Oh those Bitcoin trading bots. Those sly, sly bots. Waiting. Hiding. Lurking in the shadows. Waiting for you to place a trade, baiting you by seemingly good Bitcoin prices. Only to be usurped by a bot or to take you deep, deep down the order book. And get you to pay more than what you expected. Way more. Oh those bots.

— inner monologue of a Bitcoin trader, pre-Nov 17, 2015 (Expletives duly removed.)

We have increasingly seen bots trading on Bitcoin exchanges: market makers luring you deeper in the order book or traders using algorithms such as an Iceberg to hide their true intent. To combat bots and Iceberg, we drew inspiration from nature of a clever bear that is strong, stealth and jumps from ‘berg to ‘berg to catch its prey.

We are excited to introduce Polar Bear, our first algorithm designed to take advantage of other bots trading on the Bitcoin market.

The Problems

Iceberg allows traders to trade a large quantity of Bitcoin without moving the market adversely and does this by only showing a fraction, or the tip, of his or her order, or iceberg. For example, if a trader is selling a large quantity, the seller can break the order into many small pieces and sell them one after another as opposed to one large order, which would surely send the price downward.

The problem, however, is for the buyer on the other side of Iceberg: the buyer, not knowing there is a larger order, would end up going deeper down the order book and end up paying more than expected.

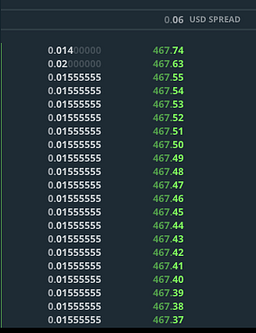

The second problem is market makers who get in front of orders, trading small quantities, and creating a false sense of liquidity. Take, for example, this order book where the market maker has created orders of 0.0155555. The net effect, if you are selling is, you may think the price is 467.74 but you will go fairly deep down the order book very quickly and most likely get 467.37 or less.

Solution: Polar Bear

We have developed an algorithm, Polar Bear, to counter these problems. You should enlist Polar Bear to work for you when:

- You are looking for an order that executes in stealth mode and is optimized for price or if you see very thin spreads with small quantities on top of the order book.

- You have a medium-sized order (under 100 btc).

- You want to benefit from an active market that is not very volatile.

How Polar Bear works:

- It feeds on the Iceberg. Polar Bear is an algorithm designed to trade only on top of the order book on the exchange with the best price. It avoids going deeper in the order book so not to fall prey to those who are trying to bait you in.

- It jumps from Iceberg to Iceberg. The Polar Bear hops from exchange to exchange. If a bot changes strategy on a given exchange, Polar Bear will move to a different exchange that provides better prices.

- It’s stealthy and suited for medium-sized orders. The algorithm is one of our hidden class of algorithms: that is, a class that doesn’t get on the order book thus preventing moving the market against you. This makes Polar Bear particularly well suited for medium-sized orders.

- It’s faster. While Polar Bear is optimized for price, it is still speedy on execution (such as faster than our other algorithm Goliath, for example).

Price over Speed

Polar Bear optimizes on price and does sacrifice order execution speed. In highly volatile markets, the market could move and your order might not fill completely. If you need to get the order executed right away (at any cost) then use our other algorithm Sniper as it’s a better choice for volatile market conditions.

Using Polar Bear

Select Polar Bear in the Algorithm list and set the limit price. The limit price on Polar Bear is similar to regular limit orders: if you are buying or selling Bitcoin, Polar Bear won’t buy it higher or sell it lower than the limit price. The differences are Polar Bear will stay hidden until the limit price is reached and Polar Bear will always try to perform better than the limit price.

It’s time to put an end to those frustrated inner monologues of getting outmaneuvered by bots.

Sign Up today to SFOX to trade Bitcoin with Polar Bear and our growing stable of advanced (nature-inspired) algorithms today.

Happy Hunting/Trading.