Ethereum is a blockchain-based platform for decentralized applications, or dApps. Whereas Bitcoin was designed primarily as a decentralized digital currency, Ethereum was built with a Turing-complete language for contracts, allowing it to serve as a platform for all types of dApps.

In Ethereum, you can write a smart contract to do virtually anything, from executing a token crowdsale to automatically distribute your assets after your death. It’s nothing short of a world computer — a decentralized virtual machine in the cloud that will execute anyone’s code in exchange for a fee. The platform design is based on two key differentiating features:

- Blockchain: Ethereum accounts store contract code and data in addition to keeping a balance. This is referred to “rich statefulness,” which is basically the ability for Ethereum to remember more and maintain more state at the blockchain level.

- Turing-complete programming language: As a “world computer,” Ethereum can run any code that a normal computer could run. People pay “gas” to miners for computational resources to run their contracts.

From the early days of Bitcoin, software developers have seen the power in the underlying blockchain technology and have looked for other areas in which to apply it.

Today, Ethereum is the blockchain development platform of choice, hosting hundreds of different decentralized apps — or dApps.

What dApps have been built on Ethereum?

Apps built on Ethereum are called dApps, short for “decentralized applications.” Because Ethereum theoretically can power any app that Amazon Web Services could, app ideas have been thrown around enthusiastically, for example from the Ethereum whitepaper, decentralized file storage, decentralized hedge funds, decentralized financial derivatives, decentralized domain name registration, and more.

So far, few clear winners have emerged. Instead, we’ve learned a lot about the challenges of building and driving adoption for dApps:

- Speed: An app with centralized infrastructure like Facebook serves approximately 175,000 requests per second while Ethereum can handle only about 13 transactions per second.

- Security: High-profile security breaches continue to plague Ethereum dApps, from the Decentralized Autonomous Organization (DAO) attack, which resulted in the loss of 3.6 million ether (worth over $50 million at that time) to the recent Parity wallet bug that resulted in the accidental freezing of over 500,000 ether (worth over $160 million at the time).

- UX: It’s hard enough to explain the concept of Ethereum, much less the idea of dApps built on top of Ethereum in which users have to install plugins like MetaMask to interact with the Ethereum blockchain from inside their web browsers.

Ethereum’s success is staked on whether there are many compelling decentralized apps beyond the current killer app for decentralization — currency. So far, two major success stories have emerged from the dApp ecosystem, ICOs and CryptoKitties.

ICOs

An ICO is an initial coin offering, a fundraising event where tokens are pre-sold to public investors and traders in exchange for Ethereum or Bitcoin.

Like an initial public offering where investors can buy and trade stock in formerly private companies, with an ICO, you purchase tokens that you can eventually trade on cryptocurrency exchanges. However, with an ICO, you typically do not own a share of the company and the rights your token accords you are often unclear or nonexistent.

What Ethereum did was make it much easier and accessible to launch a new token with an ICO by building on top of Ethereum rather than having to build the infrastructure from scratch. It established a token standard called ERC20, which got all developers using the same interface for the basic functionality needed in an ICO:

- The investor’s wallet sends ETH to the ICO’s smart contract with a request for tokens.

- The smart contract sends tokens back to the investor’s wallet.

// ERC Token Standard #20 Interface

contract ERC20Interface {

function totalSupply() public constant returns (uint);

function balanceOf(address tokenOwner) public constant returns (uint balance);

function allowance(address tokenOwner, address spender) public constant returns

(uint remaining);

function transfer(address to, uint tokens) public returns (bool success);

function approve(address spender, uint tokens) public returns (bool success);

function transferFrom(address from, address to, uint tokens) public returns

(bool success);

event Transfer(address indexed from, address indexed to, uint tokens);

event Approval(address indexed tokenOwner, address indexed spender, uint tokens);

}

(via The Ethereum Wiki)

Developers only had to implement ERC20, customize some basic code like the name of the token and total token supply, and voila, the token was ready for ICO.

