Being a crypto fund manager is hard—the traditional tools that you expect for managing clients just aren’t there yet. SFOX is changing that: we’re making it easier for crypto fund managers, traders, and service providers to get an edge. In that spirit, we’re introducing the Separately Managed Account Solution, allowing fund managers to design and administer fully personalized crypto trading strategies for every one of their clients and manage them from a single login.

The Separately Managed Accounts Solution helps crypto professionals to scale their businesses by reducing operational costs: now, crypto managers and administrators can manage everything from clients’ trading strategies to comprehensive, tax-friendly transaction reports, all from a single login portal.

This new crypto tool will be transformative for fund managers, administrators, and traders alike. Here’s why:

Are you a fund manager? The Separately Managed Account Solution could transform your client relationships:

- Provide customized investment strategies for each client

- Use enhanced tax-reporting products to take taxes into consideration when making portfolio management decisions

- Manage multiple accounts from a single interface

Are you a crypto investor? SFOX’s new tool could provide you with a new way to introduce professional management into your trading life without sacrificing control over your funds:

- Invite financial team members to help manage your portfolio

- Hire dedicated investment advisors to help manage your portfolio

- Provide custom, permissioned account access to accounting firms, portfolio managers, treasurers, tax advisors, and more

Are you a crypto service provider? Now, you may be able to scale more efficiently by cutting operational costs and needless complexity.

- View and manage all clients’ transaction histories from a single account portal

- Save time and money through SFOX’s unified transaction reports

- Trade in a suite of third-party account-management tools for a single, full-service crypto account administration solution

Read on to learn more about exactly how SFOX’s Separately Managed Accounts Solution will transform the crypto management experience of fund managers, investors, and service providers.

Crypto Fund Managers: Simplify and Scale Your Expertise to a New Level of Business

In today’s crypto landscape, fund management is too often needlessly complex, with managers bogged down by everything from fund transfer management, to reporting, to account management, to trading across many different accounts on many different exchanges. The Separately Managed Accounts Solution could lower the operational costs of wealth and investment managers, creating more time and tools for building crypto businesses.

