Since 2014, sFOX has been the solution adopted by sophisticated investors and institutions that want to efficiently deploy capital in digital assets by accessing a complete and robust suite of services. Our offering includes a master orderbook of 30+ top exchanges, OTCs, and 80+ markets to access global liquidity, an advanced trading platform, proprietary order types and algos, agnostic best execution, flexible financing, and the security investors need to trade with confidence.

Today we are reinforcing our commitment to serving the growing Institutional market by launching SAFE, our U.S.-regulated custodial solution that provides an efficient, secure, and cost-effective way to preserve digital assets and power clients’ strategies.

The rapid surge in interest in digital assets has led to an unprecedented demand for digital custodial services. Institutions must deal with much greater solution complexity than retail investors due to compliance and regulatory controls over fund movements, the need to interface with established legacy systems, reporting requirements, and much more. SAFE Custody fits within sFOX’s vision of enabling investors’ strategies by helping them generate better returns with fewer risks.

While we have offered custody services since our launch, we have expanded our product offering with SAFE Trust Co, a trust company chartered under the State of Wyoming and regulated by the Wyoming Division of Banking.

Reimagining crypto custody

Investors want to move quickly to take advantage of new money-making opportunities in the space as they arise. Every new participant in the market needs a way to safely and rapidly move and store their digital assets in total security and compliance. That’s where sFOX and SAFE come in.

A trade-centric solution to power investors’ strategies

Transferring crypto assets in and out between custody and trading accounts is inconvenient and time-consuming. Sometimes, a multiple-step process to withdraw funds from custody requires a call to customer service. All at the expense of efficiency and scalability.

At sFOX, we are bringing trading alongside custody, building our institutional product suite to provide institutions with the most seamless, scalable, and trusted solution to manage crypto assets. Integrated with the sFOX trading platform, SAFE is the first trade-centric custody solution that allows customers to trade from the comfort of their custodial trust accounts without tedious and costly transfers while maintaining the highest security standards.

A multi-level approach to securing clients’ digital assets

When dealing with blockchain technologies, security is centered around protecting private keys. The unique nature of digital assets requires new risk-control solutions, and unlike traditional systems such as ACH, SWIFT, etc., there is no central authority that can intervene.

Security has been a pillar of sFOX since its inception, with an unparalleled track record of securely protecting client assets at scale for over eight years.

