Sometimes, a boom is just noise. But every now and again, there’s a real explosion.

The decentralized finance (DeFi) industry is growing at a rapid pace, with a 610% increase in the user base of decentralized lending applications (lending dapps) and over $12 billion in total locked value since 2018. The vast majority of DeFi protocols are built on the Ethereum blockchain, and the industry boom could spell for more upward price momentum for ETH to what we’ve already seen so far. DeFi is responsible for recent all-time highs in Ethereum network usage, and naturally increases the demand for ETH. As a result, investors have seen year-to-date ETH price returns grow by more than 90%. However, as we learned in recent years, public support and billion-dollar fundraisings don’t always necessarily translate into long-term price gains.

Source: SFOX.com

For example, ICO teams raised $6.9 billion in 2018 alone, with very little to show for it in the end. Around 86% of ICOs failed, demonstrating that the market frenzy surrounding them was somewhat baseless. DeFi has several promising use-cases in banking services, trading platforms, payments, and decentralized marketplaces, but in a nascent and somewhat opaque industry, it can be difficult to separate hype from reality. Early investors of DeFi projects have seen significant gains year-to-date, however, the last 30 days have provided investors with negative returns.

Source: Defipulse.io

The questions we’re faced with today is this: does DeFi have a future based on fundamentals, or is the current boom fueled by mere speculation? To determine whether DeFi is in a bubble, we need to look at its use-cases, its risks, the progress it’s making, and whether it’s capable of delivering on its promises of decentralized financial services.

What Is Decentralized Finance?

Decentralized finance is the use of a leaderless financial system to offer and manage financial services through a governance maintained by token holders, rather than a central ruling board. The MakerDAO protocol, for example, allows users to open collateralized debt positions, staking 150% collateral to borrow sums of Maker’s DAI stablecoin, which is pegged to the U.S. dollar. The Compound protocol, as another example, enables users to earn compound rates of interest on their money, also in DAI, by lending it to borrowers.

There are many other protocols. Inherent in all of them is the concept that the project has or will have no centralized leadership, mitigating the risks of corruption and human error in the traditional banking system. Smart contracts, self-executing programs written into the blockchain, replace human banking staff in DeFi, and this also cuts down on overhead costs, allowing savings to be passed to the users.

However, the DeFi space we have today does not yet fulfill the concept of this use-case. DeFi is also vulnerable to various threats, which we’ll examine below.

Examining Risk in DeFi

There are a number of known risks to the DeFi ecosystem. The main component of DeFi is decentralized loans, with protocols typically issuing stablecoin loans collateralized with tokens such as ETH. Borrowers typically need to stake more than they borrow, such as staking $1,000 worth of ether for a loan of $500.

The ecosystem is arguably vulnerable to sudden price drops leading to a liquidation cascade. In addition to this, a successful breach of smart contracts holding the assets that secure decentralized loans would also have a major negative impact on the space.

Finally, there’s the question of whether DeFi is truly decentralized, and what it will mean if decentralization is not attainable.

