Summary:

- Bitcoin has shown upward price movements around major U.S. holidays in the last 5 months.

- Bitcoin holiday movements were prevalent in late 2017 and early 2019, as SFOX analyzed in a market report this past July.

- There appears to be a pattern of Google searches for Bitcoin climbing immediately ahead of holidays and then dropping during holidays.

- Market participants may potentially be anticipating BTC movement during holidays, creating a self-fulfilling prophecy.

With Thanksgiving in the rear-view mirror, the holiday season is upon us, and crypto traders — especially those who were around for the 2017 crypto boom — are watching Bitcoin closely.

SFOX’s research team has previously reported that holidays have correlated with temporary upswings in BTC’s price, particularly if those holidays fall during bull runs. New research by SFOX suggests that increased BTC price movement may still correlate with holidays — in which case, the crypto market may want to watch BTC closely in the coming weeks.

Bitcoin Price and Search Volume Movements Around Thanksgiving, Labor Day, and the Fourth of July, 2019

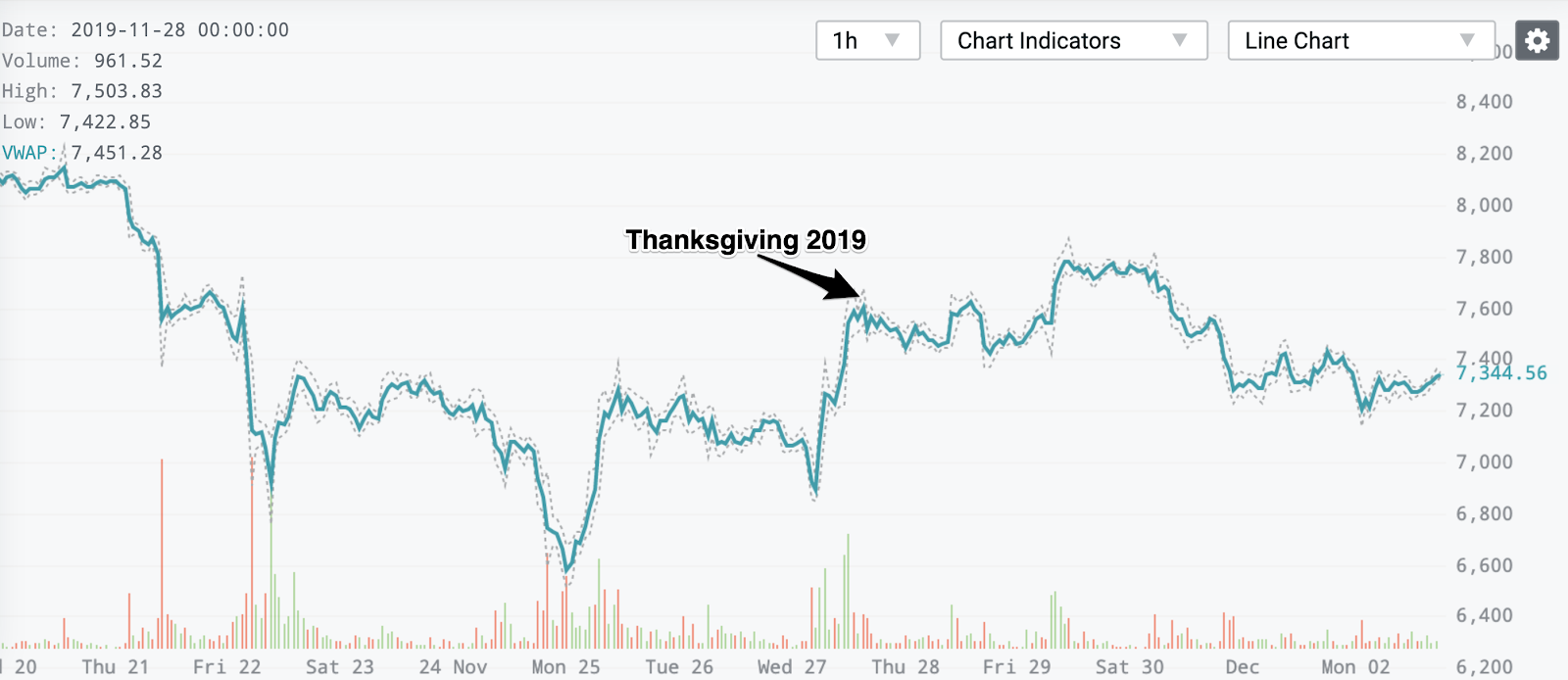

When Thanksgiving took place last Thursday, BTC found itself in the midst of a three-day climb in price.

