Summary:

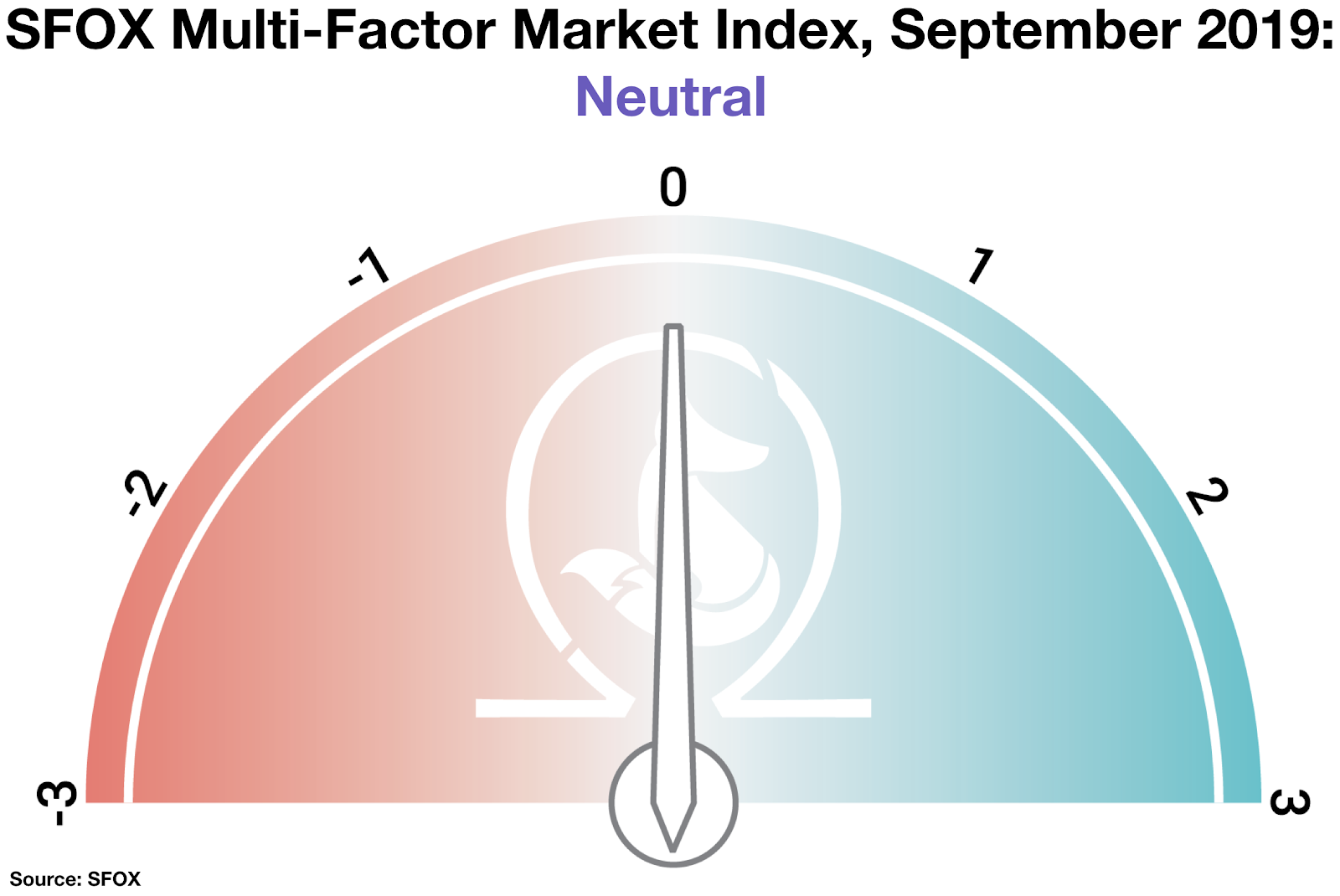

- The SFOX Multi-Factor Market Index has moved from mildly bullish to neutral as of October 7th, 2019.

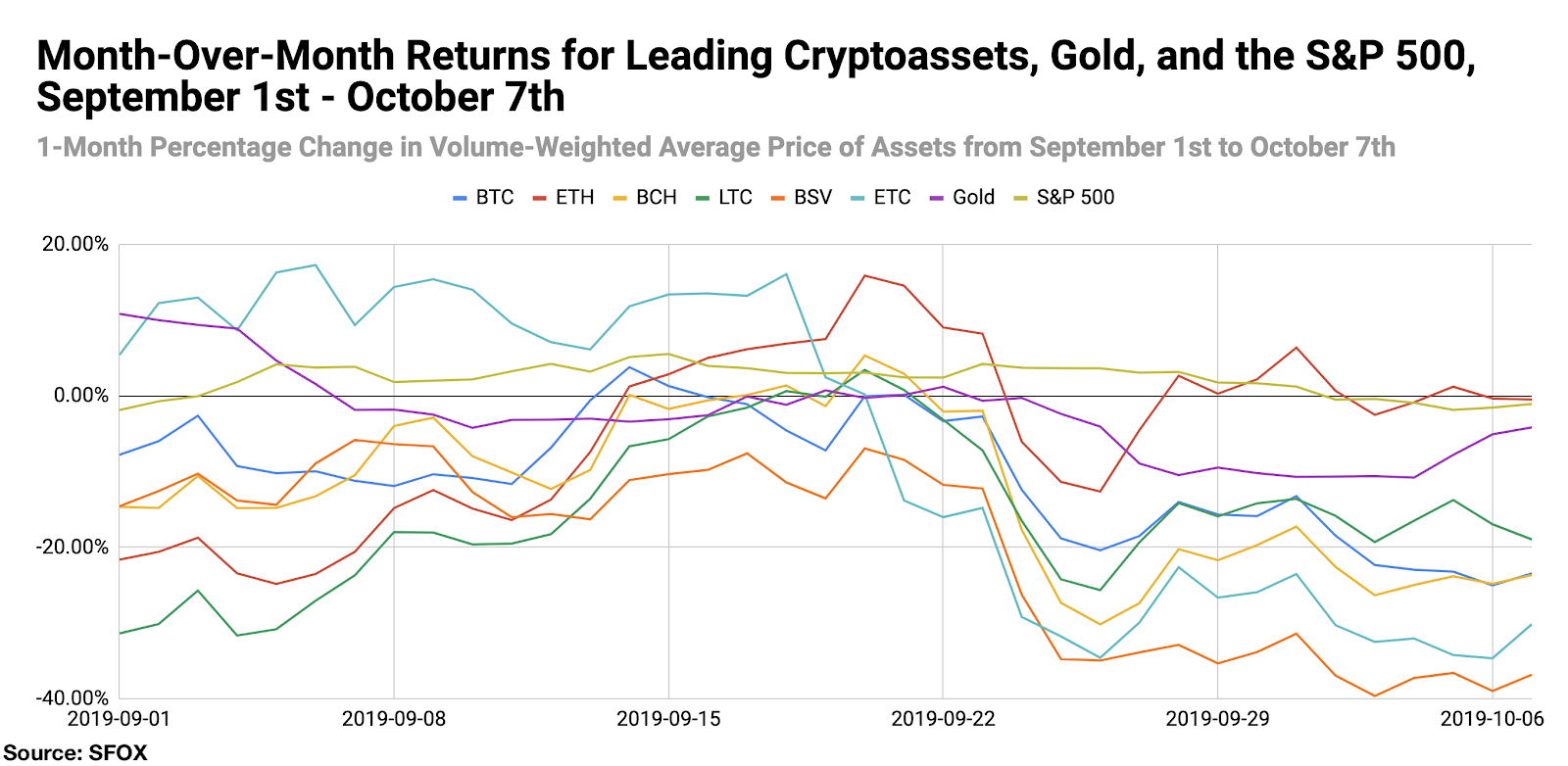

- The S&P 500, gold, and all leading cryptocurrencies show negative month-over-month returns as of October 7th, which ETH and the S&P 500 showing the least losses.