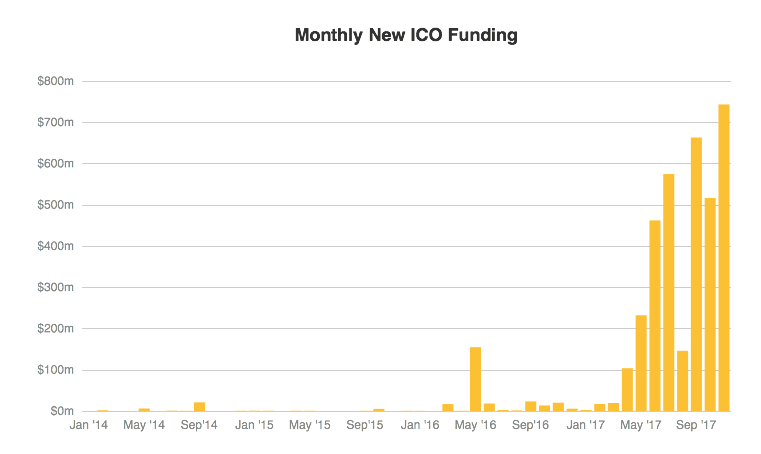

After a number of high profile ICOs like the $150 million Bancor ICO in June 2017 and with the lowering of the barrier to entry in launching an ICO, ICOs exploded in the second half of 2017, with over $3 billion in funding raised.

However, aside from Ethereum itself — which did an $18 million ICO in 2014 — there hasn’t been a product built via ICO that actually has meaningful usage for its intended purpose. Most ICOs will fail, but it’s absolutely critical to the ecosystem that one or two become massive value creation engines to ensure that the next generation of ICOs gets funded.

No question, ICOs have transformed the fundraising landscape in the near term. But they may have an even bigger impact in the future, with Ethereum becoming a decentralized NASDAQ.

CryptoKitties

CryptoKitties is a game for collecting and breeding digital kittens. Because the kittens live on the Ethereum blockchain — like owning 1 BTC on the Bitcoin blockchain — no one can destroy, duplicate or take away a kitten that you own.

To date, nearly $19 million worth of CryptoKitties have been sold (over 37,000 ether), and at one point, CryptoKitties accounted for 25% of all transactions on the network. The first non-token related dApp to take off, CryptoKitties used the scarcity property of the blockchain for collectibility, combined it with smart contracts to create game mechanics, and packaged it together with kittens to make it cuddly and fun.

The success of CryptoKitties has also shown how far Ethereum needs to scale to become a platform for games — and especially, as a platform for games that at the same time is a platform for business-critical functions like fundraising.

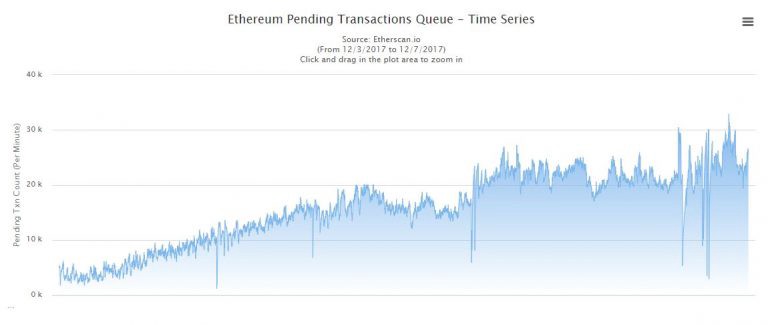

The pending transaction queue grew dramatically to over 30,000 during the rise of CryptoKitties’ popularity. As the backlog grew, getting transactions completed in a costly manner increased. The CryptoKitties team raised the suggested gas price on all transactions to 25 gwei from less than one gwei, and then again to 40 gwei from 25 gwei. The cost of breeding two cats — a core game mechanic — rose to 0.015 ETH from 0.002 ETH, an increase of $13 at the exchange rate of $1,000 USD/ETH. That makes for a game that’s either laggy and unavailable, or that’s expensive and out of reach of most gamers.