After the price of BTC bottomed out at $6515 on Monday, November 25th, it rebounded 20.8% in the following four days, peaking at a price of $7870.35 on Friday, November 29th. The price subsequently fell back to $7344.56 at the time of writing on Monday, December 2nd.

While it’s impossible to say with certainty that the Thanksgiving holiday played a role in this rebound, these data are consistent with crypto performance data that SFOX has observed over the last several holidays.

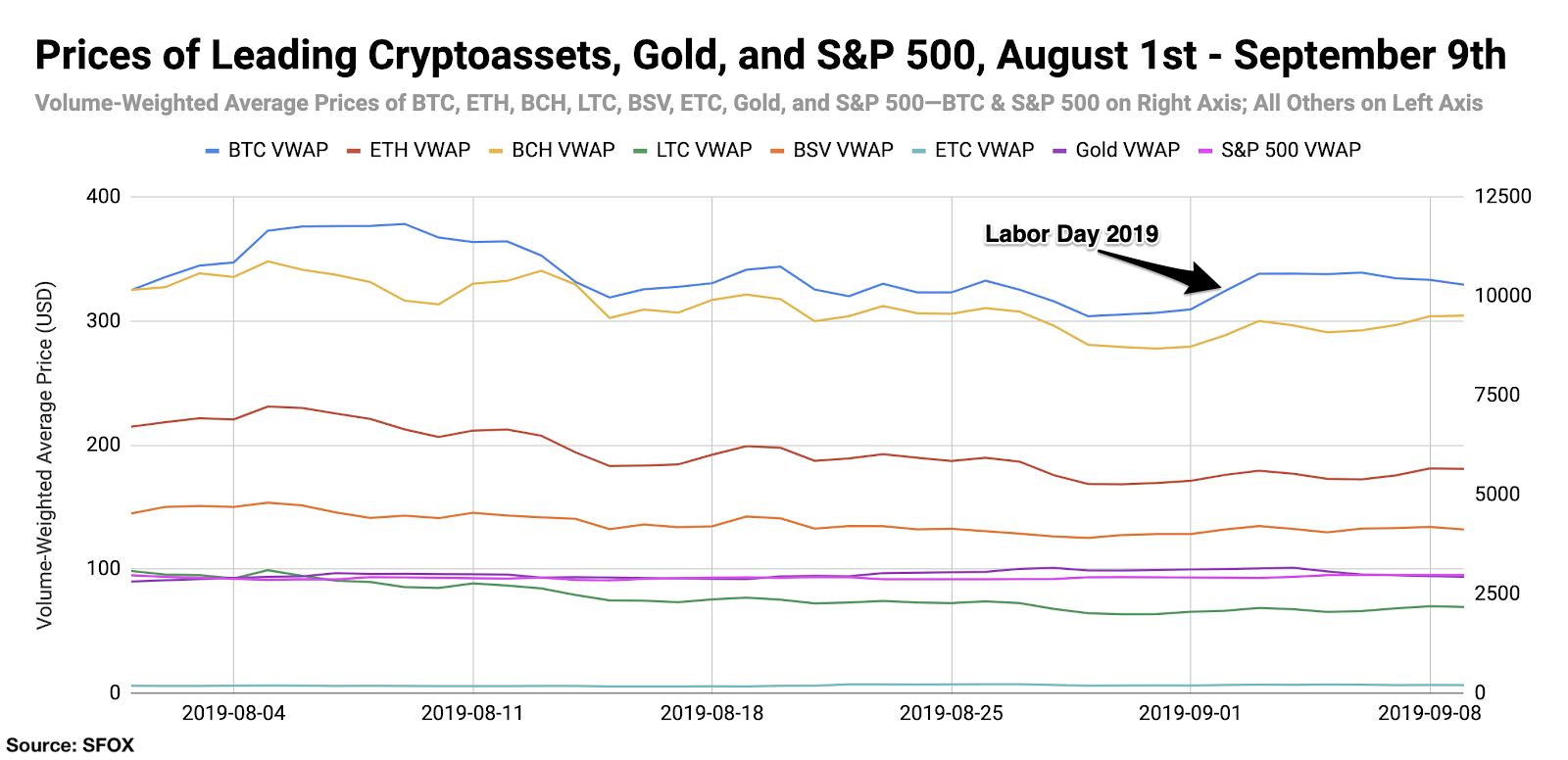

On Labor Day — September 2nd, 2019 — the price of BTC increased almost 5%, from a volume-weighted average price (VWAP) of $9668.74 to a VWAP of $10129.49. The price climbed further to $10568.49 the following day.