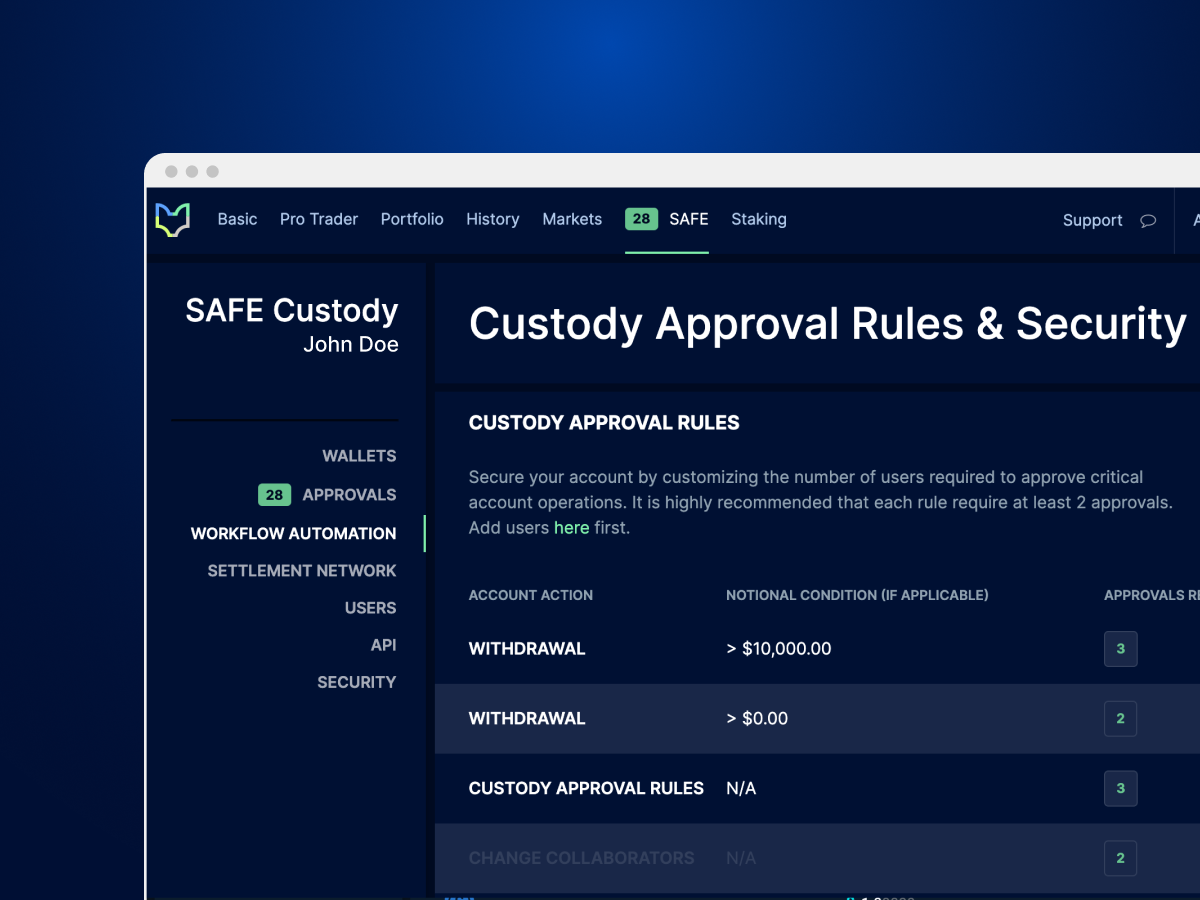

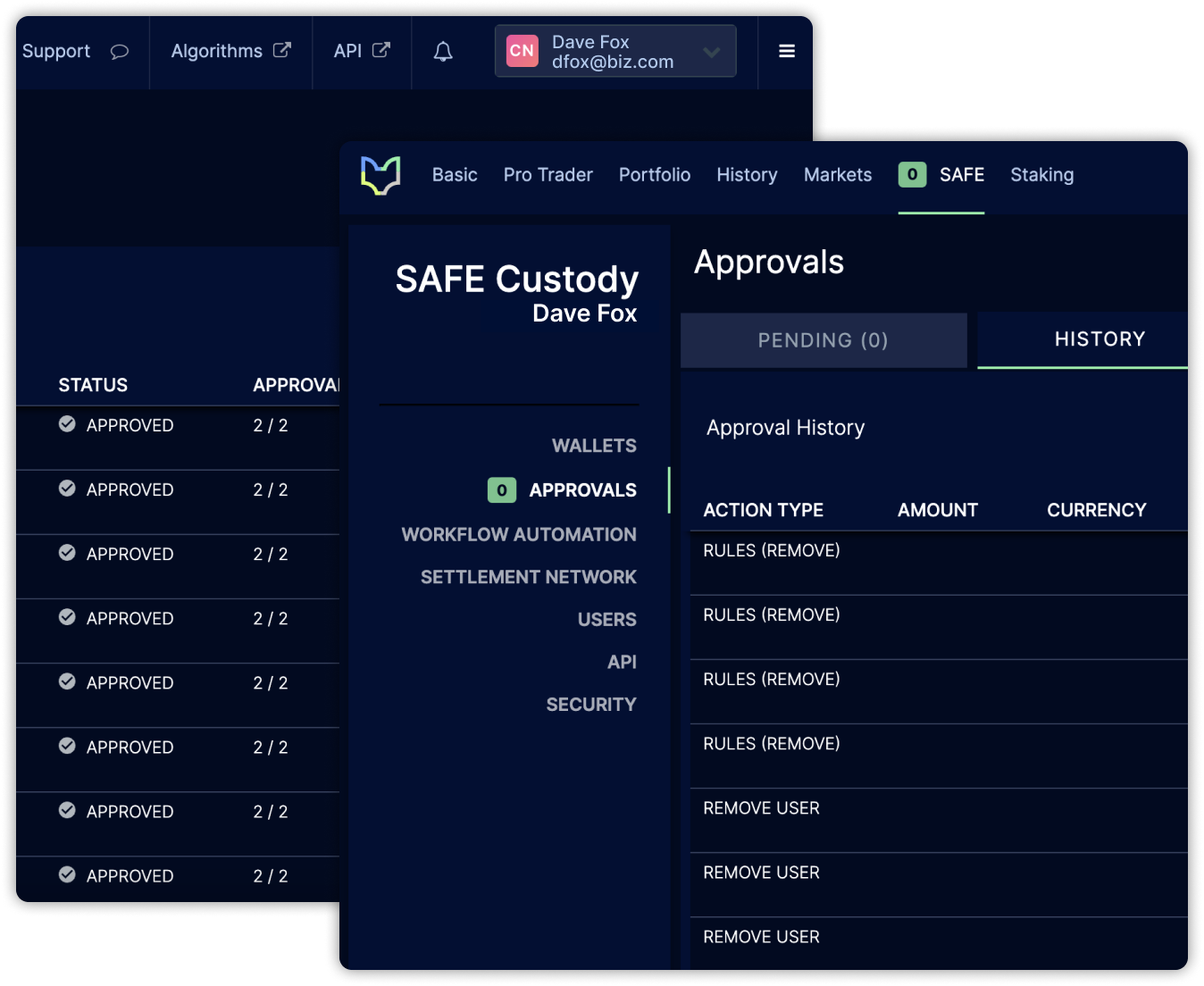

SAFE combines secure vaulting, cryptographic hardware, and organizational governance to provide multiple layers of security. Our approach to securing investors’ assets includes distributed key management where the transactions require multiple independent parties to cooperate; strict key isolation and encryption in a private and segregated environment; multi-party approval policies for all critical account actions. Our security systems are designed for multi-user operations, ensuring that no one can act maliciously or execute unauthorized transactions and instructions.

SAFE is regularly audited and is SOC 2 compliant, meaning that it is subject to the compliance standards of a traditional financial institution.

Operations streamlined for users’ efficiency and scalability

Institutional investors should consider how a custodial’s solutions could support their growing activity. For example, are there sub-accounting tools for multi-strategy accounts? How are operations secured? How does white-listing work, and how are new account holders verified and onboarded?

The SAFE platform offers institutional treasury management capabilities and workflow automation designed to securely manage accounts and permissions and ensure scalable and compliant operations. Our clients will leverage a seamless user interface to add users, create rules or customize roles.

A fully licensed and compliant partner you can trust

Our record of security is founded on our commitment to regulatory compliance, including our registrations, charters, and licenses that hold us to a fiduciary standard for our clients.

SAFE Trust Co. is a public trust company regulated under Wyoming law, operating as a standalone, independently capitalized affiliate of sFOX. SAFE Trust Co. provides custody account solutions with bankruptcy protection in the unlikely event of insolvency of SAFE Trust Co. Unlike other exchanges, SAFE Trust Co. is subject to heightened regulatory requirements under the Wyoming Division of Banking and the Wyoming Trust Code.

With support for 30+ blockchains and hundreds of assets, including ERC-20 tokens, stablecoins, and new, innovative protocols, SAFE is one of the most innovative solutions for institutions to store their crypto assets. To learn more about SAFE Custody and access a 30-day free trial, schedule a quick call with our team.