Summary:

- Whale transactions may have contributed to recent market volatility: Whale Alert identified a significant number of high-value transactions correlated to BTC’s price slump of almost 20% from October 21st to October 22nd and subsequent recovery price of almost 60% to a high of $10,610.00, suggesting that the effect of whale traders on crypto markets is alive and well.

- BTC auction from pornography ring bust may have impacted BTC’s price: After 10,000 BTC confiscated by Korean authorities were auctioned to Binance on October 18th, BTC’s price on the exchange went down from $8062.56 to $7856.89, according to Whale Alert data and SFOX’s analysis.

- USDT issuance may affect market sentiment: The issuance of USDT may have fomented bull spirits in 2019. When BTC was around $3,500, there was “an enormous amount of USDT issuances,” and Whale Alert suggests that some traders may view this “as a positive market development: they assume those USDT are going to be used to buy BTC.”

- Impact of whale traders may eventually wane: According to Whale Alert, “Bitcoin started with a few people. So the biggest chunk of the coins is going to be in the hands of the people who started it. Eventually, those people will have to sell their coins, and more people are interested, [so] the distribution of BTC is going to hopefully level out a bit more.”

Just last week, an unidentified person or institution moved 10,000 BTC — worth $92,959,818 USD at the time — from one unknown wallet to a different unknown wallet. This unidentified person or institution, who was able to move about $100 million in a single Bitcoin transaction, is an example of a Bitcoin whale.

Bitcoin whales attract bitcoin “whale-watchers”: people who keep track of whale-sized crypto transactions for a variety of reasons. That’s where Whale Alert comes in: founded by brothers Frank and Mark in 2018, Whale Alert tracks large transactions on eleven blockchains and announces the details of these transactions to their Twitter following of over 150,000 avid whale-watchers. Through their service, they have brought to crypto a practice that has a long history in equities markets: watching for large trades to gain insights into what the major players are doing and why.

Even as Bitcoin continues to mature, analysts, traders, and enthusiasts alike are trying to sort out exactly who the whales are and how they may or may not influence the crypto market. From October 21st to October 22nd, the price of BTC dropped almost 20% from a high of $8325 to a low of $6737.30; in the following three days, the price climbed almost 60%, from that low of $6737.30 to a high of $10610.00. All the while, Whale Alert logged a significant number of high-value transactions, including the 10,000-BTC transaction highlighted above, inviting the question of how whales relate to these especially large and quick market movements. Do whale movements anticipate broader market movements? Are whale movements reactionary? Do whale movements cause broader market movements? Could some market movements be the result of manipulation by whales?

SFOX sat down with Whale Alert to get their perspective on the history and behavior of crypto whales. The following is an analysis of crypto whales that combines their insights with SFOX’s market-wide crypto price, volatility, and correlation data.

What Are “Crypto Whales,” Anyway?

Discussions about crypto whales can be difficult to navigate because it’s not always clear what a crypto whale even is. Whale Alert keeps their own definition of whales simple: they define a whale as “somebody who, with what they own, can create price fluctuations.” The “somebody” in that equation can be anything from a high-net-worth individual, to a company like Xapo with substantial crypto holdings, to a crypto exchange moving large amounts of funds from one wallet to another — in fact, while many may imagine individual traders when they hear the term “whale,” Whale Alert observes that “exchanges are by far the richest custodians of Bitcoin, and their wallets are the largest ones.”

One of the consequences of Bitcoin and other cryptocurrencies being so volatile is that the same amount of a cryptocurrency may not always make someone a whale. This has led Whale Alert to change the threshold USD value for what they consider a “whale transaction” as the price of BTC has changed over time: “When 1 BTC cost $3,000,” Whale Alert told SFOX, “we had the threshold transfer value at $5 million for a transfer from an unknown address to an unknown address. Right now, we have the threshold at $50 million because the increase in BTC’s price triggered so many potential whale transfers that we had to change the definition of whale transfers.”

An interesting feature about the nature of whales in crypto markets — as opposed to something like equities markets — is that transaction information on many blockchains is totally public, giving ordinary traders and enthusiasts access to what might elsewhere hypothetically be considered “insider information.” As we’ll see later, the puzzle in the case of crypto whales is just a matter of figuring out exactly how to organize and interpret that public information, which is no small feat. (Some whales may still make their discovery harder by using platforms like SFOX to algorithmically break their large trades into smaller, less detectable trades that execute on multiple exchanges — but that’s another story.)

In a sector where many aim to democratize finance for the world, some may have reservations about the mere existence of whales. Whale Alert views the existence of whales as “a necessary thing” given the young age of crypto as a whole. “Bitcoin started with a few people. So the biggest chunk of the coins is going to be in the hands of the people who started it.” They anticipate that the number of whales will decline as the crypto continues to mature: “Eventually, those people will have to sell their coins, and more people are interested — more people are buying — and so, eventually, the distribution of BTC is going to hopefully level out a bit more, and there’s going to be, hopefully, fewer whales.”