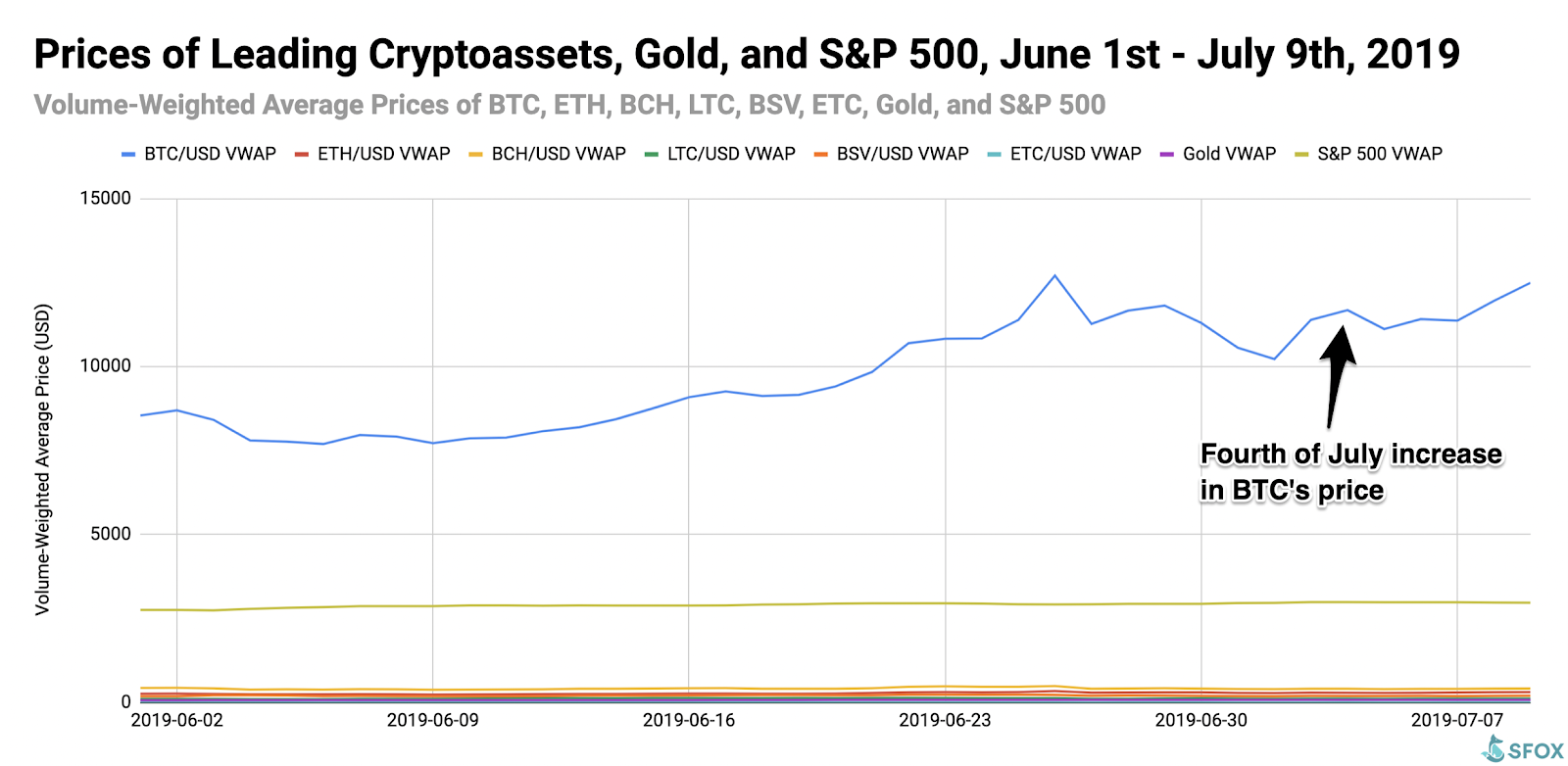

We observed similar behavior over the Fourth of July holiday earlier this year, the day after SFOX published its initial analysis of BTC’s performance: between July 2nd and July 4th of 2019, the price of BTC increased over 14%, from a VWAP of $10220.87 to a VWAP of $11677.47, before falling back to a VWAP of $11114.11 on July 5th.

