Imagine you’re watching the 15-minute chart of Bitcoin on your favorite exchange. All the signals in your trading strategy are indicating the price of Bitcoin is about to fall, so you decide to sell off your position in Bitcoin.

But when you look at the cost of your trade, you see that you sold your BTC at a significantly lower price than what you’d seen on the exchange. Because there weren’t many people with limit orders to buy Bitcoin on the exchange, your order ended up being executed at a price far worse than the one at the top of the order book.

This is just one of the very real situations in which liquidity — a financial concept that’s mostly interested academics in the past — can impact your returns when trading cryptocurrencies. A solid understanding of Bitcoin liquidity can help you understand which exchanges to trade on, when to trade, and what kind of trades to make.

What is liquidity — and what does it mean for Bitcoin?

Liquidity, roughly defined, is just how easy it is to convert a given asset to cash. It’s a term that comes from the more academic side of finance, and understanding the insights of the scholars in this field can give you direct insight into bitcoin markets.

Keynes’ definition of liquidity

In 1930, the renowned economist John Meynard Keynes offered this succinct definition of liquidity in his Treatise on Money: liquidity is the degree to which an asset is “more certainly realisable at short notice without loss.” Liquid assets, accordingly, are better for everyday transactions or short-term investments.

What does this mean for Bitcoin? As more people exchange an asset on a daily basis, the asset generally becomes more liquid. We’ve seen this in the long arc of Bitcoin’s history: in the early days, it could be hard to find people to accept your coins at any price, let alone without loss. Nowadays, different exchanges can have a vastly different number of people who have limit orders ready to buy and sell BTC at any time. That means that, even though BTC is a single asset, it can be more or less liquid on different exchanges: if you’re on an exchange that has a sparse order book, BTC might be relatively illiquid — and you could end up taking more of a loss when you exchange it than you would on another exchange.

Keynes’ liquidity preference theory

In 1936, Keynes published The General Theory of Employment, Interest, and Money, a founding text in the field of macroeconomics. Within this work, he introduced liquidity preference theory: the theory that people demand a higher premium on investments that take longer to yield a return-on-investment because these investments require one to sacrifice more liquidity.

What does this mean for Bitcoin? With 42.51% dominance in the overall crypto market as of writing, Bitcoin is one of the most liquid cryptocurrencies (though, like we just said, that doesn’t mean it’s equally liquid on all exchanges!). Other cryptocurrencies, however, can be far harder to liquidate — for example, the tokens distributed in ICOs, or the fringe tokens bought and sold on exchanges with extremely sparse order books. If you decide to invest in these less liquid cryptoassets, therefore, it had better be the case that you have reason to expect much larger returns down the line (the premium on your investment) than if you invested in BTC.

The five characteristics of liquid markets

In 2002, Tonny Lybek and Abdourahmane Sarr published “Measuring Liquidity in Financial Markets,” an overview of measurements and applications of financial liquidity. They note that there are five distinct factors to consider when it comes to the liquidity of a given asset:

- Tightness. This refers to low transaction costs, including (but not limited to) the bid-ask spread.

- Immediacy. The speed at which orders are executed and settled.

- Depth. The number of limit orders filling out the order book for that asset.

- Breadth. A high number of large orders.

- Resiliency. A quality of a market in which new orders flow in to correct imbalances and keep the price of an asset closely related to its fundamentals.

These factors don’t always directly correspond to available data, so they can be hard to measure individually — but they can give you a more precise grasp on the different aspects of a market that contribute to liquidity.

What does this mean for Bitcoin? A full understanding of Bitcoin’s liquidity isn’t as simple as looking at the order book and seeing how many limit orders are filling it: you need to consider multiple dimensions of the market. For instance: in the near future, we probably won’t see much resiliency in the BTC market: that is to say, the price of BTC probably won’t be consistently and tightly correlated to the fundamentals of Bitcoin. Why? Because, in these early days of the crypto industry, the price of crypto’s most dominant asset is heavily influenced by speculators who aren’t making bets based on the asset’s fundamentals.

Traditional methods of calculating liquidity

Also in “Measuring Liquidity in Financial Markets,” Lybek and Sarr round up of some of the “standard” formulas for calculating liquidity. Two in particular are worth noting here:

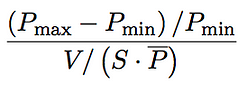

1. The Hui-Heubel Liquidity Ratio. Introduced by Baldwin Hui and Barbara Heubel in 1984, this is a way of calculating the breadth of the market for an asset: the asset’s liquidity increases as breadth increases. This ratio is defined as follows:

In this equation, P Max is the highest daily price over the last five days, P Min is the lowest daily price over the last 5 days, V is the total dollar volume traded in the last 5 days, S is the total number of shares outstanding (i.e. the number of shares held by all shareholders), and P Bar is the average closing price over the last 5 days. As the Hui-Heubel Liquidity Ratio decreases, the breadth of the market — and, with it, liquidity — increases.

2. The Market Efficiency Coefficient. Proposed by Joel Hasbrouck and Robert A. Schwartz in 1988, this coefficient is meant to describe the difference between long-term and short-term fluctuations in an asset’s price. In this way, it can give us a sense of the resiliency of the asset. It is defined as follows:

In this equation, Var (Rt) is the variance of the asset’s returns over a relatively long-term period, Var (rt) is the variance of the asset’s returns over a relatively short-term period, and T is the number of short-term periods contained in one of the long-term periods. A more resilient — and therefore more liquid — asset will have a market efficiency close to 1.