In the meantime, however, those “early adopter” Bitcoin whales still have plenty of clout. Whale Alert points to the example of a Bitcoin address holding 80,000 BTC — over $735 million at the time of writing — that has been inactive since 2011: “That address alone — if that is actually a whale who’s been holding their coins for so long without doing anything with them — if they decide, ‘Okay, let’s go sell them,’ it would crush the market completely. But it’s really hard to say anything about the status of that address: Are those keys lost? Is that person even still alive? It’s really hard to say anything about that, unfortunately: it’s just waiting to see if anything happens with those addresses.”

Crypto Whales and Market Movements: Analysis of Recent and Historical “Splashes”

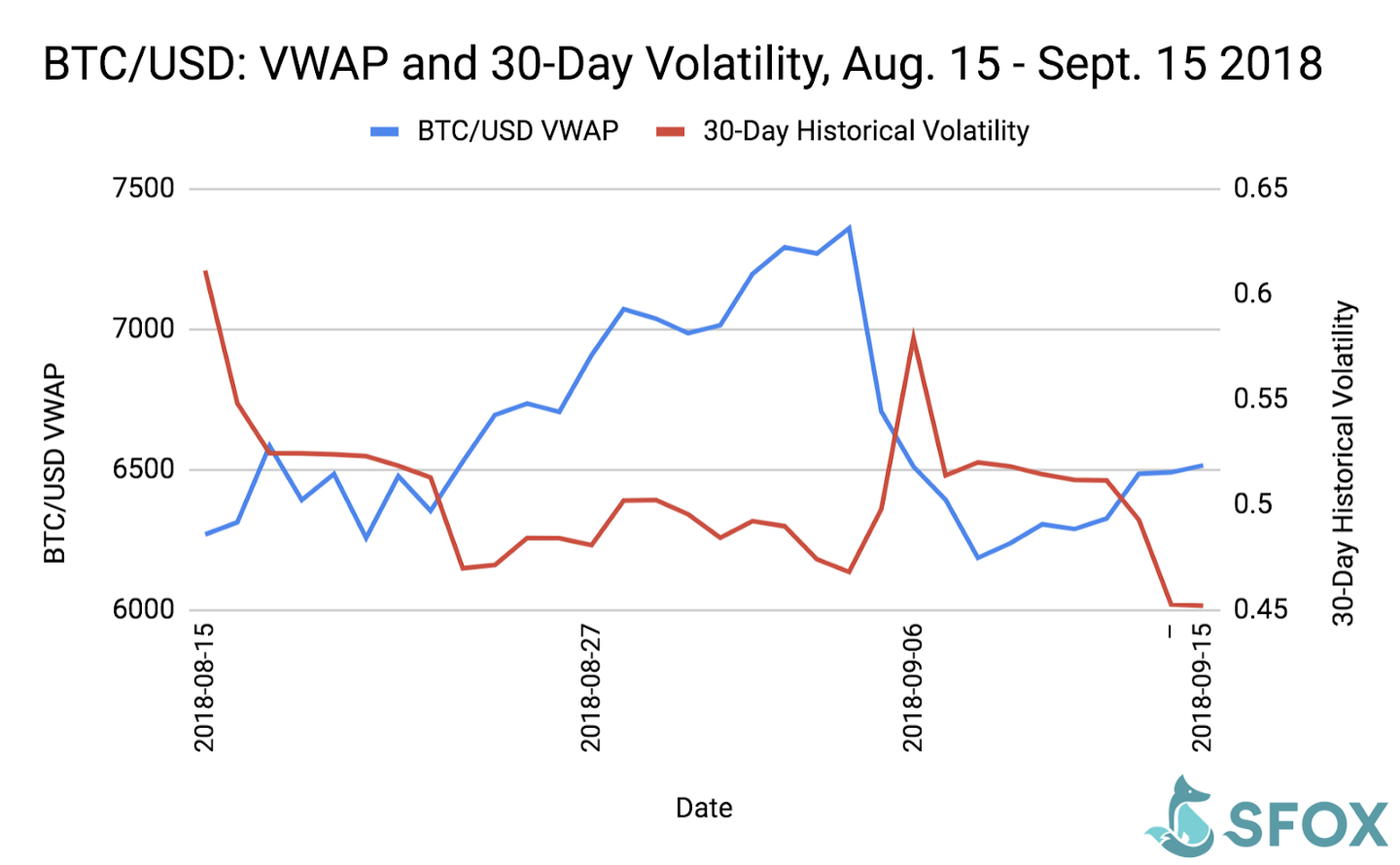

Between August 29th and September 6th of 2018, a Bitcoin whale unloaded roughly $1 billion worth of BTC, moving it from a single wallet to exchanges for selling. On September 6th, when most of the bitcoins from the wallet were sold, the price of bitcoin fell almost 15%, while its 30-day rolling volatility increased by almost 25%.

While correlation does not imply causation, stories such as this make Whale Alert “very confident that whale transactions can have a really profound effect on price in the market. […] Knowing where the currency flows,” they observe, “is a great way of predicting potential fluctuations.”

That currency flow can come from individuals or from large-scale projects and companies — such as EOS. “At one point,” Whale Alert recalls, “ETH was at $1400, and that was one of the first big whale movements that could explain the actual price fluctuations: EOS started to sell their ETH on the market, and we actually saw those movements. And so it’s not only price prediction, but it’s also explaining why the market is behaving in the way it is and who is the cause.”

