On May 6, 2010, a $4.1 billion trade on the New York Stock Exchange caused the Dow Jones Index to drop 1,000 points — nearly 10% — before bouncing back after around 15 minutes.

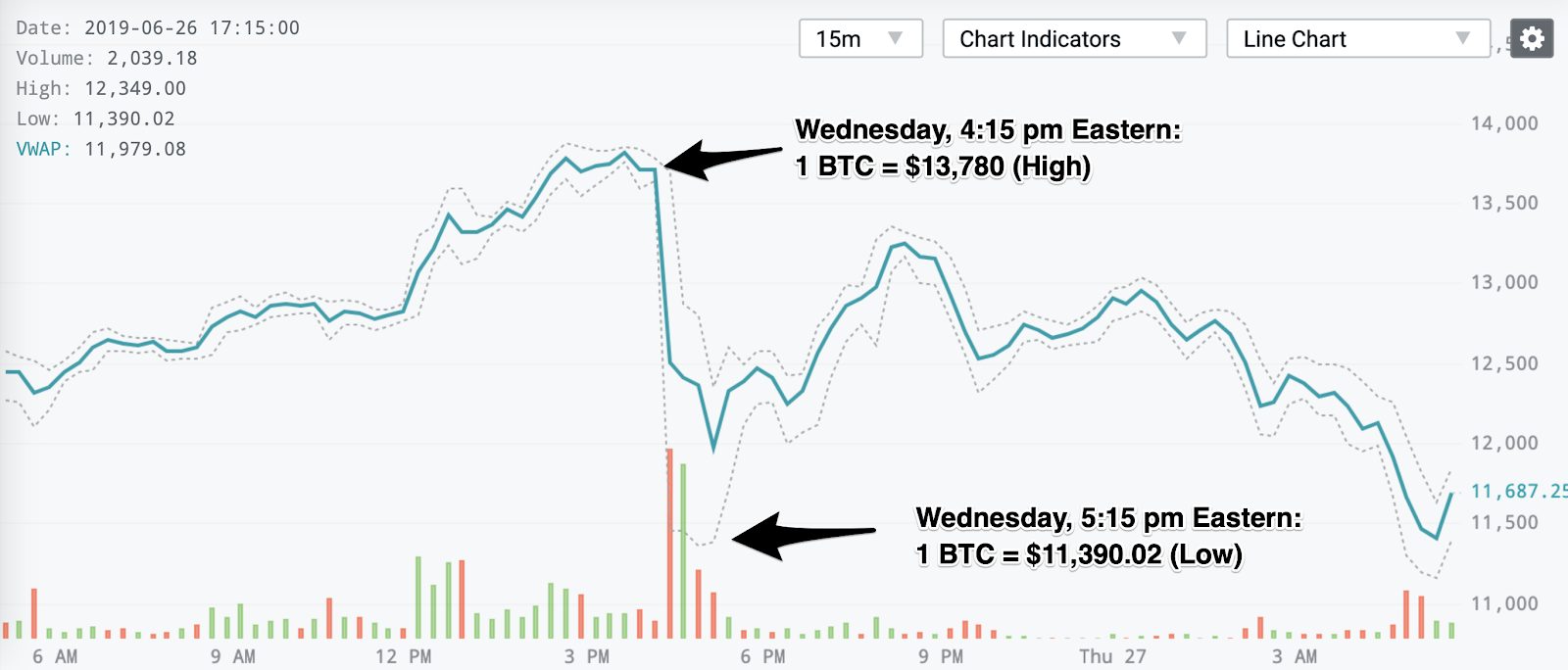

A similar tumble happened yesterday in the world of crypto. The price to buy bitcoin had risen from $11k on Monday to almost $14k on Wednesday; in just an hour, coinciding with a loss of service at a major crypto exchange, the price of bitcoin had dropped almost 18%, from a high of $13,780 to a low of $11,390.02.

These events are examples of what’s known as a flash crash: a volatile and violent downward swings in the market. Flash crashes typically occur due to algorithmic trading and high-frequency trading.

The cryptocurrency space is newer and less regulated and has less infrastructure than traditional finance, leading to a number of prominent flash crashes over the years. In this article, we’ll discuss what causes flash crashes before diving into some of the biggest flash crashes in Bitcoin history.

What Causes a Flash Crash?

Many different factors can contribute to flash crashes. A flash crash describes a phenomenon where assets on an exchange experience a rapid decline in price, typically rebounding shortly thereafter. Flash crashes are exacerbated in the age of electronic markets, where algorithmic trading automatically responds to divergences in price and can lead to widespread selling in milliseconds.

In cryptocurrency, flash crashes have historically been driven by three factors:

- Large sell orders: Large sell orders, especially on an exchange with low liquidity, can eat up bids in the orderbook, leading to disproportionately large price jumps from a single trade.

- Algorithmic trading: Automated trading algorithms and bots respond to price movements much faster than humans can, which can lead to heightened volatility and increased selling.