With Ethereum, ICOs share the same network as games like CryptoKitties. CryptoKitties’ surge meant that the network was unavailable for ICOs as well. ICOs typically are time-sensitive fundraising windows that are fulfilled on a first-come, first-served basis, so fast transaction completion times are essential to the process. During the CryptoKitties surge, the network became unreliable for these hundred-million-dollar fundraising events, which led some like SophiaTX to postpone their ICOs.

While the popularity of CryptoKitties has dipped — today accounting for only 0.5% of all transactions on the Ethereum blockchain — it has nevertheless proven Ethereum’s potential to become a platform for gaming, collecting and trading digital assets, and both combined.

Hard fork and Ethereum Classic

While Ethereum has been associated with multi-million dollar ICOs and the CryptoKitties phenomenon, it has also had dark days. The hack of The DAO in the summer of 2016 sounded two notes of concern about Ethereum that reverberate to this day:

- It is possible to create an organization or corporation that works autonomously, its behavior dictated entirely by that code. It’s also possible for that code to be hacked and the organization’s behavior to be compromised.

- The code that underlies Ethereum can be changed — if the change has the support of the majority — but doing so is controversial.

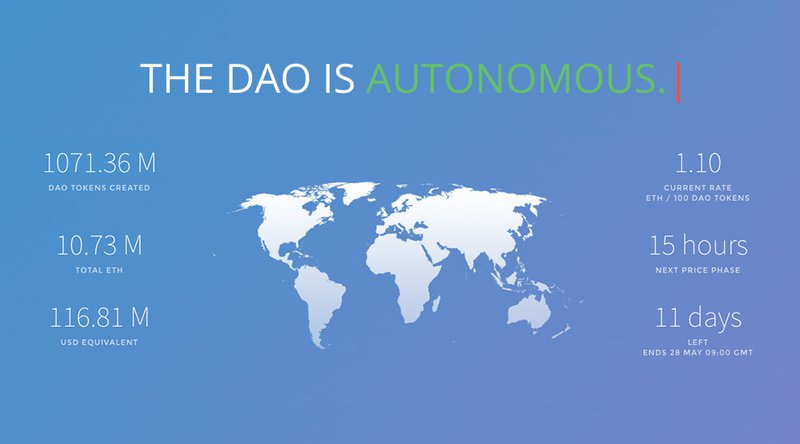

The DAO launched on the 30th of April, 2016. Short for decentralized autonomous organization, The DAO was the first mainstream attempt to bring the ethos of the blockchain from finance (where it had largely stayed) into the enterprise. The plan was to create the first decentralized, automatic, investor-directed venture capital fund.

The idea was simple: if Bitcoin could create a new decentralized, automatic and permissionless basis for money, then Ethereum (in the DAO) could, through smart contracts, create a similar basis for a corporate or non-profit or other kind of organization.

The DAO would be the very first venture capital fund ever run on the blockchain.

The DAO’s crowdsale took place that May and raised $150 million worth of Ether. About 14% of all ether tokens ever issued ended up being held by The DAO.

Then The DAO was hacked. On June 17th, 3.6 million ether (a third of the total amount sent to The DAO) was stolen.

The DAO had been built to form an organization free of the vagaries and biases of human judgment — “code is law,” went a frequent cryptocurrency refrain. However, the code behind The DAO had grown sufficiently complex that vulnerabilities had grown within it. The people behind it had not fully understood this. And this was a problem. So much of the existing ether had just been stolen that the Ethereum team was forced into a moral quandary.

They had two options:

- Refund the ether taken in the hack: By modifying the code behind Ethereum and creating a new version with different rules, everyone who invested in the DAO could have the option to get their money back — the hack would simply be erased from history.

- Do nothing and let the stolen ether remain in circulation: This would prevent a fork of Ethereum, but allowing 14% of all the world’s (finite supply of) ether to belong to one hacker could be enough of a blow as to put the whole platform in jeopardy.

The Ethereum team put it up to a vote.

