In 2011, two years after Bitcoin was released, Litecoin (LTC) entered the public arena. LTC’s creator, former Google engineer Charles Lee, described it as “silver to Bitcoin’s gold.”

But what is Litecoin, really? How has it distinguished itself from Bitcoin, and what niche will it fill in the future of finance?

Read on to find out where Litecoin came from, where it stands now, and where it’s headed in the future.

Gold is to cash as Bitcoin is to Litecoin

What does it mean for Litecoin to be “silver to Bitcoin’s gold”? Put simply, some believe that Bitcoin is better suited to be a store of value (like gold) than a medium for day-to-day commerce (like cash). This has led developers to create their own cryptocurrencies with the goal of being a better digital cash.

Litecoin was one of the earliest of these “digital cash” Bitcoin alternatives, and it remains one of the most successful.

Charles Lee discovered Bitcoin in 2011 after about a decade in Silicon Valley. He was looking for something new to focus on at the time, and an article on Bitcoin’s role in the Silk Road stoked his interest in cryptocurrencies.

Litecoin was actually Lee’s second attempt at a cryptocurrency, following up on the much less successful Fairbrix. Fairbrix tried to improve on a different cryptocurrency, Tenebrix. Lee tried out two things with Fairbrix that would ultimately prove central to Litecoin’s success:

- Public release without pre-mining. The creator of Tenebrix had tried to capture its value by “pre-mining” seven million coins for himself before publicly launching it; Lee wanted to give everyone a chance to capture his new coin’s value by releasing it publicly from the beginning of the blockchain.

- Scrypt as a proof-of-work algorithm. In late 2011, the mining of Bitcoin was becoming increasingly centralized as companies designed increasingly specialized computer processors built for the sole purpose of mining BTC as efficiently as possible. Lee created a new proof-of-work function that relied more on computer memory than on raw processing power, making it harder for centralized mining pools to control the network and making it easier for virtually anyone to mine the cryptocurrency.

These changes were meant to make Fairbrix fairer than Tenebrix, like the name implied. When a number of bugs ultimately derailed Fairbrix, Lee decided to apply these same principles of fairness to create a clone of another cryptocurrency: Bitcoin.

Thus, Litecoin was born.

A few lines of code make a big difference

Just like Fairbrix was a “clone” of Tenebrix, Litecoin is a “clone” of Bitcoin: it’s an almost-identical cryptocurrency with just a few key differences.