- Liquidity: Thin order books and a lack of liquidity on exchanges can lead to price slippage, causing the market price to cascade down.

Flash crashes are typically caused by a multiple of these factors working in tandem. A large sell order on an illiquid exchange, for example, might lead to a breakdown in price due to slippage. That might cause automated stop-losses set on orders to trigger, leading to greater selling on the exchange and crashing the price downwards.

In the rest of this article, we’ll break down the most significant flash crashes in Bitcoin history and what factors may have contributed to them.

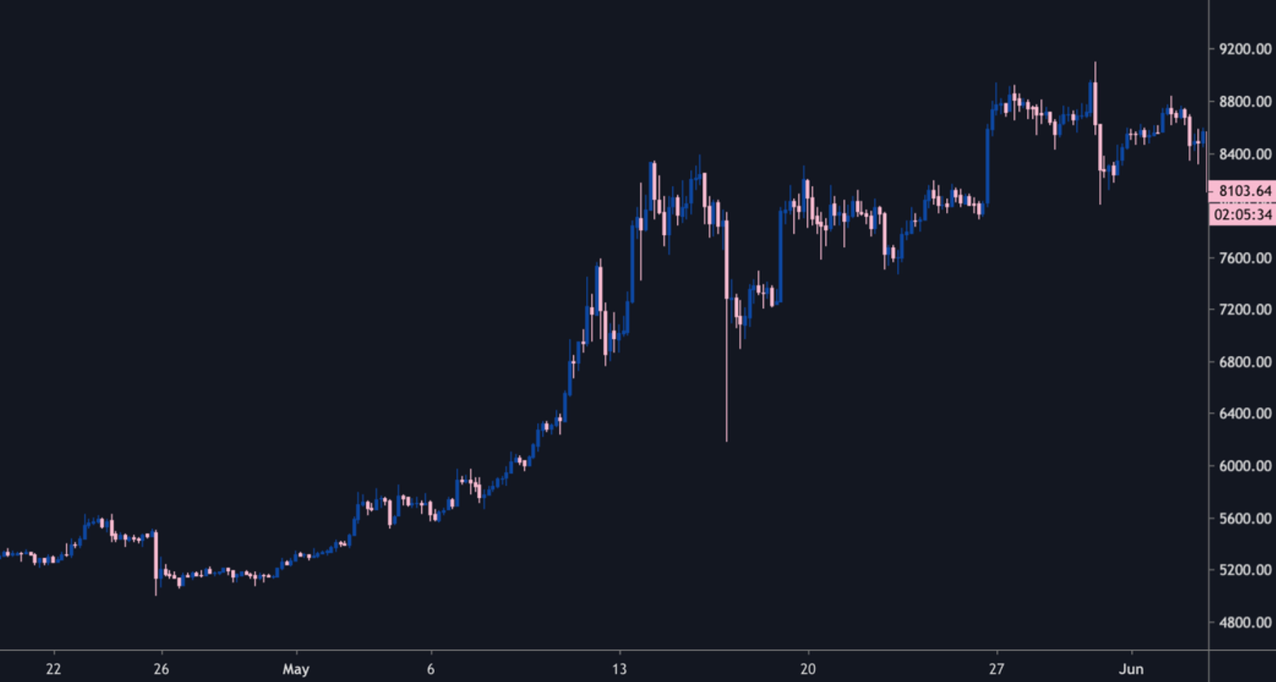

Bitstamp Flash Crash

- Exchange: Bitstamp

- Date: 5/16/19

- Drop magnitude: 20%

On May 16, 2019, at 11 p.m. ET, a massive sell order for 5,000 BTC — worth around $39 million at $7,800 per BTC — caused a flash crash down to a low of around $6,200 within 30 minutes. It’s likely that a confluence of different factors caused this 20% drop across the market.

The order for 5,000 BTC was executed at a price at $6,200. Some speculate that the seller meant to place a sell limit order for $8,200 but mistakenly set the price at $6,200.

The flash crash was exacerbated by the fact that the Bitstamp index is also used to calculate prices for BitMEX, the largest Bitcoin futures exchange. As a result, the large sell order on Bitstamp also pushed prices down on BitMEX, causing the liquidation of hundreds of millions of dollars in long futures contracts and further lowering the price of Bitcoin down further.