- The major theme of the last month has been unexpected bearish signals in terms of institutional and enterprise interest in Bitcoin — but fears about these signals may be overblown.

- Watch for further developments in Project Libra and Bitcoin futures markets to potentially impact crypto volatility in the remainder of October.

In the September 2019 edition of our monthly volatility report, the SFOX research team has collected price, volume, and volatility data from eight major exchanges and liquidity providers to analyze the global performance of 6 leading cryptoassets — BTC, ETH, BCH, LTC, BSV, and ETC — all of which are available for algorithmic trading on our trading platform.

The following is a report and analysis of their volatility, price correlations, and further development in the past five weeks. (For more information on data sources and methodology, please consult the appendix at the end of the report.)

Current Crypto Market Outlook: Neutral

Based on our calculations and analyses, the SFOX Multi-Factor Market Index, which was set at mildly bullish a month ago, has been moved to neutral as of October 7th.

We determine the monthly value of this index by using proprietary, quantifiable indicators to analyze three market factors: price momentum, market sentiment, and continued advancement of the sector. It is calculated using a proprietary formula that combines quantified data on search traffic, blockchain transactions, and moving averages. The index ranges from highly bearish to highly bullish.

As we’ll consider further in the analysis below, it appears that the downturn in market sentiment may have to do with fear around signals that “major” institutions may not be as ready and willing to jump into crypto now as some previously believed, which may have led to broader uncertainty about the trajectory of the sector. In this regard, it’s worth keeping in mind that major institutional involvement won’t happen overnight: institutional involvement is more a matter of long-term trends and infrastructure development than it is about any single product launch. As we’ll see below, that development and maturation has continued to happen in the past month.

In a recent interview with SFOX, Tim Enneking, the first crypto-fund manager and an SFOX client, emphasized that the crypto sector may simply not yet be big enough for major institutions to get involved yet: “The average size of a crypto fund,” Enneking said, “is less than $10 million. If you roll up every crypto fund — including Pantera, which is, as far as I know, the biggest one; throw in Grayscale Bitcoin Trust, which really isn’t a fund; throw it all together — it’s a small fraction of the crypto space, and the crypto space itself is, as I said, a minuscule fraction of the investment space. So, there can’t be big involvement from major institutions.”

The biggest lesson from the past month may be that, as much as many media outlets may imply to the contrary, institutional involvement ought to be measured by gradual infrastructure-based milestones rather than by singular product launches or executive comments.

Analysis of September 2019 Crypto Performance

The last 5 weeks in crypto have seen expectations of further institutional and enterprise investment in crypto challenged, notably with a reportedly underwhelming launch of Bakkt’s physically-settled Bitcoin futures and PayPal’s withdrawal from the Libra consortium. However, it’s possible that the fearful market sentiment that has accompanied this news may be overblown.

Executives at Apple sent mixed signals about their interest in cryptocurrency (September 5th; October 3rd), indicating sustained institutional uncertainty about crypto.

Apple made headlines on September 5th when Jennifer Bailey, VP of Apple Pay, told CNN that Apple is “watching cryptocurrency” and thinks “it has interesting long-term potential.” On October 3rd, however, CEO Tim Cook reportedly told Los Echos that he thinks “a currency should stay in the hands of countries” and that he’s “not comfortable with the idea of a private group setting up a competing currency.” While these comments aren’t strictly incompatible with Bailey’s comments, they may have been enough to worry some that Apple’s stance on cryptocurrency isn’t as optimistic as expected. This suggests that some major companies may remain unsure as to how they will relate to crypto and blockchain technology in the future.

The CME Group announced the launch of Bitcoin futures options in early 2020, promising new ways for traders to gain exposure to bitcoin (September 20th).

The CME Group, known in the crypto world for their Bitcoin futures market, announced on September 20th that it plans to add Bitcoin futures options to its crypto offerings early this coming year. The price to buy bitcoin rose almost 2% on the day of the news, from $9972.96 to $10166.38. This news marks the latest development in a slowly but steadily growing infrastructure of mature trading tools for crypto.

Crypto markets fell substantially following an unexpectedly lukewarm reception to Bakkt’s launch of physically-settled BTC futures (September 23rd).

Many, including SFOX, pointed to September’s launch of Bakkt’s physically-settled BTC futures as an event with the potential to move the market due to improved institutional access to crypto trading instruments. The volume traded on it, by most accounts, was received as underwhelming: as The Block’s Larry Cermak observed, Bakkt’s first week of trading volume was comparable to what some crypto exchanges see in four minutes of trading. In the four days following Bakkt’s launch, the price to buy bitcoin fell almost 18%, from $9823.40 to $8045.88. It’s possible that this drop in the crypto partly reflects traders acting emotionally when an overnight flood of institutional money into crypto didn’t happen, even though that scenario was probably unrealistic in the first place.

The SEC announced a settlement of $24 million with Block.one for running an unregistered ICO for the EOS network and token, as the regulatory standards of crypto continue to mature (September 30th).

The SEC issued a press release disclosing that Block.one reached a $24 million settlement for charges of running an unregistered ICO that raised “the equivalent of several billion dollars.” While some commentators have remarked that the fine represents a very small amount of the amount raised in the ICO, the settlement underscores the continued development of crypto in terms of clear regulatory burdens and standards of accountability — the same trend that has seen ICOs forgone in favor of STOs and IEOs in recent crypto history.

PayPal withdrew from the Libra consortium (October 4th), inviting further market uncertainty about the Facebook-led private cryptocurrency venture.

A few days ago, PayPal formally withdrew from the Libra Association, the governing body assembled by Facebook to direct its private cryptocurrency Project Libra. Doubts and concerns about the consortium of major companies behind Libra have been prevalent since well before the Senate and House hearings on Libra, and this has led some to wonder whether other companies may withdraw as well. While Project Libra doesn’t involve BTC per se, some may view it as a proxy for general advancement and acceptance of crypto and blockchain technologies.