One group opposed the hard fork — they insisted that “code was law,” and that modifying Ethereum to revert past transactions was a slippery slope.

Another supported it. They argued that code could not yet be law — that humans should still have the final say — and that it would be dangerous to Ethereum to allow such a large chunk of it to be held by hackers.

In the end, the Ethereum development team and a majority of ether holders opted to institute the “hard fork.” The Ethereum that had hosted the hacked DAO became Ethereum Classic, and the new fork of the Ethereum blockchain — the one where DAO investors got refunds — became the new Ethereum proper.

The controversy around the hard fork at the time aside, the split between Ethereum and Ethereum Classic has gone smoothly for the most part. The Ethereum community mostly coalesced around the hard forked version of Ethereum, rejecting Ethereum Classic, which is today at about $25 to Ethereum’s $1,000.

Developer support for Ethereum

Ethereum is a platform — it succeeds if dApps succeed. A standout app like Uber or Twitter emerging on Ethereum could cement its advantage for years to come. But the emergence of widely successful dApps would be a lagging indicator of Ethereum’s success.

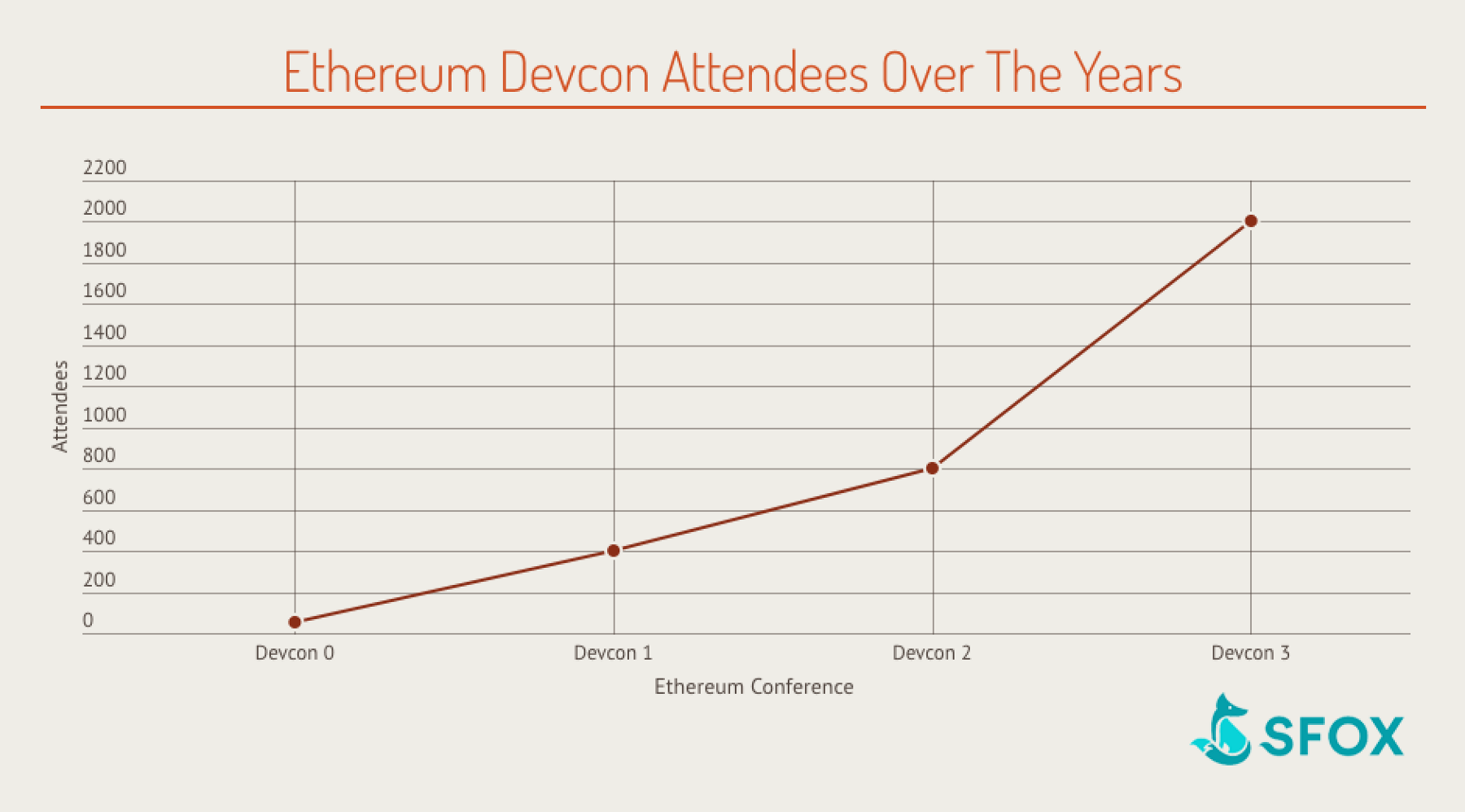

One of the biggest leading indicators of Ethereum’s health is the health of its underlying developer community. Ethereum user adoption means more and more developers are learning how to build dApps, going to meetups and conferences, and contributing core code.

Ethereum’s developer conference, Devcon, has grown in popularity, hitting 2,000 attendees in just its third year of existence. As a point of reference, the Apple Worldwide Developers Conference has typically been sold out at around 5,000 attendees.

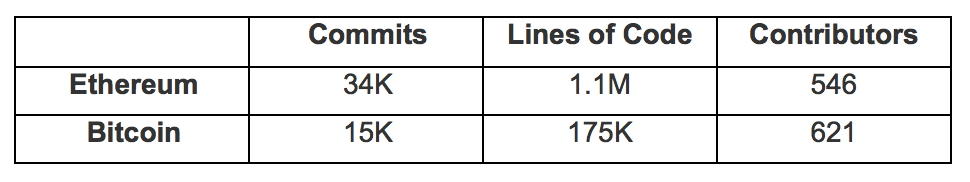

The Ethereum project is maintained by a large and active development team that’s on par with Bitcoin’s. In addition, while Bitcoin has fractured into rival factions with the Bitcoin Cash contentious hard fork, Ethereum recently pulled off a non-contentious hard fork to update the network with its Byzantium update on October 16, 2017.

The cohesion in the Ethereum community appears in stark relief to the Bitcoin versus Bitcoin Cash wars. Ethereum is headed by what some would call its “benevolent dictator” in Vitalik Buterin — will be crucial as the platform continues to work towards the kind of scale it needs to achieve real, mass adoption.