Dovey Wan, founding partner of Primitive Ventures, speculated that the sell may have been an effort to manipulate the market and drive the price of Bitcoin down to buy it at a lower price:

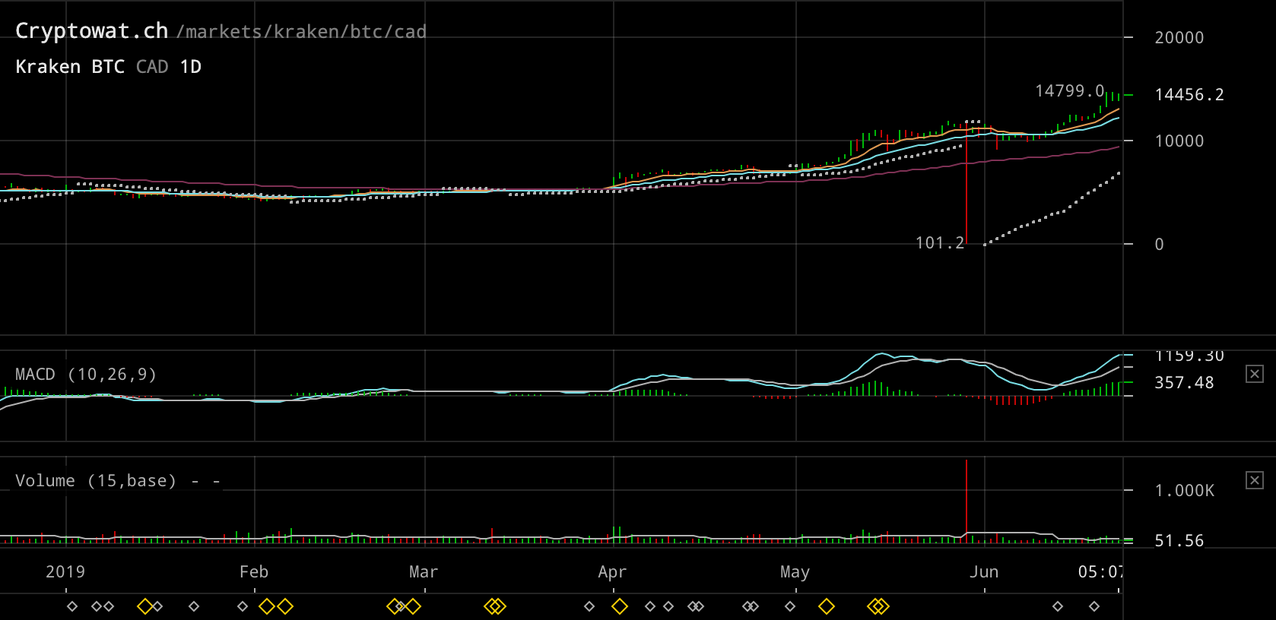

BTC/CAD Kraken Flash Crash

- Exchange: Kraken

- Date: 5/29/19

- Drop magnitude: 99.1%

On May 29, 2019, the BTC/CAD (Bitcoin / Canadian Dollar) pair flash-crashed from around $11,800 CAD per BTC to a low of $101.2 CAD, a drop of over 99%. Within minutes, the price shot back up, but not before a few lucky traders had their $100 CAD orders filled by unlucky traders placing market orders into the crash.

This was able to happen because there’s limited liquidity on Kraken’s BTC/CAD pair, which currently does around 70 BTC in daily volume, meaning that a single 100 BTC order on Kraken would be enough to substantially move the price. On the day of the crash, one commentator on Reddit found a sell order for 1,155 BTC placed at a price of $101, which may have caused the crash.

One Twitter user theorized that the flash crash may have been caused by a hacker:

While it’s impossible to say for certain what actually caused the flash crash, one factor at play may have been the lack of liquidity on Kraken’s BTC/CAD pair. Kraken’s XBT/USD pair, as a point of contrast, has a 24 hour volume of nearly 10,000 BTC — over 140 times the daily volume of their BTC/CAD pair.

Mt. Gox Flash Crash

- Exchange: Mt. Gox

- Date: 6/19/11

- Price drop magnitude: 99.4%

On June 19, 2011, large sell orders on the Mt. Gox exchange caused a flash crash from around $17.01 to around $.01. This flash crash erased the rally from $2 per BTC to around $32 per BTC in the months prior to the crash.

In the weeks prior to the flash crash, multiple users on the Mt. Gox exchange had their accounts hacked. A database of Mt. Gox passwords was also leaked and publicly available.

One theory around the flash crash is that the hacker obtained access to a large sum of BTC by gaining access to user accounts on Mt. Gox. However, due to Mt. Gox’s $1,000 per day withdrawal limit, they were unable to withdraw the stolen BTC at current prices. By selling a large amount of BTC and crashing the price, it would have been possible for them to withdraw the stolen funds in accordance with Mt. Gox’s daily withdrawal limits.

While Mt. Gox decided to reverse the transactions that occurred during the flash crash, they never provided a compelling explanation of what exactly happened and what may have caused the crash.

Flash Crashes are a Fact of Life

In an age of electronic trading, flash crashes occur in nearly every market, whether they’re traditional markets or cryptocurrency markets. In the world of Bitcoin, the problem has historically been exacerbated due to a lack of liquidity on exchanges. As the market matures, and trading volumes rise on exchanges, it will be harder to move the price of Bitcoin through large sell orders, which may help limit the extent of flash crashes in the future.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.