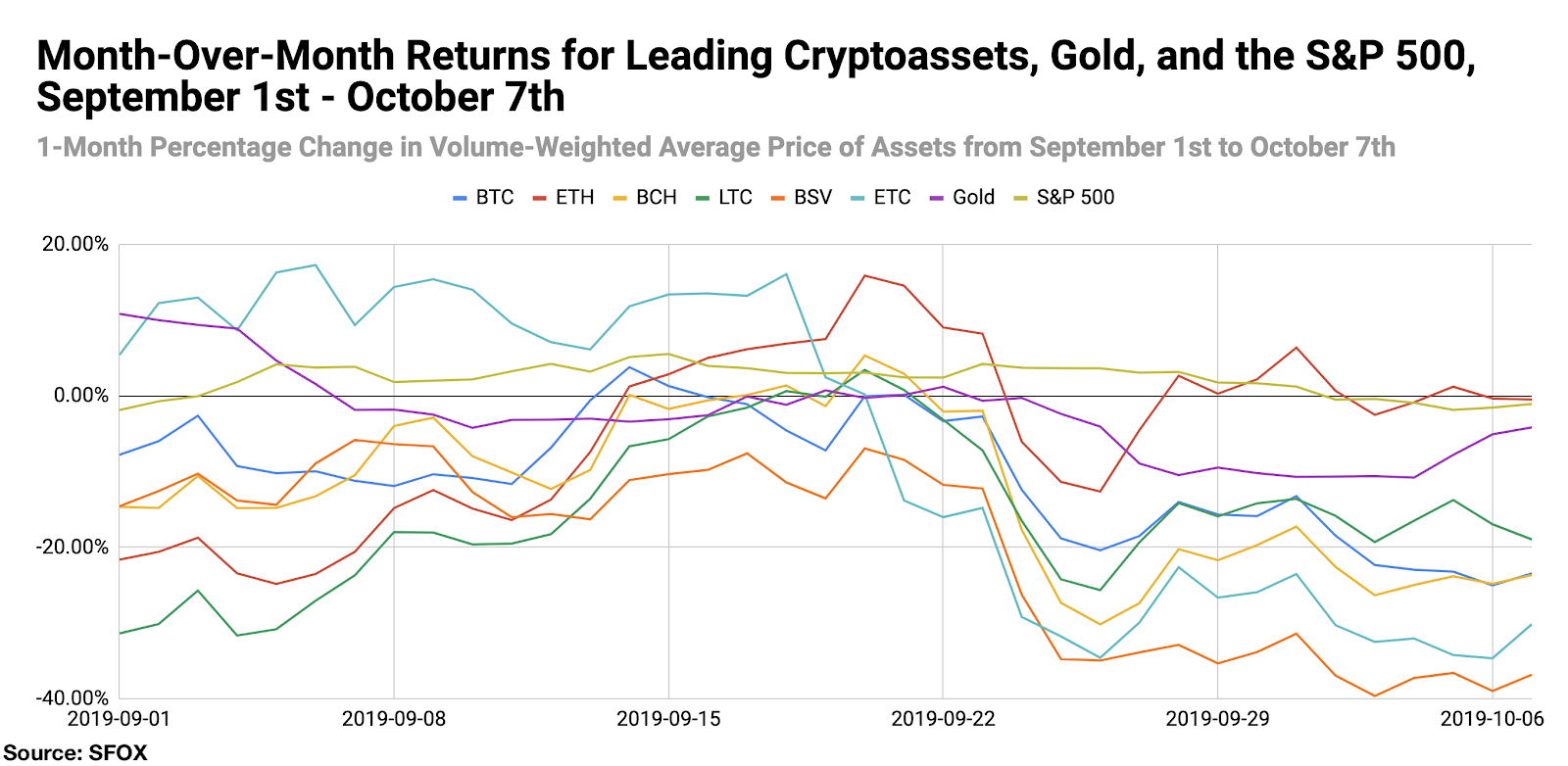

The S&P 500, gold, and all major cryptoassets showed negative month-over-month returns as of October 7th, suggesting broader macroeconomic uncertainty may be at play.

As of this past Monday, leading cryptoassets, gold, and the S&P 500 all showed negative month-over-month losses. ETH and the S&P 500 lost the least (-0.47% and -1.06%, respectively), while BSV and ETC lost the most (-36.83% and -30.16, respectively). While there’s no obvious reason for ETH and the S&P 500 leading the pack, it may be that ETH was bolstered by news of increased gas limits and new support by BitPay, while the S&P 500 may have been bolstered by what some interpreted as a positive jobs report.

Recent events such as the China-U.S. trade war have suggested that broader macroeconomic uncertainty impacts crypto markets just as it does equities and bonds, and these most recent data reinforce that idea. The most recent downturn could potentially reflect macro factors from an ongoing impeachment inquiry to recession worries potentially looming large for traders.

What to Watch in the Rest of October 2019

Look to these events as potentially impacting the volatility of BTC, ETH, BCH, LTC, BSV, and ETC in the remainder of October 2019:

Further developments about the Libra Association and its member companies.

Whether or not you believe that Libra ought to have a bearing on Bitcoin, the market may be watching Libra for signals about broader enterprise sentiment towards and adoption of crypto and blockchain technologies — especially as a key player has just departed from the Libra Association.

Ongoing trends or changes in Bakkt futures volume.

Insofar as the market may have been spooked by low volume figures at Bakkt’s launch, further changes in Bakkt’s volume could theoretically impact Bitcoin’s volatility as well. In-house data on Bakkt’s Bitcoin futures contracts can be found here.

CME BTC futures last-trade date (October 25th).

Crypto volatility typically moves around the time of futures expirations. Because Bakkt has had such low trading volume so far, it may not be the case that its futures expirations will impact crypto volatility, but its last-trade date is October 16th.

Further updates on the CME Groups’s upcoming Bitcoin futures options.

As more details about the CME Groups upcoming Bitcoin futures options offering develop, crypto volatility could potentially be impacted — not unlike what we saw in the leadup to Bakkt’s launch.

Get the SFOX edge in volatile times through our proprietary algorithms directly from your SFOX account.