MakerDAO: Centralization and collateral risk

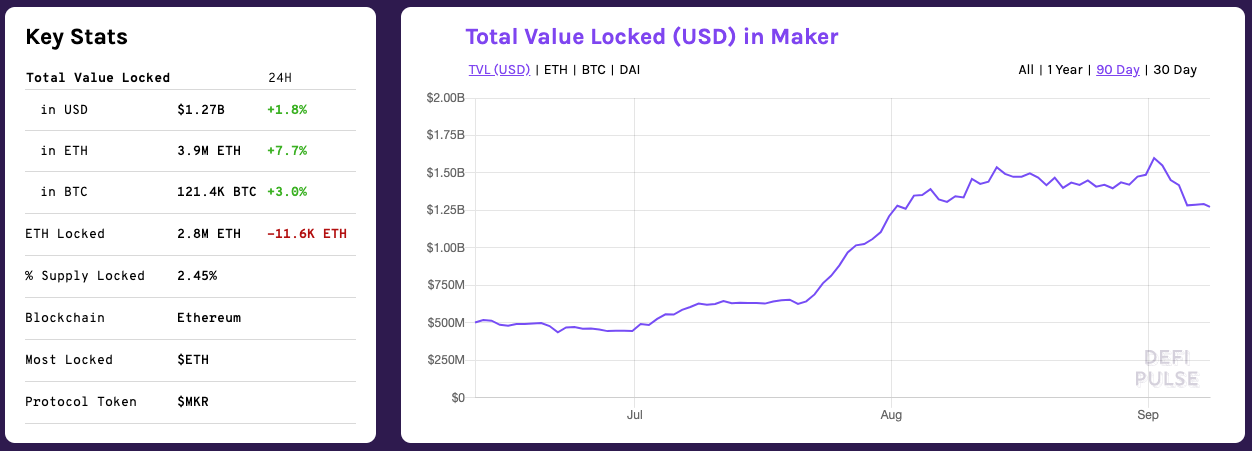

The lending protocol with one of the most locked assets is Maker, with 13% of DeFi’s value locked in Maker contracts.

Source: DeFi Pulse

The protocol issues loans in the DAI stablecoin and uses interest rates (the “stability fee”) to keep DAI stable and pegged 1:1 to the U.S. dollar. However, interest rates soared 40 times higher, to 19.5%, in mid-2019, surprising many borrowers and leading some to remark that their experience with DeFi was worse than traditional finance.

The MakerDAO protocol issues MKR tokens to stakeholders, which can be used to vote, and MKR holders voted to allow multi-collateral loans in late 2019, allowing currencies other than ETH to be used as collateral. This made DAI less vulnerable to ETH price drops, and the interest rate subsequently dropped to 5.5%.

However, that didn’t solve the problem entirely. On March 12, 2020, lending protocol MakerDAO became undercapitalized due to a 50% drop in the price of ETH, and this drop liquidated more loans than the entire project’s history 10 times over.

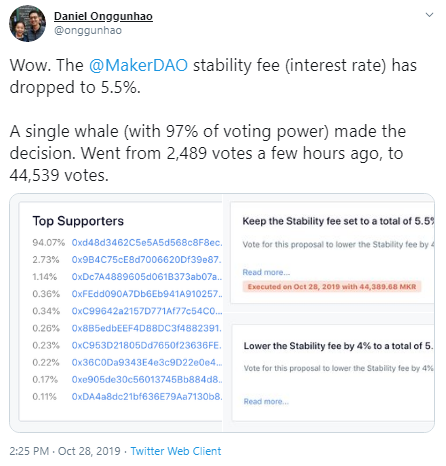

The voting mechanism behind the multi-collateral decision highlighted another problem: while 150 addresses voted, 50% of all voting tokens were held by just five addresses, indicating that the Decentralized Autonomous Organization (DAO) behind MakerDAO is, in fact, highly centralized, with control in the hands of just one to five parties.

Source: Twitter

Software engineer Daniel Onggunhao, quoted in the image above, made the excellent point that “as an early stage, hard-to-understand technology, decision-making tends to naturally centralize.” The issues of opaqueness and inaccessibility are not unique to MakerDAO: rather, these are challenges with which the entire DeFi space—and, indeed, much of the crypto sector—is currently grappling.

Hacks and Exploits

Funds locked in DeFi are only as secure as the code of their underlying protocols. The swift rise of lending dapps is encouraging to some investors, but one risk of booming technology is that some projects will rush development to capitalize on demand.

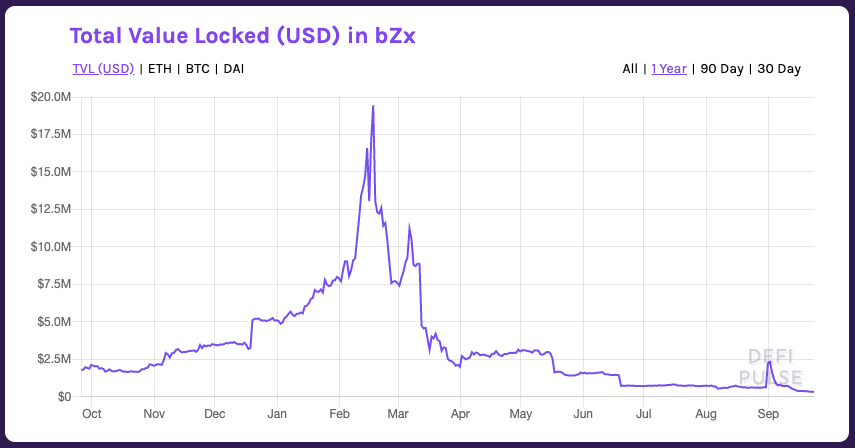

On February 14, 2020, the eighth-largest DeFi lending platform, bZx, was hacked while the development team was attending an Ethereum meetup in Denver. The hacker exploited several bugs across multiple bZx protocols, extracting 1,193 ETH, worth approximately $300,000 at the time.