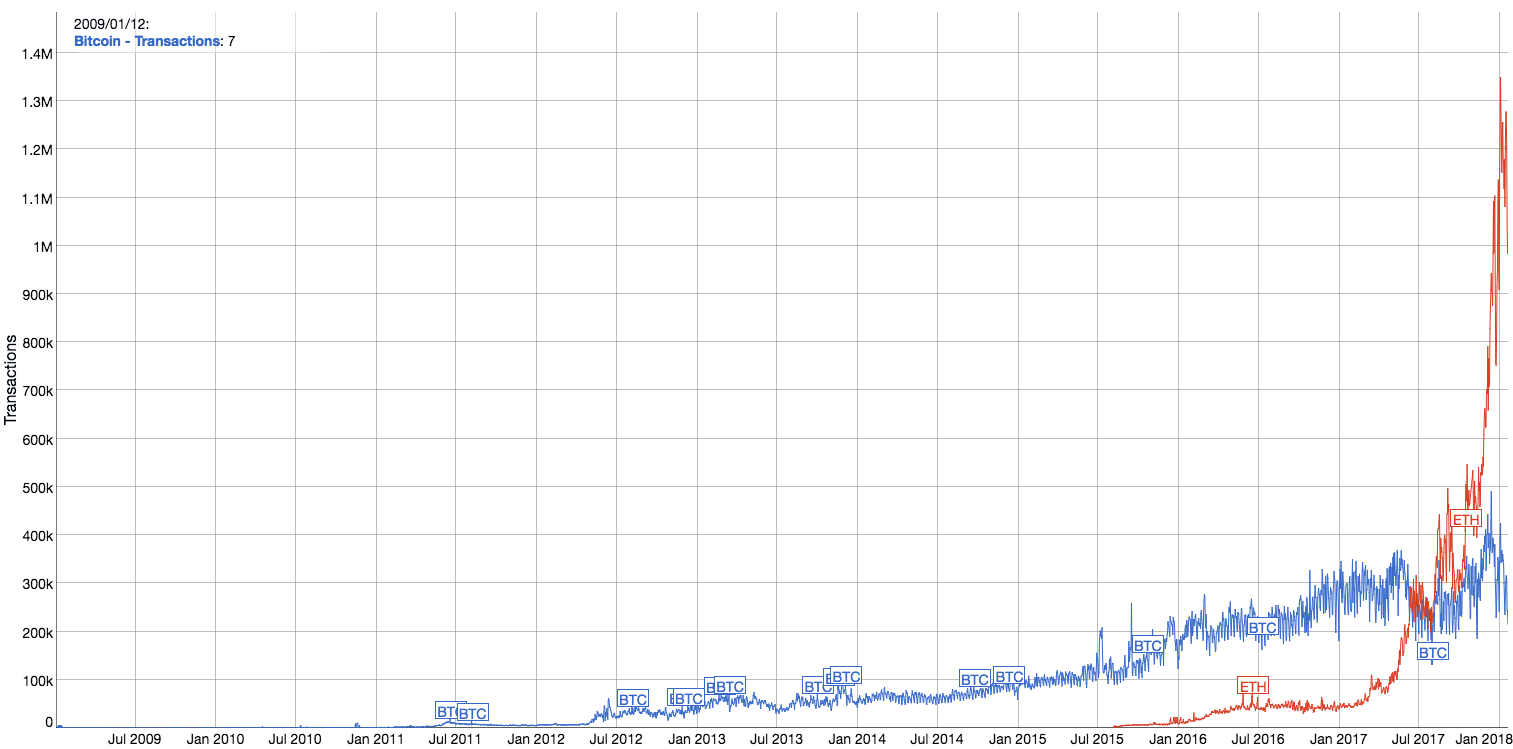

Transaction volume for Ethereum

Scaling transaction throughput is the major focus of the core Ethereum development team as it’s a prerequisite to having dApps of any significant level of usage. The Ethereum network currently processes over 1 million transactions per day, over three times Bitcoin’s 300,000 transactions per day.