The Details: September 2019 Crypto Price, Volatility, and Correlation Data

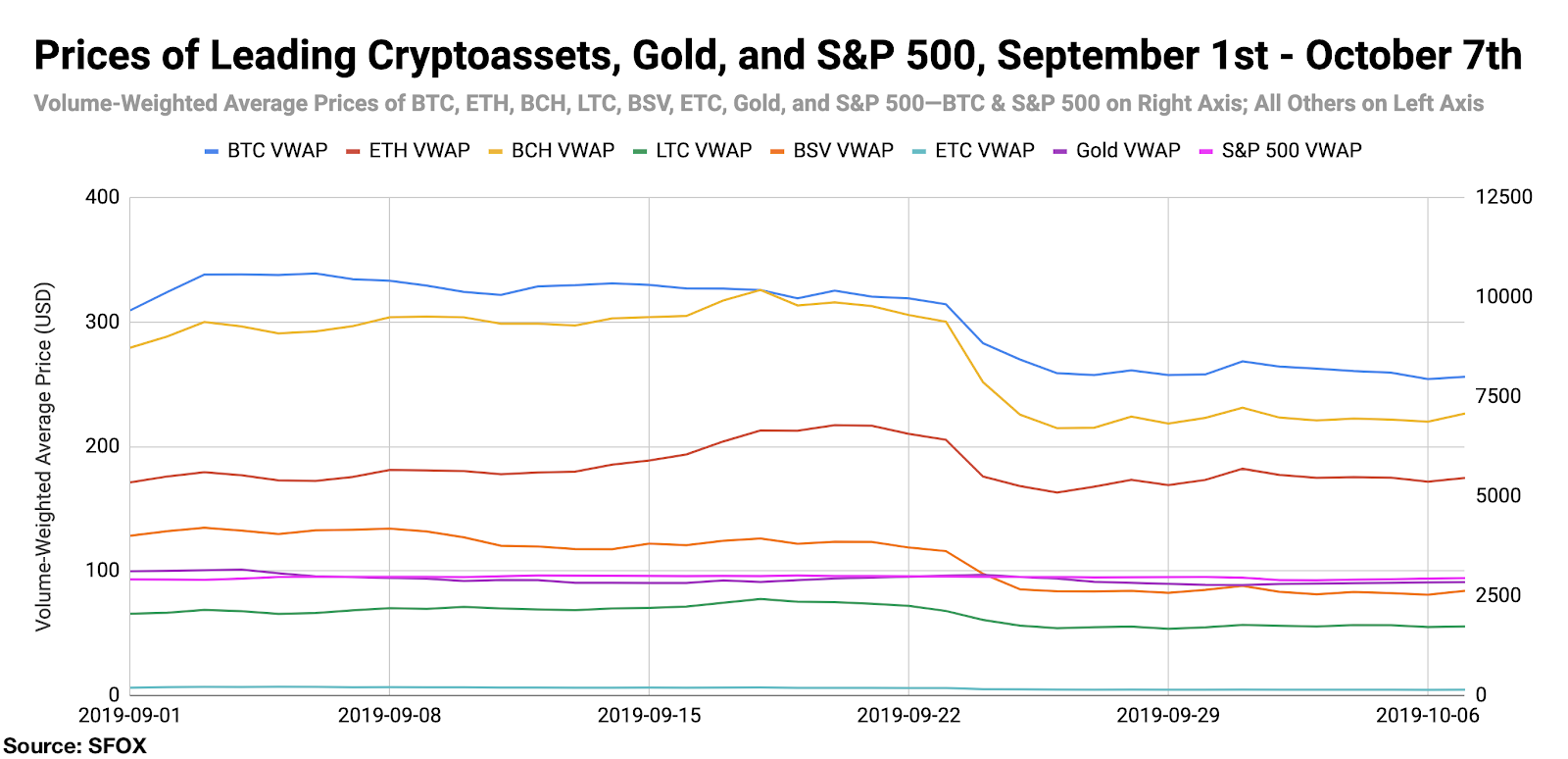

Price Performance: Punctuated Descent

The price to buy bitcoin has ranged over $2627.15 — roughly 33% of its current price at the time of writing — in the past month, peaking at a price of $10572.51 on September 4th and bottoming out at a price of $7945.36 on October 6th.

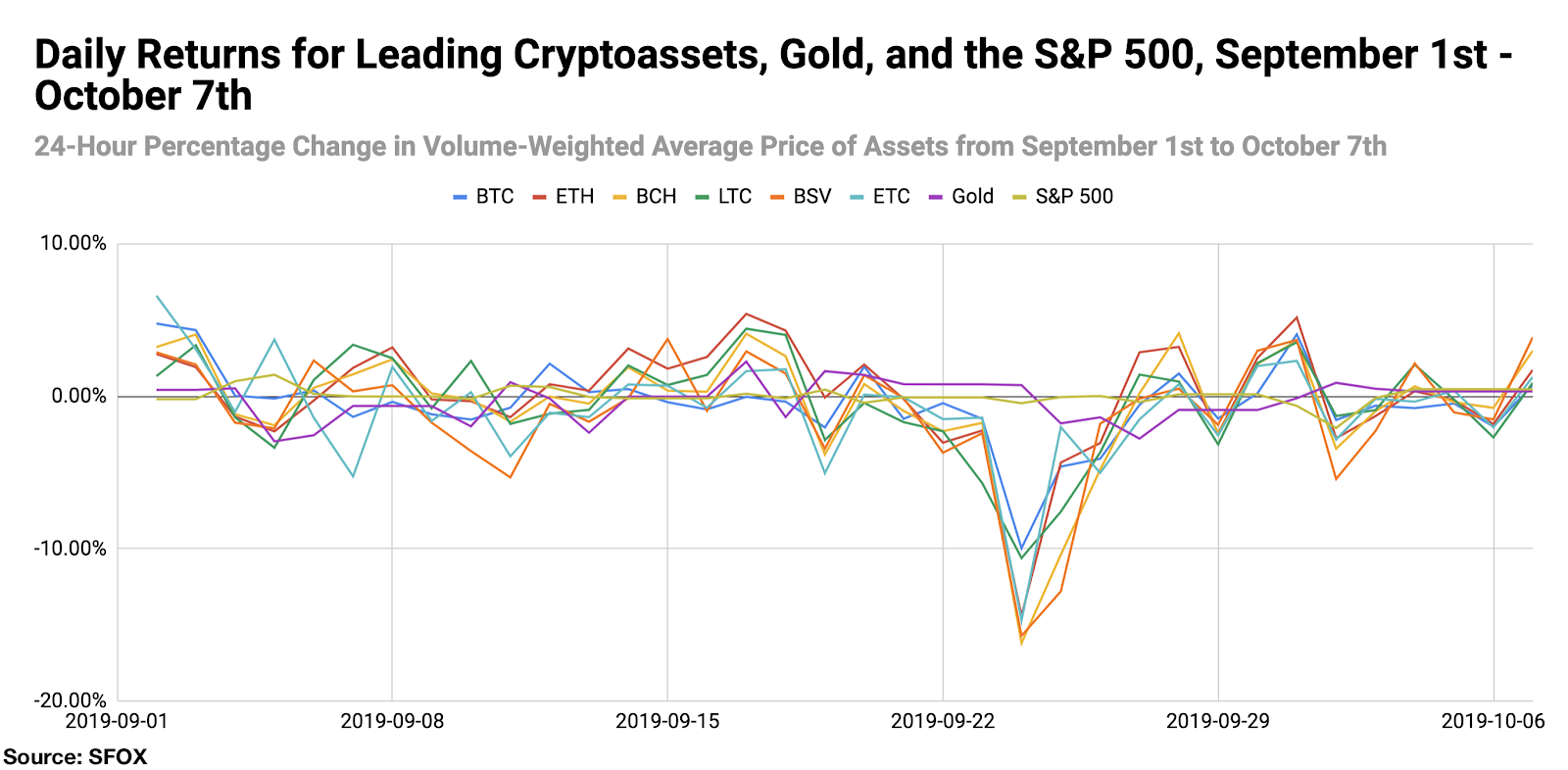

By looking at daily returns for leading cryptoassets, gold, and the S&P 500, we can see the precipitous decline in crypto prices beginning on September 24th, following the launch of Bakkt’s BTC futures contracts.

