Watching the crypto market just got easier. Today, SFOX is thrilled to announce the launch of FoxEye: a suite of tools for viewing and analyzing the entire fragmented crypto sphere with ease in one place.

We’re also excited to announce a brand-new tool in the FoxEye suite: Time and Sales, which you can learn all about below.

Time and Sales joins two other FoxEye tools which veteran SFOX traders are already intimately familiar with. Our integrated, cross-platform order book allows traders to view the order books of over 20 major crypto exchanges and liquidity providers in one place (and our best-in-class trading algorithms allow them to trade across all of those order books at once). Our market-wide price and volume charts allow traders to view cryptoasset price and volume trends at a glance, at whatever timescale they prefer for their personal trading strategy.

The entire FoxEye suite is free of charge for all SFOX traders. Just log into your SFOX account and check it out the entire crypto market in one simple trading UI.

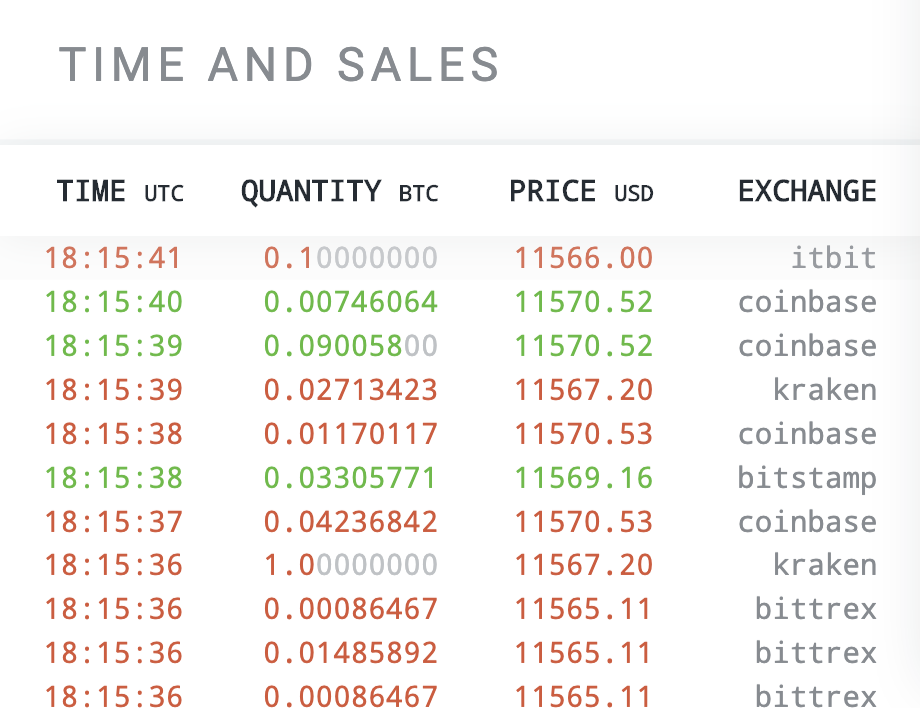

Time and Sales offers traders a live feed of the most recent trades for a given cryptoasset. You can see all the critical trade data at a glance:

- Time of trade execution

- Whether trade prices are going up or down (red indicates a downtick; green indicates an uptick)

- The amount of the asset that was traded

- The price at which the trade was executed

- What exchange the trade was executed on

Time and Sales is available for all cryptoassets enabled on SFOX: BTC, ETH, BCH, LTC, BSV, and ETC.

We’re excited to provide Time and Sales to traders as another tool in their arsenal, enabling them to form more sophisticated trading models and act on them quickly.

Like the other tools of FoxEye, Time and Sales provides an integrated view across all exchanges. This allows you to better understand both overall market activity and individual exchange activity at a glance.

Here are some examples of how you can use Time and Sales to better read the crypto market:

Speed of trades: The rate at which new trades populates Time and Sales can be possible indicators of how active the market is. If new trades are pouring in quickly, then the market may be relatively more active; if new trades are coming in less frequently, then the market may be relatively slow. One can also easily see whether trade activity is marketwide or instead constrained to a single exchange.

Active exchanges: Traders may infer what’s going on in the market based on whether trades are coming in from many exchanges or a single exchange. For instance, a trader who sees a large number of sell or buy orders on a single exchange might hypothesize that a whale is executing a large order and act on that hypothesis before the rest of the market recognizes and reacts to that signal. The ratio of buy to sell orders and the rate of trades may provide traders with valuable information about price momentum that can often be difficult to collect and act on in a timely manner.

Color-coded direction of trades: Each trade that populates Time and Sales is colored either red or green. The color indicates whether the most recent trade is at a higher or lower price than the previous trade (i.e. whether it was an uptick or a downtick, respectively). Green indicates that the associated trade was conducted on an uptick (that is, at a higher price than the previous trade). Red indicates that the associated trade was conducted on a downtick (that is, at a lower price). Generally speaking, buyers initiate uptick transactions (and sellers initiate downtick transactions).

Spotting Arb: These signals open up new opportunities to crypto traders. For instance, if trades on a single exchange are mostly green whereas trades on a different exchange are mostly red, there may be an arbitrage opportunity across those two exchanges. SFOX’s cross-exchange trading algorithms let you act quickly to capture those arbitrage opportunities as soon as you see them. Even if you’re not looking for arbitrage opportunities, our smart-routing or polar bear algorithms would allow you to get a better execution price and therefore better returns in these market conditions.

Combined with existing SFOX tools such as our integrated order book, and our integrated, market-wide price and volume charts, we’re confident that Time and Sales will be the latest step in giving our traders the edge they’ve come to expect.

The early history of the crypto market has seen challenges in distributing information and data. We built the tools of FoxEye to challenge this status quo by giving everyone interested in crypto free visibility into everything that’s happening on public exchanges. We’re confident that this trend towards increased transparency will move the crypto market further away from fragmentation and closer to a more balanced marketplace for all participants.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.