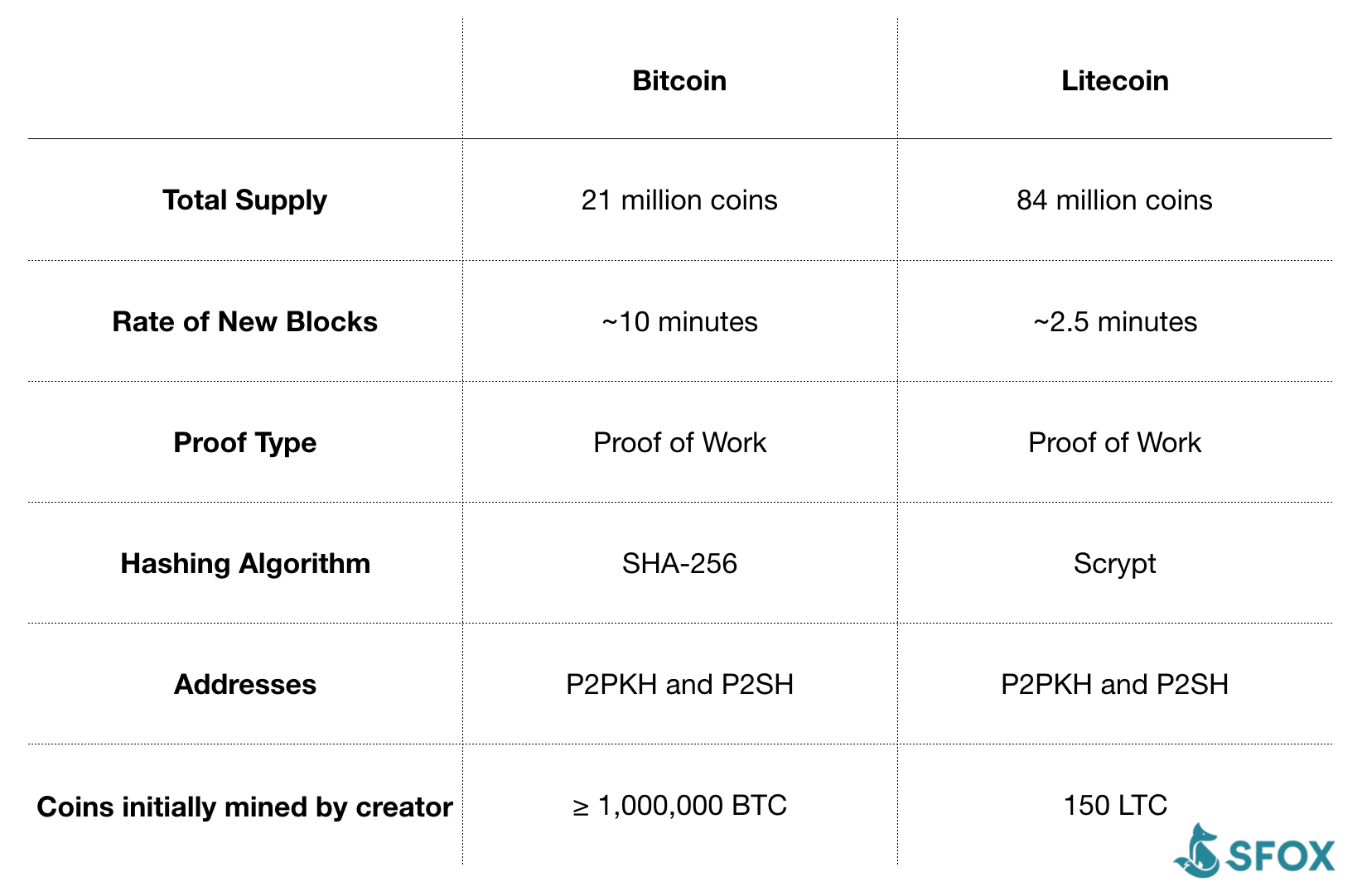

Here’s a rundown of six major points of comparison when it comes to Litecoin vs. Bitcoin:

It’s worth emphasizing that Litecoin and Bitcoin are structurally more alike than different: they have the same type of addresses (P2PKH and P2SH), the same consensus mechanism (proof of work), and most of the same code. Yet the few differences that Litecoin has are aimed to make is a much better cryptocurrency for day-to-day commerce. How can that be?

The most obvious way is through shorter block times. Shorter block times mean that it takes less time for merchants to confirm transactions, which means that people can theoretically exchange their LTC for goods and services faster than they can exchange their BTC.

While the different hashing algorithm underpinning Litecoin’s consensus method might not be that significant now, it probably played a big role in getting Litecoin off the ground in the first place. Like Fairbrix before it, Litecoin uses Scrypt — a memory-based algorithm rather than a CPU-based algorithm — which made it harder for hardware developers to build ASICs optimized for mining that cryptocurrency. Nowadays there are mining rigs specialized for mining Litecoin, but the fact that such rigs weren’t initially fesible — combined with the fact that Lee only mined 150 LTC before releasing it to the public — probably incentivized the public to actually mine the coin, contributing to its adoption as one of the leading altcoins out there.

Finally, the quadruple number of total LTC relative to BTC aims to ensure that, while Litecoin and Bitcoin will both be immune to inflation, Litecoin will always have a significantly lower market cap than Bitcoin, encouraging people to actually use it transactionally rather than storing value in it like Bitcoin — another point of analogy between Bitcoin vs. Litecoin and gold vs. silver.