The development team shut down the affected protocol using a centralized master key and issued a statement saying that user funds would not be affected. Just four days after that hack, though, bZx fell prey to a second attack, losing an additional $633,000.

The knowledge that bZx’s protocol could be exploited by hackers and also shut down through a centralized backdoor undermined confidence in the project, and it fell from 8th place to last place on the rankings of DeFi lending platforms by volume.

Source: DeFi Pulse

While no users were directly affected, the hack served as a reminder that DeFi protocols can potentially be exploited and may garner more attention from bad actors as the space expands. bZx is not the only DeFi platform to suffer a hack, with dForce briefly losing $25 million in April 2020—100% of all locked assets on the protocol at the time.

Fortunately, funds were recaptured and restored to users two days later. The issue may not be unique to smaller protocols, either: A february 2020 study by the Imperial College London modeled a potential exploit, in the form of a governance attack, on the MakerDAO protocol.

More recently “pulling the rug” or “rug pulls” scams have been increasing at an alarming rate. These scams consist of rogue actors placing fake token swaps or false representations of tokens – that would never amount to anything – on the decentralized exchanges, like Uniswap, and unstake their entire liquidity for the ethereum. To safeguard from these “rug pulls”, investors should pay close attention to the smart contracts they’re interacting with and do your own research “DYOR”.

Defi is tied to Ethereum

As well as risks from market forces and bad actors, there’s the issue of scalability to contend with. Not all DeFi ecosystems are built on Ethereum — several are built on Ethereum Classic and Bitcoin Cash. DeFi startups have been raising funds to take the DeFi sector further beyond Ethereum.

However, Ethereum is currently the dominant blockchain in DeFi, and it may not be possible to scale the blockchain to meet growing industry needs.

While Ethereum developers are working on multiple ways to accommodate future growth, the platform has yet to implement a satisfactory scaling solution. The fact that DeFi is so closely linked to the Ethereum platform increases the associated risk.

The DappRadar 2019 report stated, “As demonstrated by a sharp rise in gas prices during September, dapps running on this Proof of Work blockchain remain vulnerable to systematic factors.”

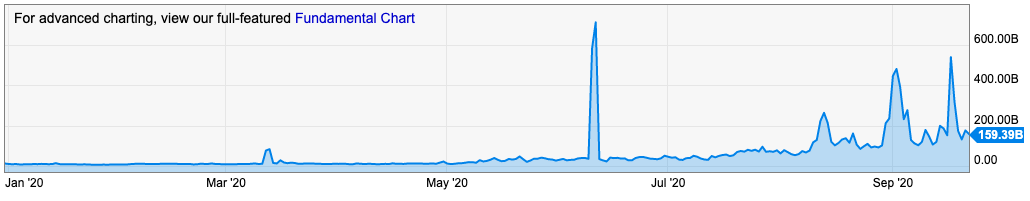

Source: Ycharts

Gas prices have also spiked in March during the 50% Ethereum price crash and has increased since August. March’s spike was precipitated by a Bitcoin flash crash, an event that wreaked havoc throughout the crypto space, while the growth in August has been driven by DeFi’s popularity. Network congestions, high gas fees, and flash crashes have led to major price differences across different crypto exchanges, with several derivatives platforms, such as BitMEX and Deribit, suffering downtime. SFOX, in contrast, was designed to mitigate this kind of risk by allowing users to access a globally aggregated order book and place orders across multiple exchanges, getting the best possible price at any given time.

However, not all cryptocurrency projects are shielded against the risk of black-swan events; $4 million in MakerDAO loans was liquidated, leading to a debate in the community as to whether an emergency-shutdown “circuit breaker” is needed, as seen in the traditional financial markets.

DeFi entrepreneur Ryan Berckmans participated in the community discussion and summarized the conversation around the issue of circuit breakers:

The social contract of MakerDAO is that MKR tokens take a haircut in the event of system failure. . . . Keepers and MKR buyers should prepare for sustained high gas prices, and downward pressure on ETH and MKR. The Dow Jones hit sell-off circuit breakers three times in the past week and a half. It’s a historic week.

