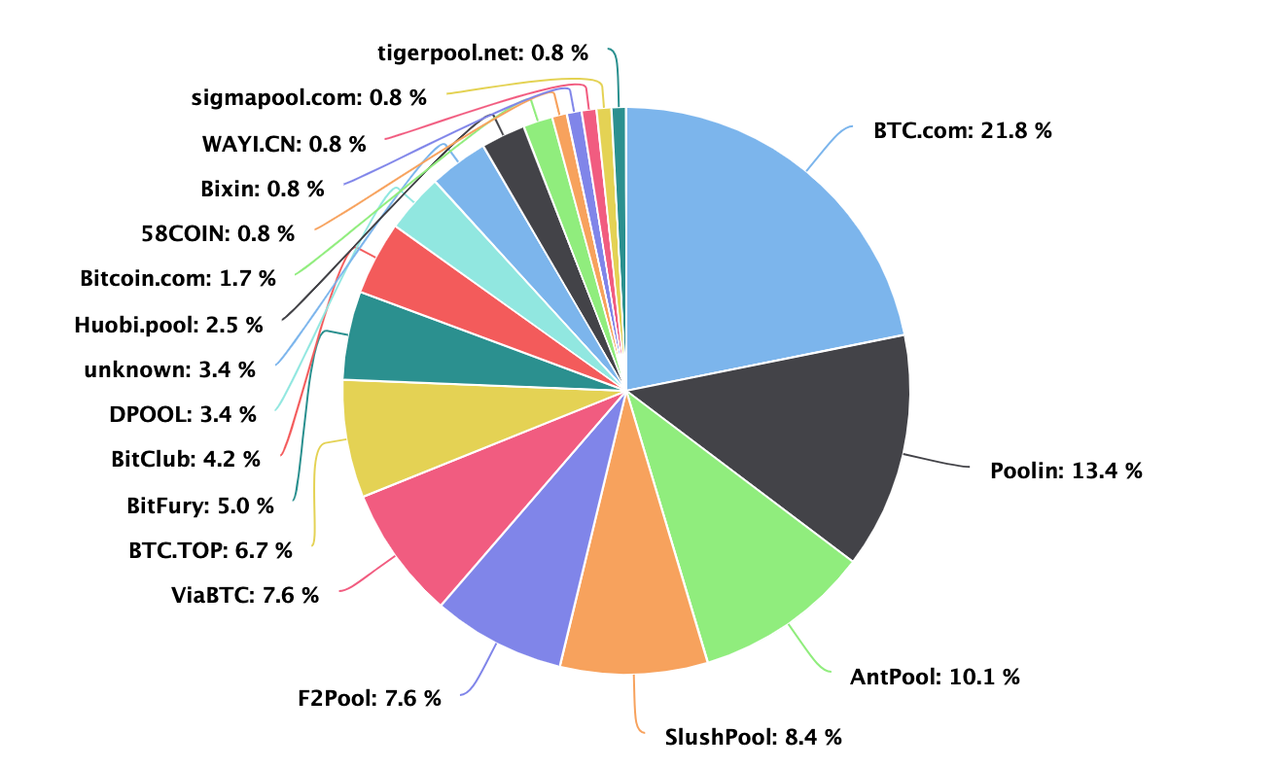

Bitcoin Cash is similarly centralized. On Bitcoin Cash, the top four mining pools control over 53.7% of hash power on the network — making it almost as centralized as Litecoin.

It’s interesting to note that while Bitcoin Cash’s critics claimed that larger blocks would lead to higher miner centralization, this hasn’t really made a difference, as Bitcoin Cash is actually slightly less centralized than Litecoin. While Litecoin was originally designed to stymie mining centralization and Bitcoin Cash embraced big miners from the jump, both chains today see a high degree of mining centralization.

Are We Ready for Electronic Cash?

Litecoin recently made waves for “the Flappening”: its total market cap approached $2.8B, surging above Bitcoin Cash’s market cap of $2.45B. Despite this, the currencies are actually more similar than different as the #5 and #6 largest currencies by market cap.

Both seek to satisfy a perceived need for electronic cash with low fees and fast confirmation times. But while the two currencies have different philosophies for scaling transaction throughput, neither is actually seeing enough transaction volume for these differing philosophies to make a difference yet.

Litecoin and Bitcoin Cash are two major currencies battling it out for the throne of electronic cash — but the demand for electronic cash simply doesn’t seem to be that high yet. That makes what happens next all the more interesting. Whether Litecoin with Layer-2 scaling or Bitcoin Cash with bigger block sizes wins will be a testing ground for how other cryptocurrencies grow and scale.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.