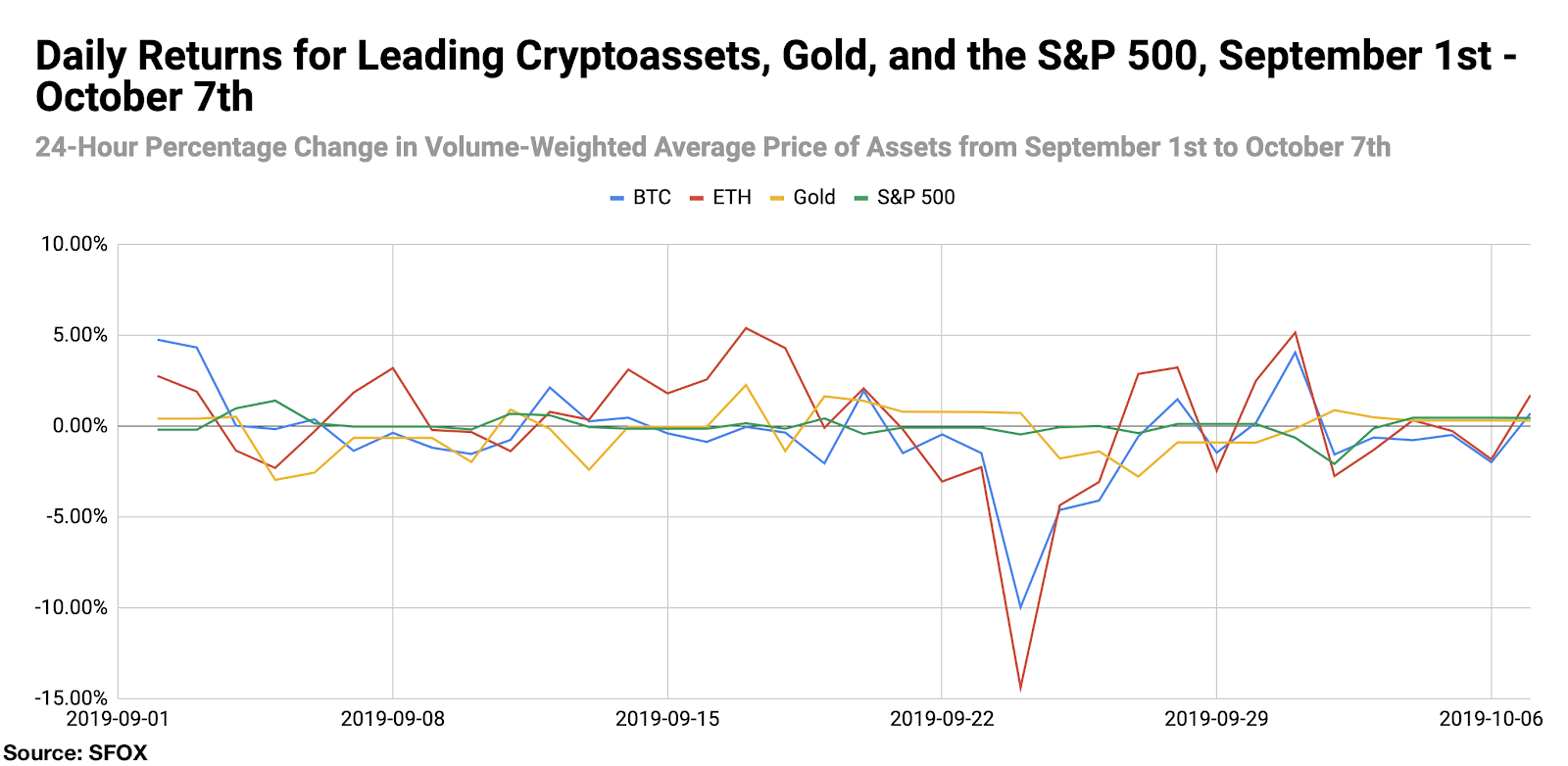

For greater graphical clarity, see this additional chart tracking only the daily returns of BTC, ETH, gold, and the S&P 500:

As we discussed above, all leading cryptoassets, along with gold and the S&P 500, had negative month-over-month returns as of October 7th. ETH and the S&P 500 lost the least (-0.47% and -1.06%, respectively), while BSV and ETC lost the most (-36.83% and -30.16, respectively).