What does this mean for Bitcoin? Much like other indicators of technical analysis, there are many ways to measure the various aspects of Bitcoin liquidity. As you explore trading BTC on various exchanges, consider keeping track of a variety of liquidity measurements. Which ones correspond with how easy it actually is to buy and sell bitcoin without taking a loss in the process? As you find the most informative formulas, you can incorporate them into your broader trading strategy.

Towards a liquidity index

At the end of 2014, Danyliv, Bland, and Nicholass proposed a new liquidity index, intended to accommodate most of the five factors that Lybek and Sarr said contribute to liquidity. In Convenient liquidity measure for financial markets, they defined this index as follows: it is the multiple of the asset’s daily traded volume and average price (otherwise known as the consideration), divided by the price range of the asset over the day.

The greater this value is, the more liquid the asset in question is for that period of time.

What does this mean for Bitcoin? Even though this liquidity index wasn’t crafted with cryptocurrency in mind, you can use it as a way of calculating Bitcoin’s liquidity on various exchanges. You can gather all of this data from exchanges themselves and plug it into the equation to compare which exchanges provide more liquidity for trading BTC — provided the exchanges are being honest about their data.

How can Bitcoin liquidity be a problem for traders?

Especially in these early days of regulated and unregulated Bitcoin exchanges, liquidity can vary hugely depending on where and when you trade Bitcoin. Treating all exchanges as equally liquid can lead to you unknowingly paying significant premiums on your trades. Here are some of the major ways in which Bitcoin liquidity can trip you up when you’re trading.

Bitcoin liquidity can vary across exchanges at a single time

You might imagine that a single asset has a singular degree of liquidity — but different exchanges have different order books. If you sell some BTC on Gemini while Bitfinex has more limit orders in its order book, your trade might end up costing more than it would have on Bitfinex simply because you had to go relatively deeper in Gemini’s order book, to a lower limit order, to sell your BTC.

Bitcoin can vary in liquidity on a single exchange at different times

Not every time is equally opportune for trading BTC. On weekends and holidays, fewer people are actively trading bitcoin and other cryptocurrencies — many traders will have closed out their positions and orders prior to those times.

With fewer orders on all the exchange books at these times, you’ll end up paying a higher premium for your trades than you would at higher-volume trading times.

Exchanges could be lying to you

How sure are you that exchanges are providing you with accurate data?

It might be enticing to arm yourself with formulas for calculating Bitcoin liquidity and dive into price/volume data on various exchanges — but, while that’s a good thing to do, you should take exchanges’ self-reported numbers with a grain of salt.

Six months ago, trader Sylvain Ribes collected data on the orderbooks of different crypto exchanges and analyzed how a $50k USD selloff of BTC would impact the price of BTC on each exchange. He investigated upwards of 13 exchanges that he determined were probably lying about their volumes. OKex, he claimed, could be faking up to 93% of its alleged trading volume.

Especially in these early days of crypto regulation, exchanges aren’t equally trustworthy. It can be dangerous to take their self-reported numbers at face value.

How can you solve the problem of Bitcoin liquidity in your own trading

Liquidity can be a problem when trading bitcoin — but, when you understand the problem, you can turn the problem into an advantage. Here’s how you can integrate your new knowledge of Bitcoin liquidity into your own trading strategy.

Trade on a platform that lets you access multiple order books

Instead of constantly searching multiple exchange order books to see which one is providing Bitcoin with the most liquidity at any given moment, you can try a platform like SFOX that gives you access to the liquidity of multiple exchanges. You can use one of our trading algorithms, such as Tortoise, to automatically find and execute your trade on the exchange that provides you with the most liquidity — and, therefore, the best price.

Avoid trading in predictable “dry spells”

Even if you can’t trust what exchanges are telling you about their volume, you might be able to trust certain patterns of human behavior — for instance, that trading volume on widely observed holidays will be relatively low, leading order books relatively sparse. Consider making it a rule to not trade on holidays or weekends to avoid trading environments that are predictably less liquid than ordinary weekdays.

Read external sources to determine exchanges’ credibility

Just because some exchanges lie about their numbers, doesn’t mean there aren’t ways to get to the truth of the matter — Sylvain Ribes’ article is proof of that. Before you start trading on an exchange, consider exploring what others are saying about it as a form of due diligence — exchanges’ subreddits, recent articles and analyses about the exchange, and so forth. Indicators that an exchange is regulated — KYC compliance, for instance — are also a good sign that its numbers are relatively trustworthy.

Help contribute to Bitcoin liquidity

Many exchanges, recognizing the value of additional liquidity, offer maker rebates to those who submit limit orders and thereby add depth to the exchange’s order book. Acting as a market maker in this way can save you money, while also contributing in a positive way to the overall crypto ecosystem.

One coin, many degrees of liquidity

While liquidity might initially seem like a merely academic subject, it has many lessons to teach about the price of bitcoin.

It’s easy to lull yourself into thinking that the only fees you’re paying for your BTC trades are the ones that exchanges explicitly mention. But lack of liquidity — whether that’s from trading on an exchange with no depth, or trading on a weekend, or trading on a deceitful exchange — is a hidden fee that makes your trade more expensive than it needs to be.

So even if Bitcoin liquidity is a bit academic, get studying! It might just end up making you a better trader.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.