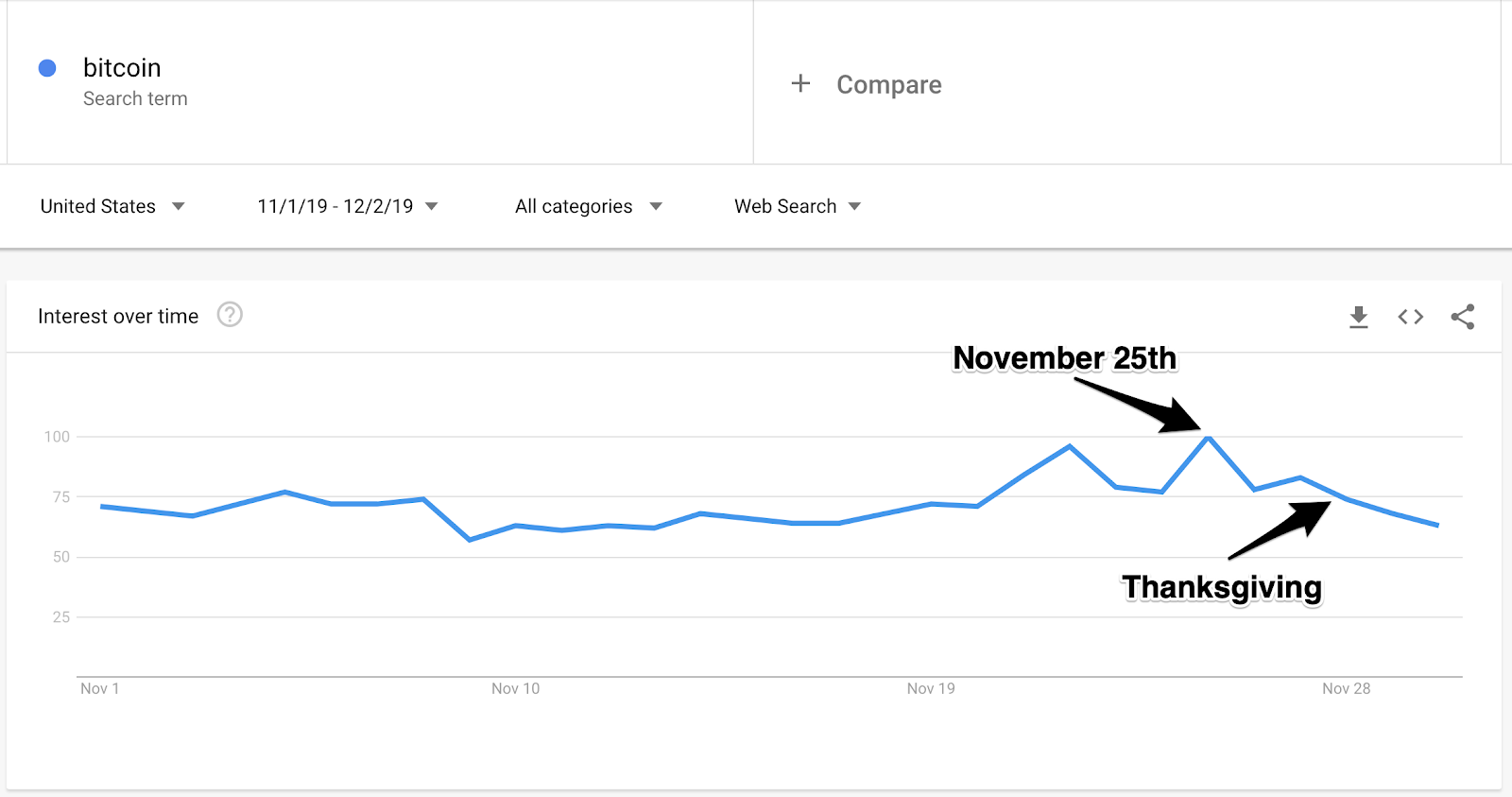

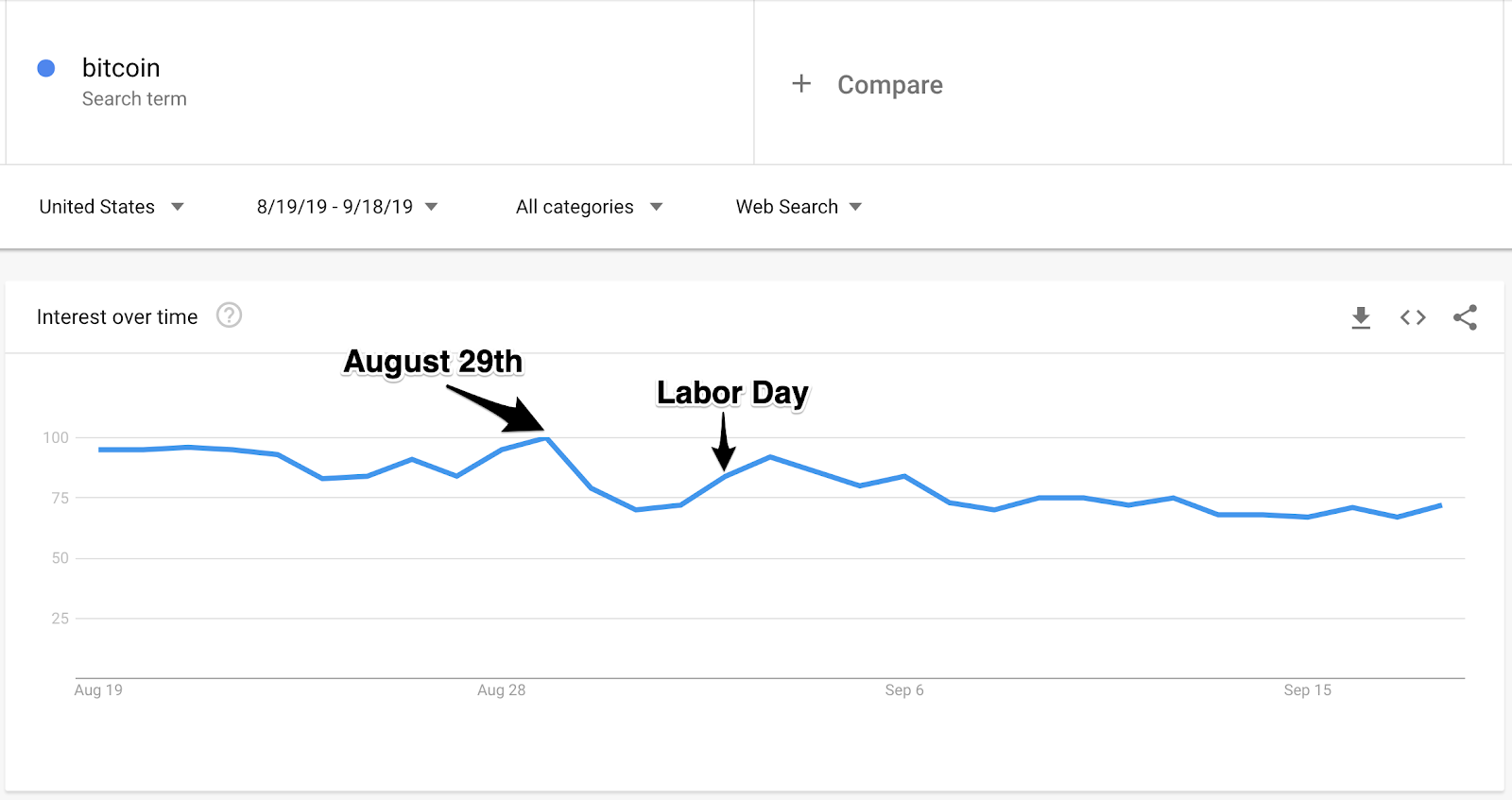

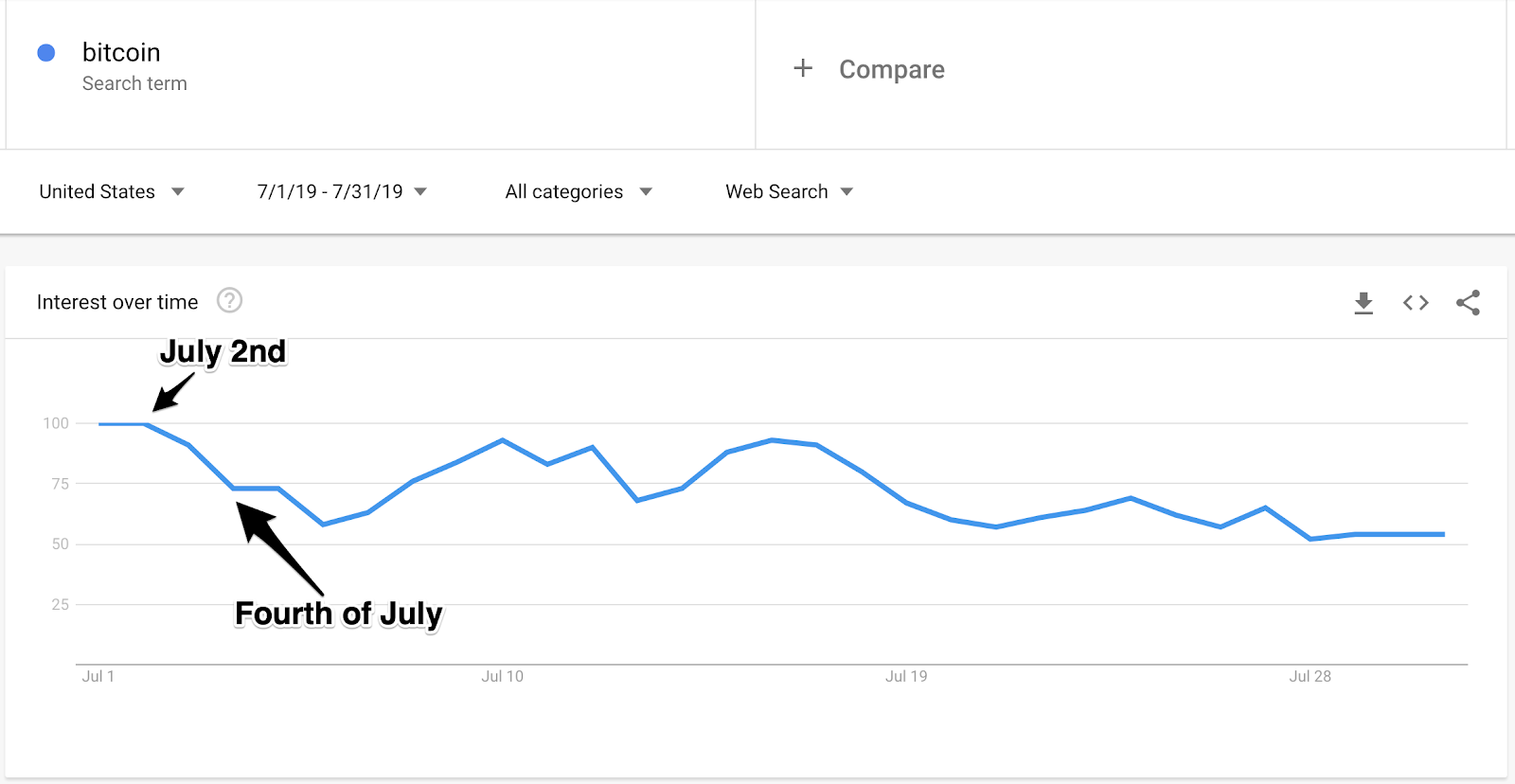

In SFOX’s first analysis of Bitcoin holiday performance, we found that holidays also appeared to correlate with increases in the relative volume of Google searches for ‘bitcoin’. In the case of the more recent holidays analyzed above, SFOX has observed a slightly different trend: according to data collected from Google Trends, relative Google search volume for ‘bitcoin’ peaked before major U.S. holidays, bottoming out during the holidays themselves.

In November 2019, Google search volume for ‘bitcoin’ peaked on the 25th, the Monday before the Thanksgiving holiday — and the day when the price of BTC bottomed out before beginning to recover.

Similarly, the relative Google search volume for ‘bitcoin’ peaked on August 29th, 2019, the Thursday before Labor Day weekend — the same day the price of BTC bottomed before recovering over the Labor Day holiday.