Kyle Samani, managing partner at Multicoin Capital, criticized the infrastructure of the DeFi ecosystem, saying:

Yesterday showed us just [how] immature this market is. We have a long way to go. We proved that nothing that works today will actually work at scale. We need global scale systems.

However, while what Samani wrote may have been correct in March, progress has been made since then.

Progress in Scaling

Synthetix, the second-largest lending protocol in DeFi, has partnered with Optimism, an Ethereum 2.0 scaling team, to tackle the issue of scaling. On May 6, Cointelegraph reported that Optimism was testing the Synthetix Exchange on the Ethereum 2.0 solution and developing gas-free transactions to reduce the issue of congestion and latency.

The scaling team reported a reduction in oracle latency of up to 37.5 times, something that could make a big difference to the DeFi ecosystem. DeFi relies on oracles to trustlessly relay information such as the current price of ETH. The March 2020 flash crash saw popular oracle Chainlink suffer delays of up to six hours when relaying price information to various DeFi protocols, and Maker’s oracle was also affected. If Ethereum 2.0 can reduce latency long-term, a major weak point for DeFi could be fully addressed.

Optimism also reported a drop in transaction delays of 75 times, as well as lower gas fees and exchange fees.

Ethereum 2.0 will launch later this year, and, at that point, we’ll be able to reevaluate whether scaling will continue to pose an obstacle to DeFi. Ethereum 2.0’s multi-client testnet is due to launch on August 04, with the beacon chain scheduled to launch in November. The launch may be delayed if bugs or errors are found in the meantime. Investors interested in DeFi would do well to monitor Ethereum’s progress on scaling closely, and you can follow our blog or Twitter account for ongoing updates as they come.

DeFi Moving Forward

Regardless of the issues in the space, total locked assets have grown 10x and the popularity of a trustless decentralized environment cannot be ignored. DeFi is growing and has a promising future, however, with any nascent technology there’s still a lot to be improved. DeFi is tentatively meeting the use-case of issuing loans outside of traditional financial institutions and DApp volume has grown 650% year-over-year; and doesn’t look to be slowing down.

While MakerDAO is one of the dominant market leaders, other projects are beginning to approach its volume of locked assets.

The expansion of other competing projects strengthens the space and makes it less dependent on a single protocol.

The space is not truly decentralized and remains vulnerable to risks such as market movements, smart-contract hacks, and lack of progress toward decentralization. To date, and as a young industry, DeFi has not improved on traditional finance.

The space is delivering on certain aspects of the use-case at the moment by issuing loans and may be more accurately referred to as “open finance” for the time being. However, investors would do well to pay close attention to the centralization and risk factors of any individual projects that may arise in the ongoing boom before deciding for themselves whether those projects have legs.

Trading on SFOX

Amazing client services and support are some of the most important core beliefs of SFOX. Regardless of your account size, we will provide white-glove service to all our customers and make sure you have the experience you deserve. We strive for excellence and availability. If you would like to speak and communicate with a team member about our services and system, we will make ourselves available over the phone, video or email.

SFOX was founded in 2014 and is recognized as the first crypto prime broker. We’ve raised over $23 million from some of the most prominent VC firms including (but not limited to) DCG, Blockchain Capital, Khosla Ventures and Social Capital. We’re one of the most trusted crypto prime brokers today with over 200,000 users that include individual traders, brokers, banks, funds and exchanges. As a full front-to-back crypto trading solution, we’re one of the few to offer custody, smart routing execution, a full suite of algorithmic order types, SMA infrastructure, access to a global liquidity network of the largest exchanges, OTC providers and unique dark pool liquidity all from a single, centrally-funded account.

Unlike other platforms, we offer custody, clearing and instant settlements. We also provide a single point of access to the largest global pool of liquidity that includes the major exchanges, OTC providers and our dark pool liquidity. Our advanced smart routing orders not only look for the best prices, but our system will break orders up to achieve the best VWAP across our global liquidity network. We’ve processed over 150 million trades and have maintained an uptime greater than 99.8%. We also have end-to-end order placement latency within tens of milliseconds.

Let us help you trade with edge.

Trade Smarter

If you’re only as good at the venues at which you trade, then why aren’t you trading at all venues at once? The integrated order book is at the heart of how SFOX creates edge, but it’s also just the tip of the iceberg in terms of the toolkit they’ve been giving savvy crypto traders for half a decade.

Want to take the whole suite for a test drive? Sign up for SFOX for free and start trading.