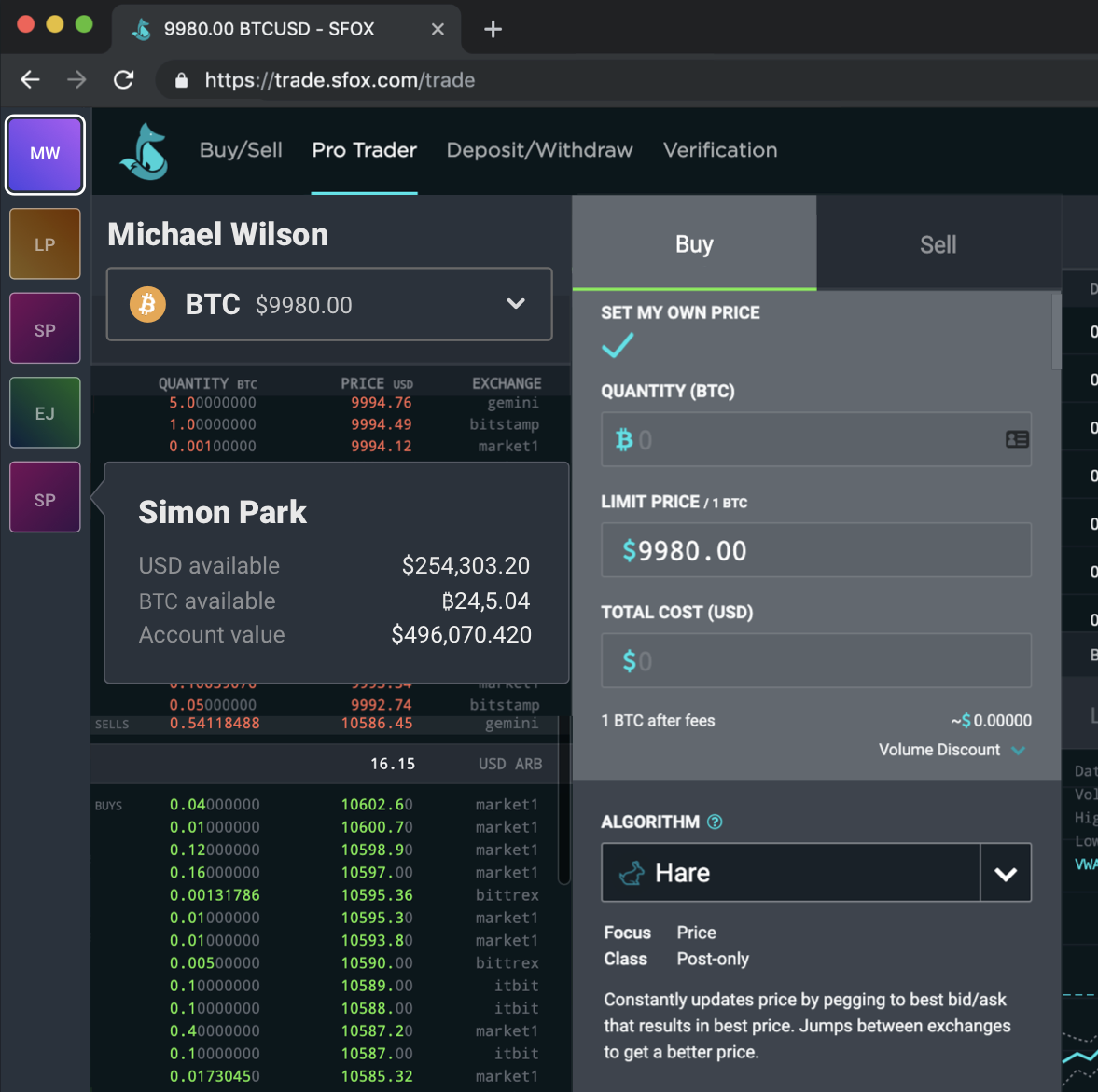

The Separately Managed Accounts Solution provides managers with a single trading interface from which they can see and trade across all the accounts under their management:

Combined with SFOX’s other tools, managers now have a single-point solution for their entire fund management workflow. The FoxEye data suite allows them to see real-time trade data on all major crypto exchanges in a single feed, while SFOX’s integrated order book and trading algorithms allow them to trade across every crypto exchange from their single SFOX account. Finally, SFOX’s transaction reports provide easy-to-read, unified reporting for each account under their management — no more marrying reams of transaction records from multiple exchange accounts.

For established fund managers, Separately Managed Accounts Solution provides an opportunity to make them more efficient at what they’re already doing and grow their services accordingly.

Nabeel Qadri, Managing Partner at crypto fund-of-funds Protocol Ventures, has already seen the potential for Separately Managed Accounts Solution to transform the value proposition of crypto fund management: “SFOX’s SMA product,” he said, “is a game-changer for prime brokerage in crypto. We can deploy a suite of strategies at scale and size our risk efficiently while minimizing slippage and reducing the impact our orders have on the underlying price of the asset. Transfers in and out are seamless and the customer service team is extremely responsive. As a fund of funds, we need to be institutional-grade — SFOX gets that.”

Crypto Investors: Have Your Funds Work for You, Not Someone Else

For many crypto advocates, the value of Bitcoin and other cryptocurrencies lies in their promise of giving individuals new freedom and control over their own money. It’s ironic, then, that many crypto funds typically provide limited visibility through quarterly reports.

Separately Managed Accounts Solution changes this equation by providing investors access to detailed information on every single trade that agent makes on their behalf. When used in conjunction with SFOX’s industry-leading cross-exchange trading algorithms, this allows investors to work with their managers to develop totally bespoke, sophisticated investment strategies that live up to the crypto sector’s standards of transparency and verification.

