On January 3rd, 2009, the Bitcoin network was created as Satoshi Nakamoto mined the first block of Bitcoin. Embedded in this first block was the text “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Bitcoin was created as a decentralized, peer-to-peer currency, which its advocates saw as an antidote to centralized banks and financial institutions. Bitcoin’s early history was ridden with events such as the infamous Mt. Gox hack and the Silk Road bust — a testament to an exuberant, nascent industry that played fast and loose with regulation.

All of this is changing. Nearly a decade after Mt. Gox set up shop, the Bitcoin landscape couldn’t be more different as a growing number of institutions enter the space.

Currently, this is playing out across three key areas:

- Futures markets: Regulated, dollar-settled futures from the CME and CBOE allow institutions to take long and short positions on Bitcoin without actually owning the digital asset.

- Bitcoin ETFs: Like futures, a Bitcoin ETF would allow investors to gain indirect exposure to Bitcoin. More importantly, it represents a key milestone in the legitimization of the space.

- Custody: The growth of custody services is allowing investors to hold and secure Bitcoin, mitigating the risk of losing or misplacing their private keys. These solutions help institutions to comply with regulations and invest in digital assets.

In this article, we’ll walk through a brief timeline of institutional growth in Bitcoin, before diving into each of these three areas.

A Timeline of Bitcoin’s Path to Maturity

Bitcoin futures are now traded on regulated exchanges like the CME. Major financial institutions, from Goldman Sachs to BlackRock, have announced initiatives in Bitcoin. Investors not only have access to regulated exchanges to buy and sell bitcoin, but there has also been significant growth in custody services from players like Coinbase and Fidelity to help investors secure their bitcoin.

The timeline below shows the increasing institutionalization of Bitcoin over the past decade:

- July 2013: The Winklevoss twins file the first application for a Bitcoin ETF.

- November 2013: The US Senate holds hearings on Bitcoin to discuss challenges the digital currency poses to regulatory agencies.

- March 2014: Xapo, a bitcoin wallet and cold-storage business, offers its products to the public, in what is one of the first custody solutions for Bitcoin.

- June 2015: New York State creates the BitLicense with an aim at regulating virtual currencies. Any company that deals in virtual currencies with operations in New York must apply and be approved for a BitLicense.

- October 2015: SFOX opens to the public, introducing the prime dealer model to the crypto sector.

- March 2017: The SEC rejects the Winklevoss ETF proposal.

- December 2017: The CME and the CBOE launch Bitcoin futures.

- May 2018: Goldman Sachs launches a Bitcoin trading desk.

- August 2018: The owner of the NYSE announces that they’re in the process of creating Bakkt, a federally regulated, physically-backed futures market for Bitcoin.

- October 2018: Asset manager Fidelity launches a platform for trading virtual currencies targeted at institutional investors.

- March 2019: The CBOE announces that it will not continue adding Bitcoin futures contracts, likely due to a lack of volume. Fidelity launches its Bitcoin custody solution.

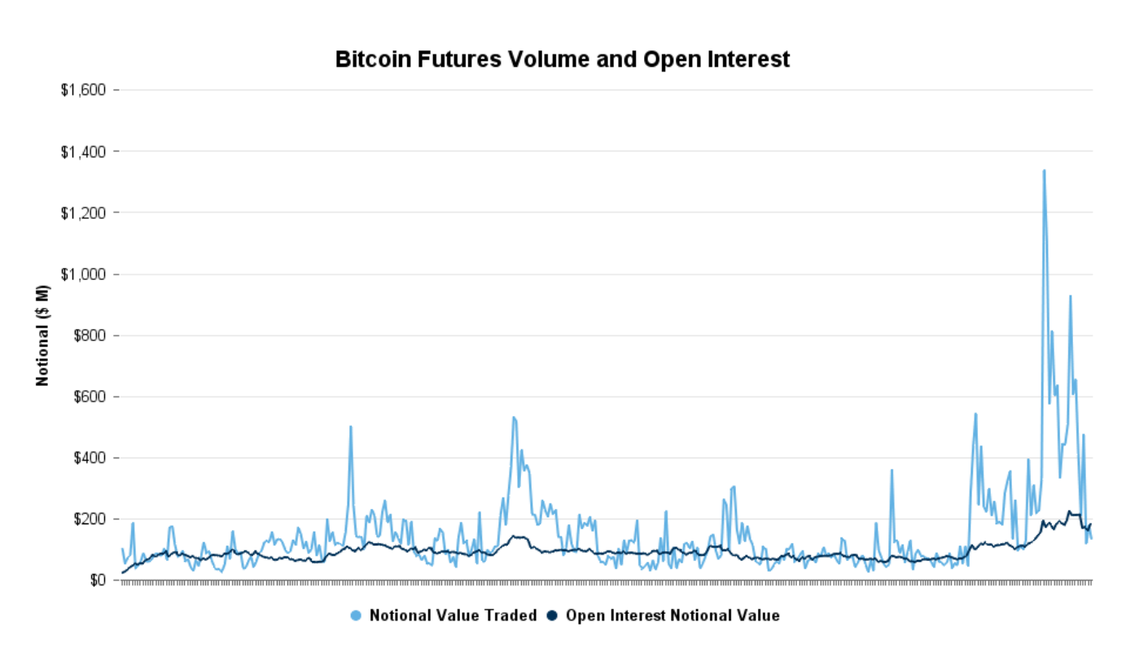

- May 2019: The CME announces that May was its highest-volume month for Bitcoin futures, with an average daily volume of $515 million in notional value. Fidelity announces that it will allow customers to begin trading Bitcoin and other virtual currencies in the coming weeks. Microsoft announces that it’s building a decentralized identity tool on Bitcoin.

