At sFOX we believe in radical transparency and best execution. sFOX was built by traders to help buy side and institutional investors navigate the increasingly fragmented digital asset marketplace. We have aggregated the top exchanges and liquidity providers in the market, allowing our customers to execute into deep, bespoke pools of liquidity. Our liquidity pools are composed of unique orthogonal market makers, thus enabling customer execution into a highly skewed and often choice or inverted market. sFOX provides a master orderbook of 30+ top exchanges and OTCs, across 80+ markets, providing 10x deeper liquidity than any other single exchange.

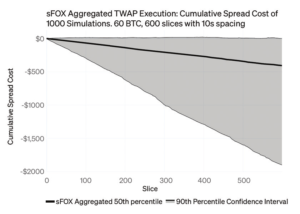

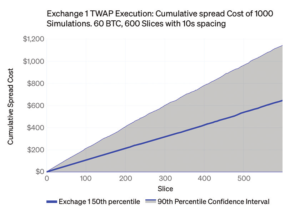

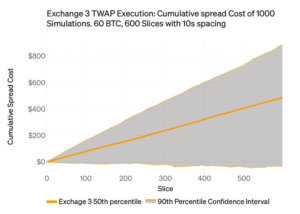

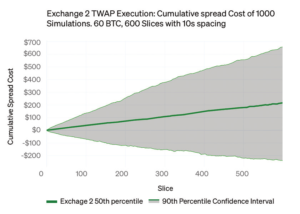

To test the performance benefit of transacting with sFOX, we simulated a Trade Weighted Average Price (TWAP) algorithm to buy 60 BTC with 600 slices and 10-second spacing to quantify the benefit of dealing in a transparent and highly aggregated environment. We performed 1,000 simulated TWAP executions over three major exchanges and compared the performance to sFOX. The sFOX median (50th percentile) performance decreased execution costs by $393 compared to executing at mid, while the median performance for the three leading exchanges increased execution costs between $230 – $678 compared to executing at mid.

Fundamentally, the benefits of executing in a highly aggregated environment which allows one to execute at or better than mid is clear. We can now quantify the benefit of executing in an aggregated environment and the impact is significant. The task of navigating the

fragmented digital marketplace for an institutional investor is daunting, however, sFOX has done the work and provides radical transparency and best execution in a single platform all while managing credit across exchanges.