“Altcoin” with a capital “A”

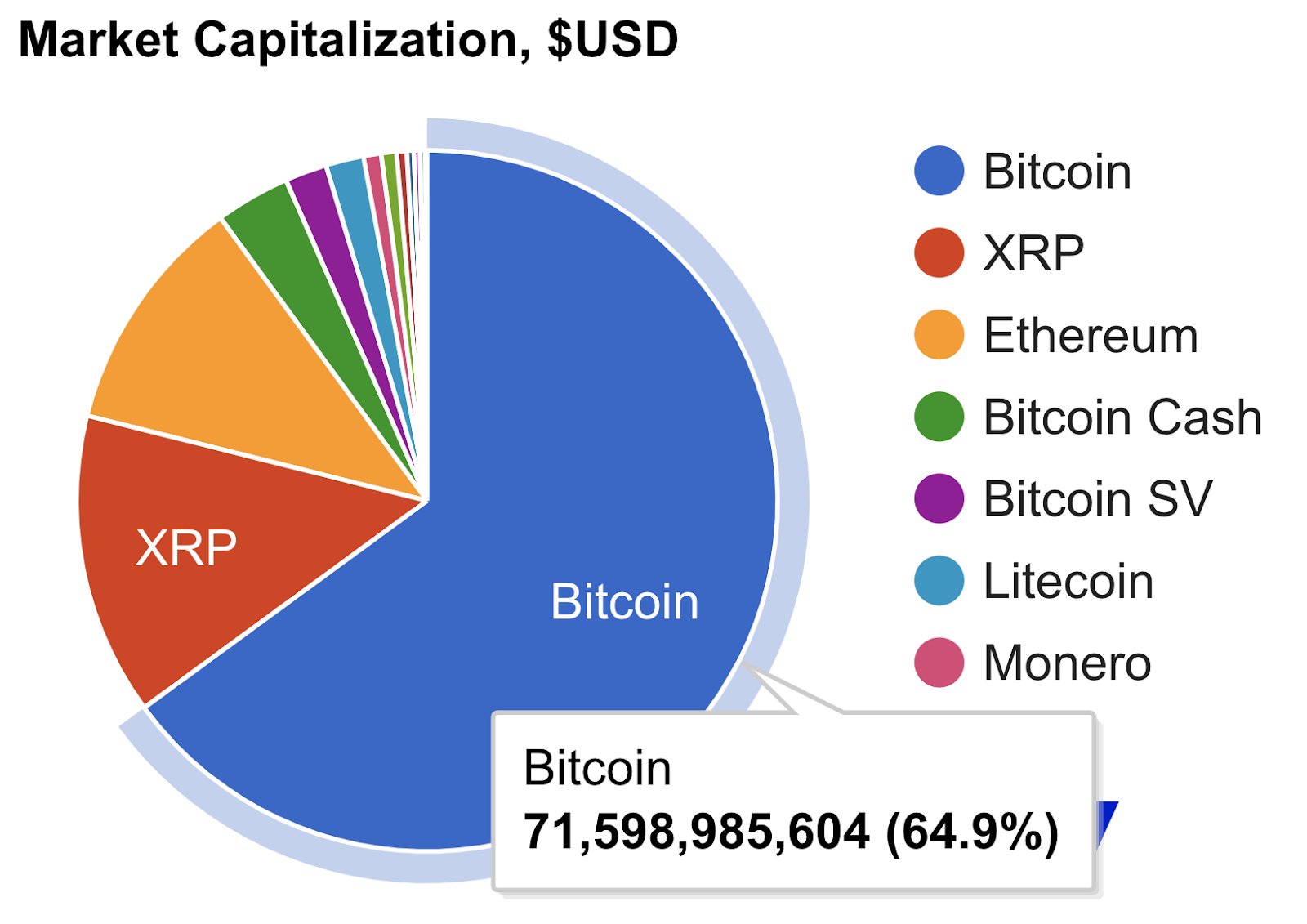

Despite being a near-clone of Bitcoin, Litecoin has risen above many other altcoins in terms of adoption and market capitalization.