And, in the same vein, the relative Google search volume for ‘bitcoin’ peaked on July 2nd, 2019, — the same day the price of BTC bottomed before recovering over the Fourth of July.

A Self-Fulfilling Prophecy?

Back when SFOX analyzed crypto holiday performance in July, we posited that holidays could theoretically contribute to upswings in BTC’s price because of families getting together, experiencing FOMO, and subsequently researching and purchasing BTC. However, the most recent data we’ve analyzed here show Google searches for ‘bitcoin’ peaking before holidays, not after; therefore, that hypothesis doesn’t seem like a plausible explanation of the trend we’ve seen over the last three major U.S. holidays.

So, what’s going on here?

While there aren’t many holiday data to evaluate at this young point in crypto’s history and correlation does not imply causation, these most recent data put us in mind of an observation made by Whale Alert when SFOX interviewed them last month. Whale Alert tracks and alerts its audience of especially large transactions made on Bitcoin and other major blockchains. While such large transactions could theoretically move the market, Whale Alert also observed that “Whale Alert has such a large following at the moment, and it’s kind of hard to see what the effect is of us posting our transactions on our Twitter feed: that might actually influence the price in itself. And we haven’t done much research on that — on what our influence actually is.”

Just like the expectation of whale movements impacting the crypto market could end up impacting the market, we might be witnessing the crypto market preemptively responding to holidays simply because traders expect the market to move around holidays. This would explain why Google searches for ‘bitcoin’ have peaked before recent holidays rather than after recent holidays: market participants could be researching BTC’s position ahead of holidays and then taking long positions in BTC in an expectation of a short-term price increase over the holiday, creating a kind of self-fulfilling prophecy that actually does drive the price of BTC up in the short term.

While this is just one possible explanation for what’s going on, it underscores the many forces — from speculation, to trader expectations, to asset fundamentals — that may be at play in any given market trend. Regardless of which forces are really driving BTC’s holiday behavior, it seems as though BTC remains sensitive to major U.S. holidays for the time being, so market participants may wish to keep an eye on upcoming holidays as we enter the month of December.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.