This level of personalized service extends from trading strategy all the way to management terms and fees. SFOX leaves it entirely up to investors and managers to negotiate their own terms, which means that investors have the opportunity to set up economic arrangements outside of the industry-standard 2/20 management-performance fee that managers typically charge. Fund managers can curate individualized tax-based strategies for their clients, taking into consideration which tax bracket clients are in — something that’s increasingly difficult with alternative solutions such as mutual funds. If investors and managers wish to include it in their management agreement, the Separately Managed Accounts Solution also provides the infrastructure for investors to be able to withdraw their account funds at any time, making fund restrictions much more flexible and negotiable than many traditional management agreements.

Managing account permissions for fund managers is easy: when an investor invites a manager to their account, they can use an easy checklist to determine what those managers will and won’t be able to do within their account, from trading, to withdrawing and depositing funds, to accessing SFOX’s API.

With Separately Managed Accounts Solution, SFOX is bridging the gap between professional financial services and financial freedom for crypto investors: now, you can retain total control over your funds while still enjoying the benefits of professional fund management.

Crypto Service Providers: Spend Less Time on Operations

Service providers such as fund administrators and accountants spend countless hours retrieving trade reports from exchanges and/or clients and reconciling trades and funds. Some service providers resort to either building their own tools from scratch to alleviate these headaches, or else pay for a third-party tool.

SFOX’s Separately Managed Accounts Solution changes this. By providing accountants and fund admins the ability to easily view and manage their client’s reporting from a single portal, these service providers can save hours or even days that would otherwise be spent collecting reports, freeing up precious resources for focusing on their main tasks. The amount of resources saved may be even more significant when accountants and fund admins also take advantage of SFOX’s unified transaction reports, optimized specifically for accounting purposes.

Full-service fund administrator MG Stover & Co. has experienced the benefits of SFOX’s latest product offering firsthand: “SFOX’s new Separately Managed Account Solution,” they said, “combined with MG Stover’s services, will allow common clients to benefit from a new seamless workflow when managing crypto portfolios and trading across many exchanges, while reducing operational costs across trading and reporting. Since our inception in 2007, we have sought to improve the fund administration experience for investment managers; we see SFOX’s Separately Managed Account Solution as the next extension of this philosophy for crypto services.”

Crypto Trading Just Leveled Up

For too long, crypto analysts have been waiting for trading infrastructure to catch up with the ideals and sophistication of crypto. With the Separately Managed Accounts Solution, that infrastructure is here. Whether you’re an investor or a manager, this tool will give you the freedom to do more with crypto trading without compromising your autonomy.

Ready to go? Sign up for SFOX and let’s get started.

Click here to learn even more about SFOX’s Separately Managed Accounts Solution.

About SFOX: SFOX is the largest prime dealer for professional traders and businesses to trade and manage their digital assets with edge. We offer a simple, reliable, and secure way to access best-priced liquidity for digital assets through a institutional-grade blockchain trading platform. SFOX’s offering includes: seamless cross market execution, advanced algorithmic order types, global market data analysis, and blockchain infrastructure support.The company has raised $23M to date from investors including Khosla Ventures, DCG, Blockchain Capital, Tribe Capital, and Social Capital.

About Protocol Ventures: Protocol Ventures is the leading digital assets fund of funds, providing investors with continued access to the world’s top crypto funds. The firm serves as an institutional access point to digital assets, providing investors with access to the highest quality deal flow. Protocol’s advisory team consists of Naval Ravikant, Avichal Garg, and some of the most respected investors in crypto. Their investors include top-tier VCs and executives from Yahoo, Skype, Hearts, Mayfield, August Capital, Floodgate, Menlo Ventures, and Data Collective.

About MG Stover & Co.: MG Stover & Co. is a full‐service fund accounting and administration firm built by former auditors and fund operators to deliver world-class solutions to the alternative investment industry. By partnering with our clientele, we become an institutional extension of their management team while delivering a boutique experience. We empower investment managers; reducing their operational cost, enhancing their reporting capabilities and exceeding their investor’s expectations. The firm has dedicated teams focused on Hedge Funds and Digital Asset Funds as well as a separate team delivering services to Venture Capital, Private Equity, and Real Estate funds.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.