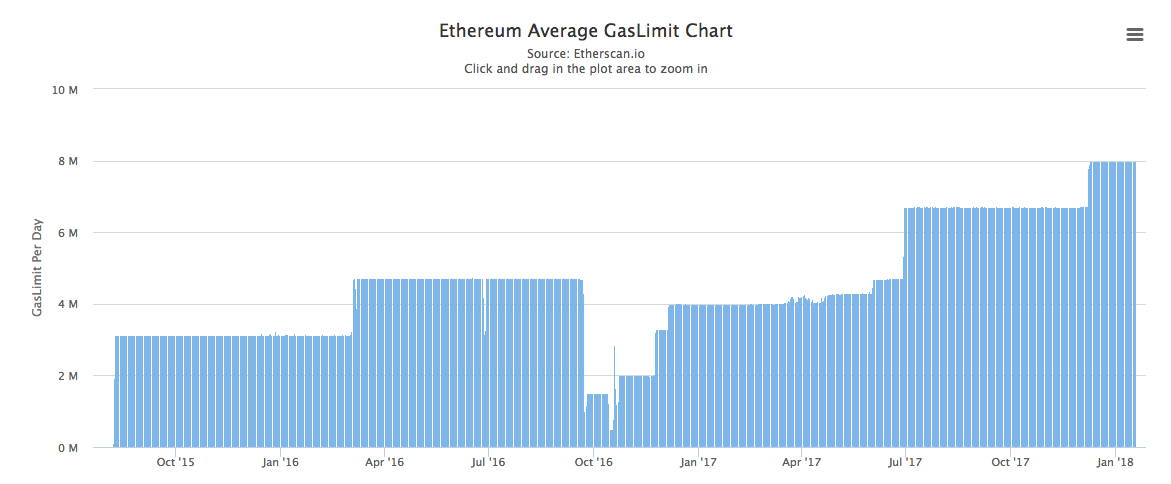

Unlike Bitcoin, Ethereum does not have a fixed block size. Instead, Ethereum blocks have gas limits, which serve as an upper bound for the cost of computation that goes into that block. The higher the gas limit, the more gas the transactions that can go into that block can consume.

Bitcoin’s block size is hard coded as a requirement to validate a block. That’s why, to increase the block size, there needs to be a hard fork.

In contrast, the gas limit in Ethereum is dynamically decided by miners through a process akin to voting. A new block can have a gas limit within 0.1% up or down from its parent block’s gas limit. Miners who want to increase the gas limit can push it up, while those who want to decrease it can push it down. The majority will prevail on where the gas limit will stay.

Miners moved the gas limit up twice in 2017 to relieve congestion and keep fees low. However, raising the gas limit is only a short-term solution that’s on the verge of topping out — raising the gas limit increases centralization and the number of orphaned blocks (called “uncles”).

Here are five of the major initiatives — currently in active development — that could each result in increases ten to one hundred times to the transaction throughput:

- Raiden: off-chain payment channels

- Plasma: blockchains within blockchains

- Sharding: break the network into smaller independent “shards”

- Truebit: off-chain computation

- Cosmos: interoperable, independent, parallel blockchains

These initiatives use different means but aim for the same ends. They all want instant transactions on the Ethereum blockchain, with very low fees, with a system that is scalable well into the future.

When that vision of low fees and fast transactions comes true, it will be good for the entire Ethereum ecosystem — users, developers, and even traders.

Trading Ethereum

Ethereum, at $95 billion, currently has the second-highest market capitalization of any cryptocurrency. Its twenty-four-hour trading volume of $3.4 billion currently puts it at the second most traded cryptocurrency in the world as well.

Many exchanges, support the buying and selling of Ethereum in various trading pairs — here are the top ten from the last twenty-four hours, ranked by volume per exchange.

SFOX supports buying and selling ETH across multiple exchanges, providing volume to those exchanges.

The price of Ethereum, which hovered between $50 and $100 USD around the beginning of 2017, shot up to $400 during the middle of June. This raised the profile of Ethereum dramatically, increasing its number of traders and supporting exchanges. Volatility, which had swung from as high as 12% at times, settled into a pattern between 5% and 7.5%.

Low volatility is critical not just to Ethereum traders, but to everyone involved in the Ethereum ecosystem. Ether isn’t just an asset whose price goes up and down — it’s the fundamental unit of computation on the Ethereum Virtual Machine (EVM). When the price of Ether is volatile, it means the cost of sending gas to miners and operating dApps is volatile.

When it costs a nickel to get time on the world computer one day, and fifty dollars the next, it becomes harder to get your work done.

By increasing the liquidity of Ethereum, exchanges like ours can help build up the Ethereum ecosystem and the individual traders in it.

What’s next for Ethereum

CryptoKitties, as ridiculous as it was to some people, did mark an important moment for the evolution of Ethereum as a real platform for applications. The massive explosion in speculation and adoption of digital kittens showed what a future of dApps — from the every day to the suddenly viral — might look like. It also illustrated what the limitations are today in the EVM.

Today, Ethereum has the wind behind it — its #2 cryptocurrency market capitalization has held steady, and sentiment has consolidated around it as the “application” platform to Bitcoin’s blockchain currency platform. The question Ethereum has in front of it is whether it will be able to scale its platform so that the next CryptoKitties doesn’t clog the rest of it.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.