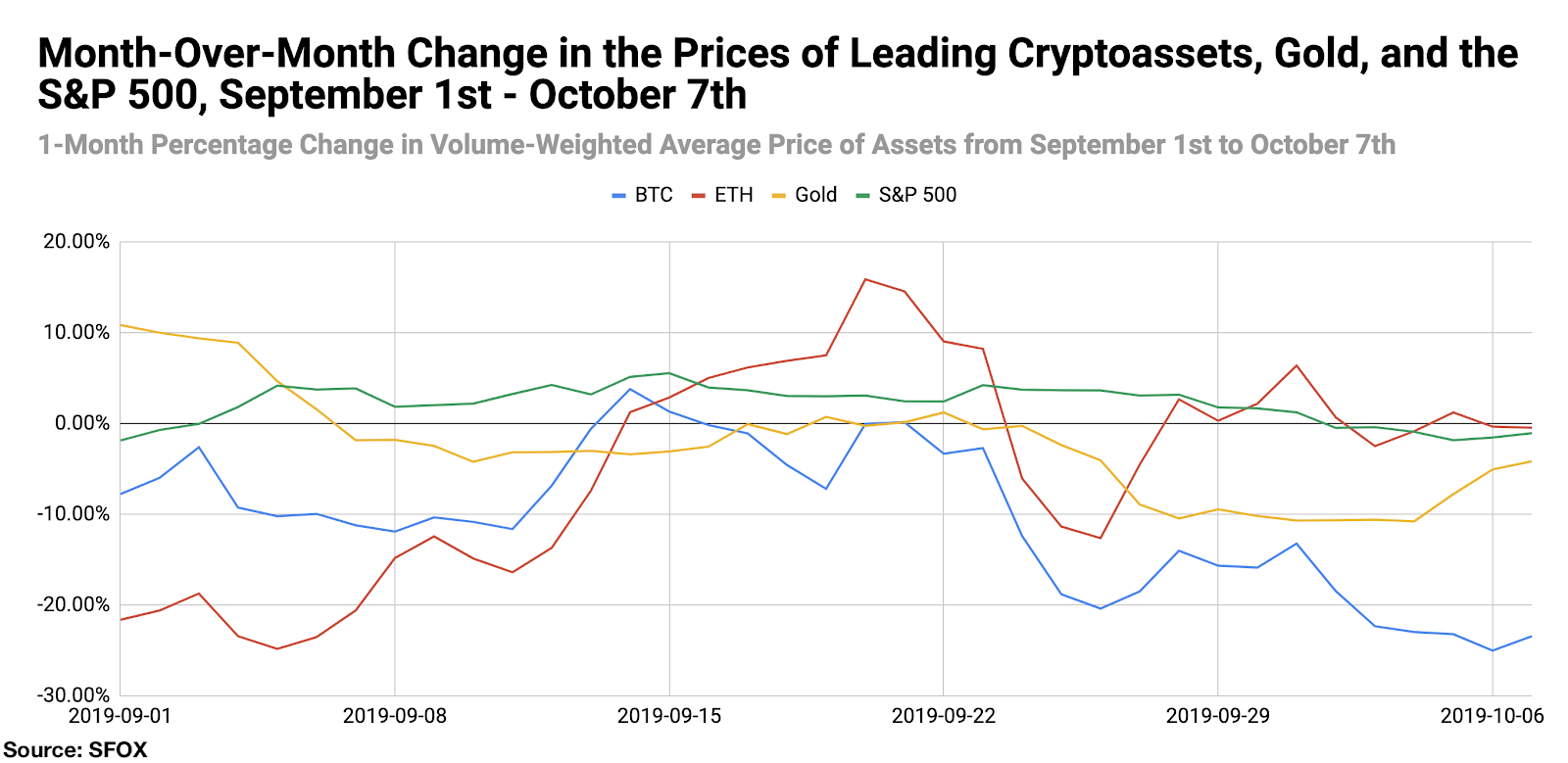

For greater graphical clarity, see this additional chart tracking only the month-over-month changes in the prices of BTC, ETH, gold, and the S&P 500:

Volatility: Renewed Waves

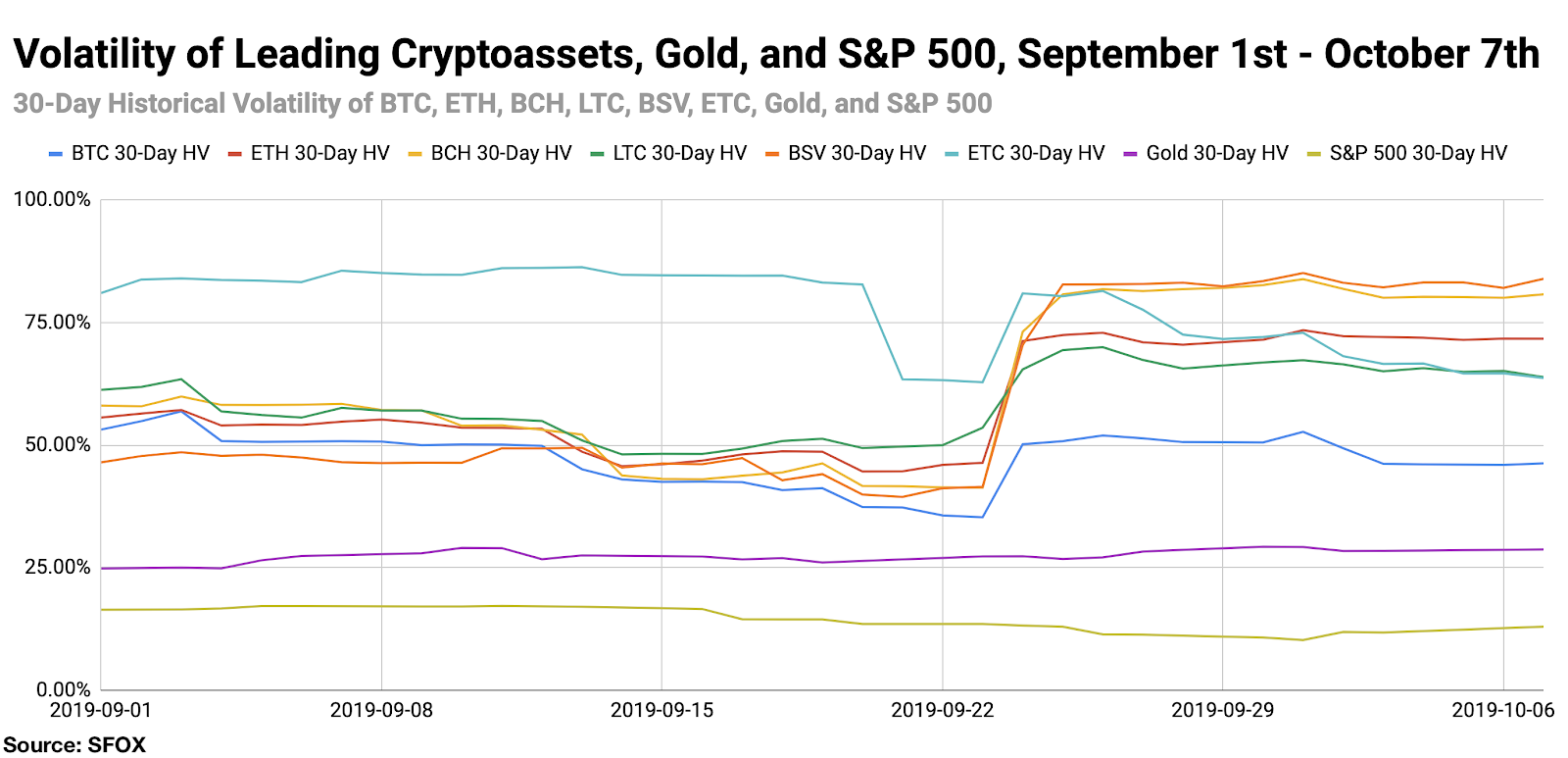

By looking at the 30-day historical volatilities of BTC, ETH, BCH, LTC, BSV, and ETC, we see that the general trend of crypto volatility declined up until September 24th (the day after Bakkt launched), at which point there was a climb in volatility corresponding with the drop in BTC’s price. Bitcoin’s volatility increased from 35.28% on September 23rd to 50.17% on September 24th.