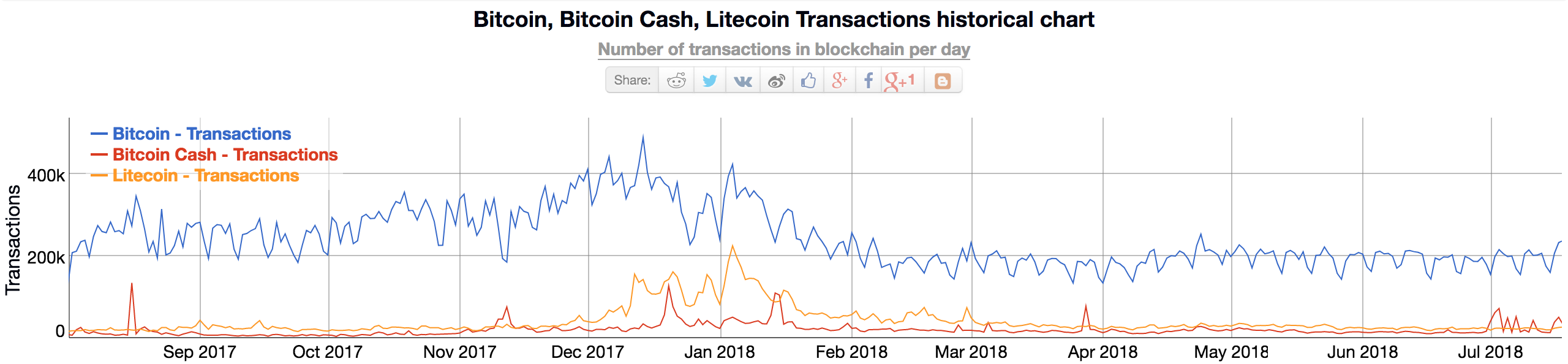

Even though Litecoin’s transaction volume has remained roughly an order of magnitude less than Bitcoin’s, it still hovers at around 30,000 transactions per day, which is nothing to sneeze at. As a point of reference, Bitcoin Cash — the other major cryptocurrency that aims to be better for daily commerce than Bitcoin — currrently clocks in at around 20,000 transactions per day.

Since Litecoin is focused on serving as a medium for commerce, transaction volume seems like the best metric for evaluating its success over time. That said, it’s also worth noting that its market capitalization distinguishes it among the many altcoins that have emerged since the advent of Bitcoin.

Litecoin has maintained a steady presence as a “Top 10” cryptocurrency by market capitalization. At the time of writing, it’s the #5 coin, with a total market capitalization of ~$3.3 billion USD.

While there are surely a number of factors that have contributed to Litecoin’s success, a lot of it probably has to do with Lee’s early choices in launching the cryptocurrency: though he didn’t go so far as to call it Faircoin, he gave everyone the chance to “get in on the ground floor” of something that looked suspiciously like Bitcoin — and that initial interest laid the groundwork for broader adoption, which is critical for a commerce-focused cryptocurrency.

What is the future of Litecoin?

What will it take for Litecoin to succeed in the long run?

The name of the game here is widespread commercial adoption and use. In that regard, it has competition. Most notably, Bitcoin Cash has emerged in the last year as a distinct cryptocurrency with a virtually identical mission to Litecoin’s: to be a better mode of digital cash than Bitcoin.

There are a few possible outcomes right now in blockchain-powered commerce:

- Bitcoin swallows up commerce-oriented altcoins and becomes dominant as digital cash.

- Litecoin swallows up Bitcoin Cash as the dominant form of digital cash — or vice versa.

- Litecoin and Bitcoin Cash carve out distinct niches, becoming more specialized.

With the whole crypto industry still so nascent, it’s hard to say what will happen next — but wherever the industry moves, there’s a good chance that Litecoin will play a key role in it.

Looking to trade LTC across multiple liquidity sources from a single account? Log onto SFOX and start trading!

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.