- June 2019: LedgerX receives approval for bitcoin-settled futures contracts.

- July 2019. ErisX receives approval for bitcoin-settled futures contracts. Bakkt begins user-testing for bitcoin-settled futures.

Starting with the Winklevoss ETF proposal in 2013 to the recent approval of bitcoin-settled futures from LedgerX and ErisX in 2019, Bitcoin has matured unbelievably quickly over the past ten years. Below, we’ll dive into the three key categories where institutions are entering Bitcoin: futures, exchange-traded funds, and custody.

Regulated Bitcoin Futures

For years, retail traders have been able to buy and sell Bitcoin futures on exchanges not subject to U.S. regulatory oversight like BitMEX and OKEx. Today, the rise of Bitcoin futures trading on U.S. regulated exchanges like the CME gives institutional investors and traders the ability to take on greater exposure to Bitcoin. Regulated futures markets allow traders to speculate on the price of BTC and hedge for potential downside risk.

The CME and the CBOE both launched futures trading for Bitcoin in December of 2017. Both institutions are regulated by the Commodity Futures Trading Commission (CFTC) in the United States.

Initial futures volume on the CME was low upon launch, with an average daily notional volume of 1,056 BTC in contracts traded for December 2017. Trading volume has picked up substantially over the past year, with an average daily notional volume of 13,604 BTC in contracts traded for May 2019 — or around $108 million.

The CME so far has emerged as the dominant player, edging out the CBOE, which announced in March that it would stop listing new Bitcoin futures contracts. Despite this, a number of new futures exchanges are launching in 2019 to challenge the CME.

Key events to watch:

- Bakkt exchange will begin user-testing Bitcoin futures listed on the ICE in July 2019. Bakkt will offer physically delivered futures contracts settled in bitcoin.

- LedgerX is launching physically-backed Bitcoin futures in 2019 on a platform called Omni, which will be open to both institutional and retail investors. LedgerX also plans to offer physically-settled Bitcoin futures.

- ErisX is planning on offering regulated, physically-settled Bitcoin futures trading in the United States.

Bitcoin ETFs

Last year alone, the SEC rejected nine different proposals to establish a Bitcoin exchange-traded fund (ETF). While the road to creating a Bitcoin ETF has been long, it remains an important symbol in the effort to a major target for the broader institutionalization of Bitcoin.

The argument for creating a Bitcoin ETF is that it would allow investors to gain exposure to Bitcoin by purchasing shares in a fund on a public market — without the inconvenience of having to create an account on an exchange or secure their Bitcoin in cold storage. For institutional investors facing regulatory and compliance issues, this may prove extremely important. Proponents of Bitcoin ETFs claim that they will help to entice further institutional investment in the crypto sector.

Unlike traditional physical commodities such as gold or oil, Bitcoin is relatively easy to purchase and store. It’s unclear, therefore, whether a Bitcoin ETF would actually have a major impact on the market and lead to greater investment.

Beyond the functional value of a Bitcoin ETF, however, the approval of such a fund would have significant symbolic value in the story of Bitcoin’s maturation. Early in Bitcoin’s history, many viewed the virtual currency as merely a tool for criminals to purchase illegal goods online or launder money. A Bitcoin ETF approved by the SEC would help to create a broader stamp of legitimacy on Bitcoin and the fledgling digital currency sector.

Key events to watch:

- The Bitwise ETF proposal to list on the NYSE Arca is currently being reviewed by the SEC, which has postponed making a decision on the proposal twice. Comments on the current proposal are due on June 22nd, and the SEC will make a decision following comments.

- The VanEck SolidX ETF proposal to list on the CBOE BZX exchange also remains under review by the SEC, following several delays. The SEC is expected to release its decision on August 19th.

Bitcoin Custody

Bitcoin is a virtual currency — unlike gold or cash, it can be digitally stored. Without proper security precautions, this can make Bitcoin holders vulnerable to hackers and theft. The rise of custody solutions that help institutions secure their bitcoin holdings is a key first step to securing their broader investment in the market.

In traditional markets, institutional investors typically rely on third-party custodial services to safeguard assets and securities, from currencies to stocks and gold. Custody services help settle transactions in the assets that they hold for their clients. It’s so important that SEC chairman Jay Clayton spoke to the need for better custody solutions as a key milestone in approving a Bitcoin ETF. Institutions entering Bitcoin have the same need for custody of their assets.

Custody solutions for bitcoins help investors manage their assets in cold storage, removing some of the risk from investing in Bitcoin.

Key events to watch

- Further regulatory guidance will be crucial in the development of custody solutions for bitcoins and other cryptoassets. The SEC and FINRA released a statement on July 8th expressing doubts that current crypto custody solutions can comply with custodial regulations, particularly the Customer Protection Rule. The staffs of the Division of Trading and Markets and FINRA emphasized that they were in favor of innovation, but a breakthrough in Bitcoin custody will have to persuade them that custodians can maintain the proper safeguards on their clients’ holdings.

The Evolution of Bitcoin

In the past decade, Bitcoin has come a long way from Satoshi’s initial experiment in creating a decentralized, peer-to-peer currency, which was initially used by only a small handful of cypherpunks and developers. While Satoshi’s initial motivation for Bitcoin was in part as a safeguard against centralized control and financial institutions, increasingly we’re seeing these institutions lean into Bitcoin.

That’s not a bad thing. The institutionalization of Bitcoin — from the futures market, to ETFs, to custody — will provide greater adoption and liquidity for the Bitcoin as a decentralized and trustless store of value. Institutional adoption of Bitcoin is a testament to Bitcoin’s strength and enduring value.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.