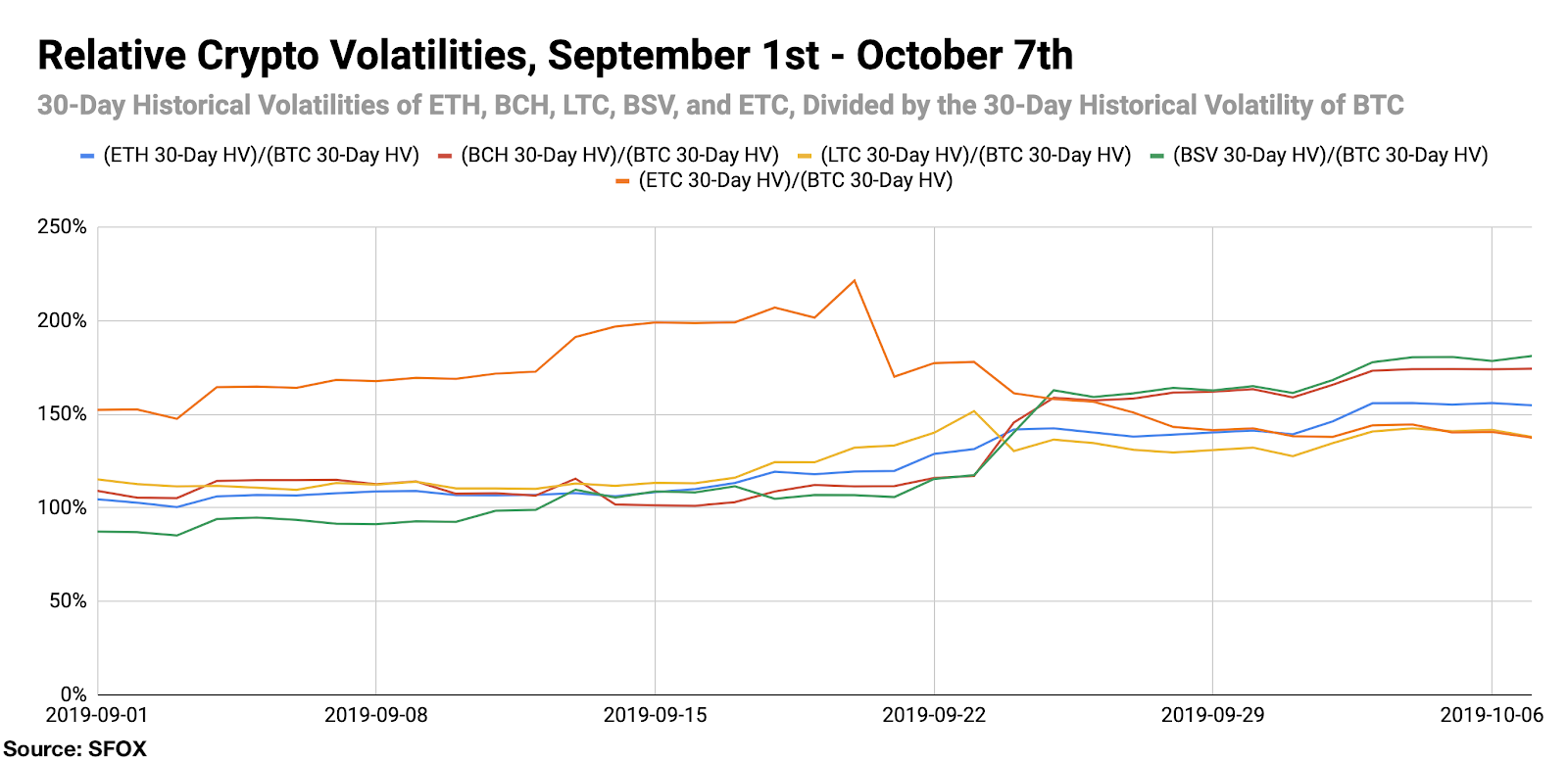

By looking at the 30-day historical volatilities of ETH, BCH, LTC, BSV, and ETC as a percentage of BTC’s 30-day historical volatility, we can see more clearly that most altcoin volatility was following BTC’s volatility, with altcoins becoming relatively more volatile from September 24th onwards. We also saw ETC’s volatility coming more into alignment with that of other altcoin’s following its outsized performance in August.

Price Correlations: A Bitcoin-Dominated Narrative

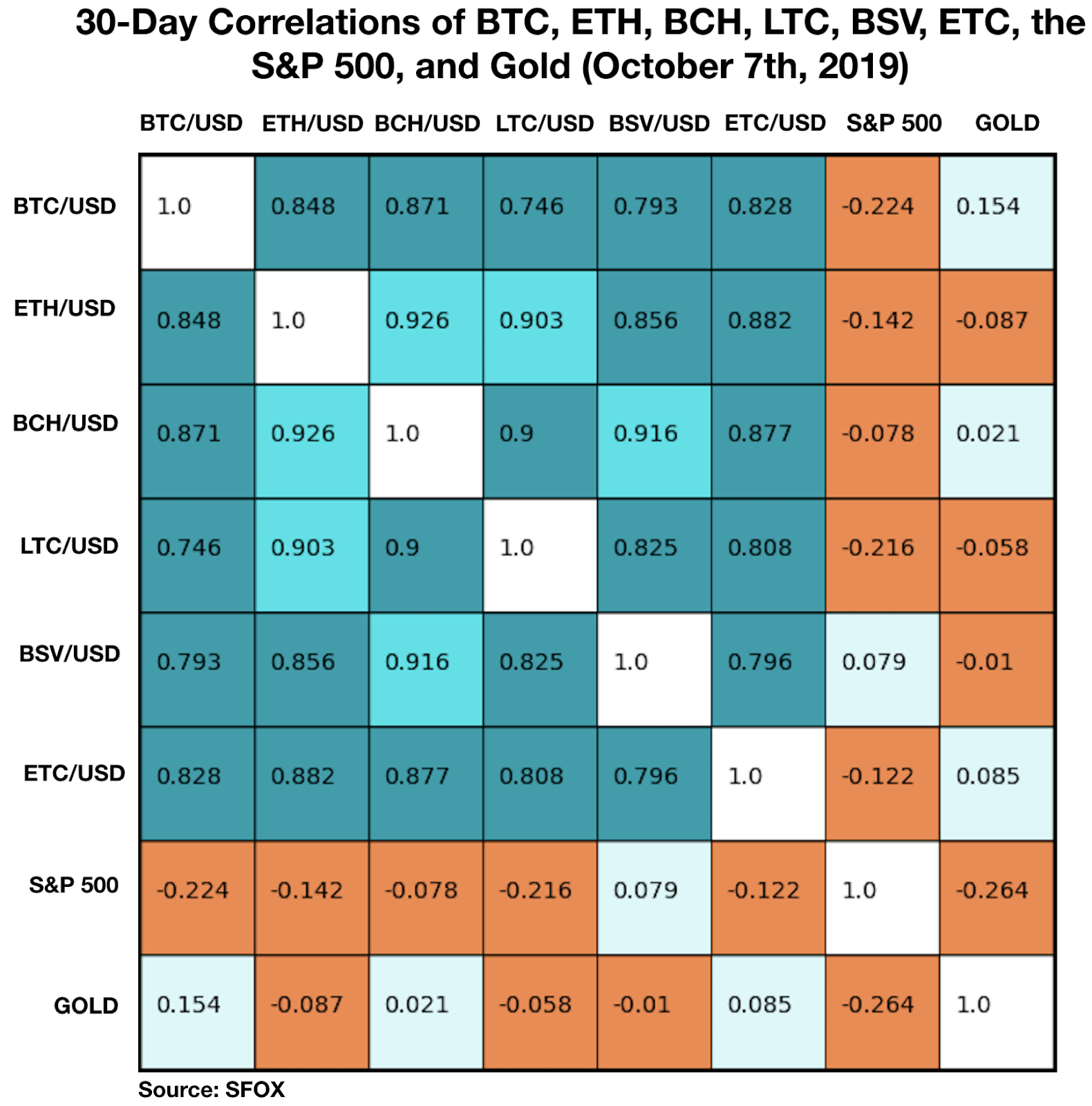

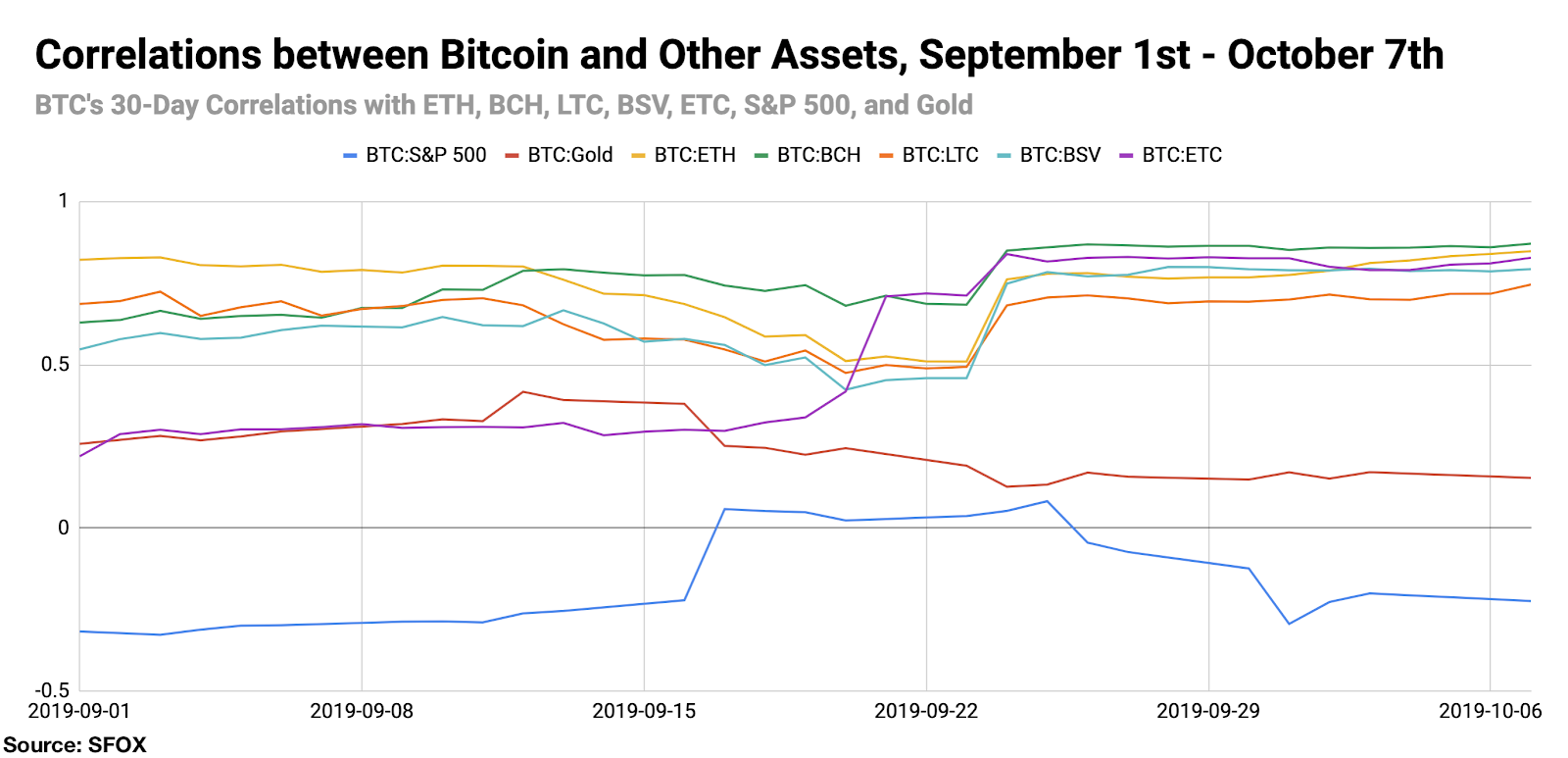

The most recent crypto correlations data show all leading cryptocurrencies having relatively near-zero correlations with both the S&P 500 and gold, consistent with their behavior in previous recent months. Leading altcoins are also more closely correlated with BTC than they have been in the past, reinforcing the idea that recent news about institutional BTC interest may have overshadowed the rest of the crypto market.

See the full SFOX crypto correlations matrix below:

Notice also that all major altcoins — ETH, BCH, LTC, BSV, and ETC — are more correlated with each other then they are with BTC, suggesting that current market conditions may be leading some traders to think conceptually lump these cryptoassets together as “coins other than bitcoin.”

For a more complete look at BTC’s correlations with other assets throughout the past five weeks, see the following graph:

Appendix: Data Sources, Definitions, and Methodology

All cryptocurrency prices are denominated in USD unless otherwise noted.

We use two different in-house volatility indices in creating these reports:

1. 30-day historical volatility (HV) indices are calculated from daily snapshots over the relevant 30-day period using the formula:

30-Day HV Index = σ(Ln(P1/P0), Ln(P2/P1), …, Ln(P30/P29)) * √(365)

2. Daily historical volatility (HV) indices are calculated from 1440 snapshots over the relevant 24-hour period using the formula:

Daily HV Index = σ(Ln(P1/P0), Ln(P2/P1), …, Ln(P1440/P1439))* √(1440)

S&P 500 performance data are collected from Yahoo! Finance using GSPC (S&P 500 Index) data. Gold performance data are collected from Yahoo! Finance using XAU (Philadelphia Gold and Silver Index) data.

The cryptoasset data sources aggregated for crypto prices, correlations, and volatility indices presented and analyzed in this report are the following eight exchanges, the order-book data of which we collect and store in real time:

- bitFlyer

- Binance

- Bitstamp

- Bittrex

- Coinbase

- Gemini

- itBit

- Kraken

Our indices’ integration of data from multiple top liquidity providers offers a more holistic view of the crypto market’s minute-to-minute movement. There are two problems with looking to any single liquidity provider for marketwide data:

- Different liquidity providers experience widely varying trade volumes. For example: according to CoinMarketCap, Binance saw over $20 billion USD in trading volume in November 2018, whereas Bitstamp saw $2 billion USD in trading volume in that same time — an order-of-magnitude difference. Therefore, treating any single liquidity provider’s data as representative of the overall market is myopic.

- Liquidity providers routinely experience interruptions in data collection. For instance, virtually every exchange undergoes regularly scheduled maintenance at one point or another, at which point their order books are unavailable and they therefore have no market data to collect or report. At best, this can prevent analysts from getting a full picture of market performance; at worst, it can make it virtually impossible to build metrics such as historical volatility indices.

Building volatility indices that collect real-time data from many distinct liquidity providers mitigates both of these problems: collecting and averaging data from different sources prevents any single source from having an outsized impact on our view of the market, and it also allows us to still have data for analysis even if one or two of those sources experience interruptions. We use five redundant data collection mechanisms for each exchange in order to ensure that our data collection will remain uninterrupted even in the event of multiple failures.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.