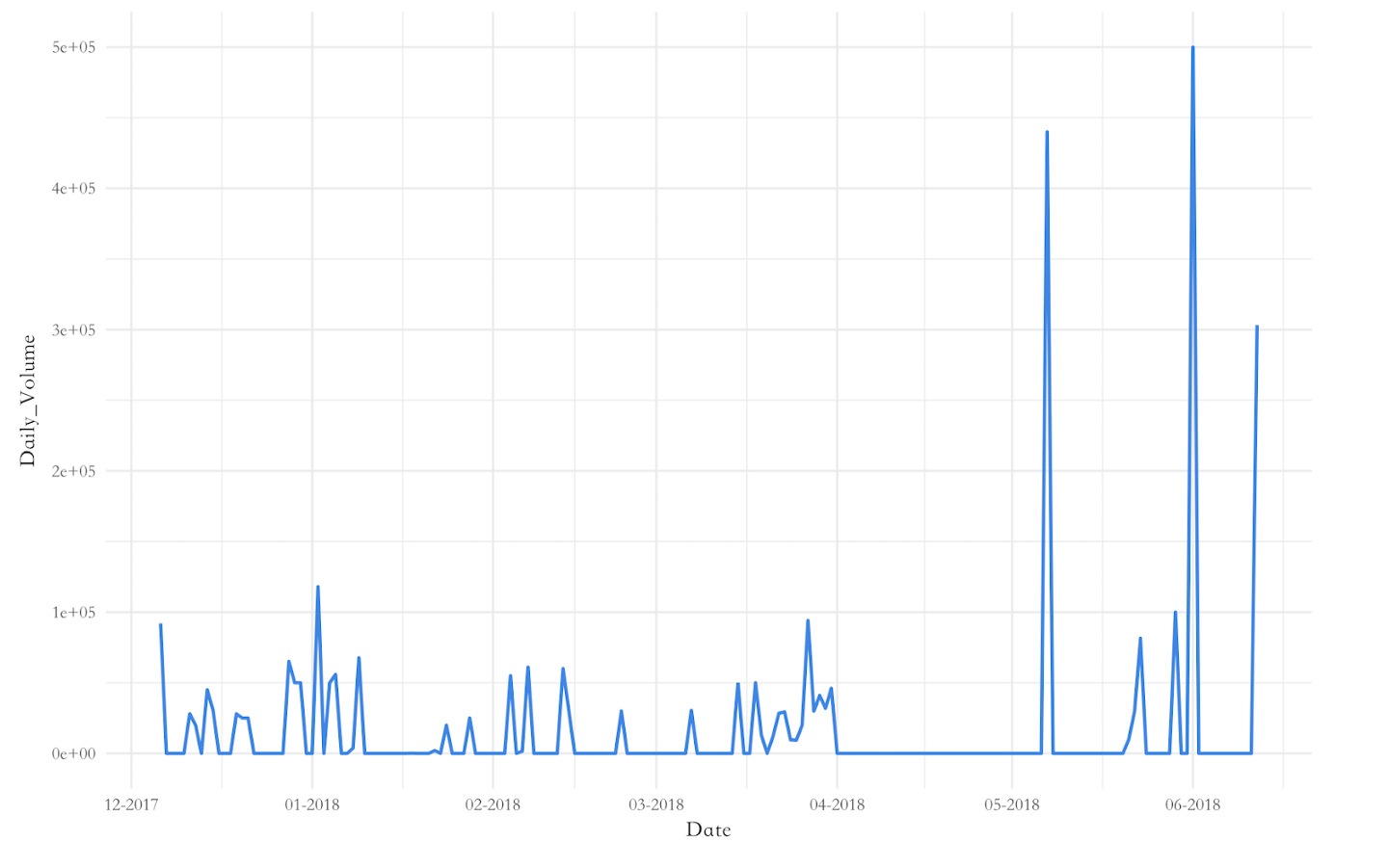

Along with most of the crypto sector, ETH experienced a general downtrend in price during the first half of 2018 (see the first graph below); during the same period, EOS gradually moved roughly 3 million ETH from their crowdsale wallet to Bitfinex (see the second graph below).

Part of what makes analyzing the impact of whale movements so difficult is that any given whale movement doesn’t necessarily mean that the whale in question is buying or selling cryptocurrency, which means that these movements don’t necessarily exert the same pressure on crypto prices as whale-sized sell orders do. The fact that EOS moved funds to Bitfinex at a given time does not imply that they sold all those funds at that time, which explains why there’s no apparent correlation between EOS movement of ETH onto Bitfinex and fluctuations in ETH’s price. On the other hand, unusual spikes in ETH’s trading volume during that time period led some to believe that EOS was selling its ETH holdings, and these spikes did correlate with price movements. For instance, when an abnormally large amount of ETH was traded on Bitfinex on May 28th, 2018 (180,000 ETH in one hour), several analysts suggested that EOS might have been liquidating large amounts of their holdings on the crypto exchange.

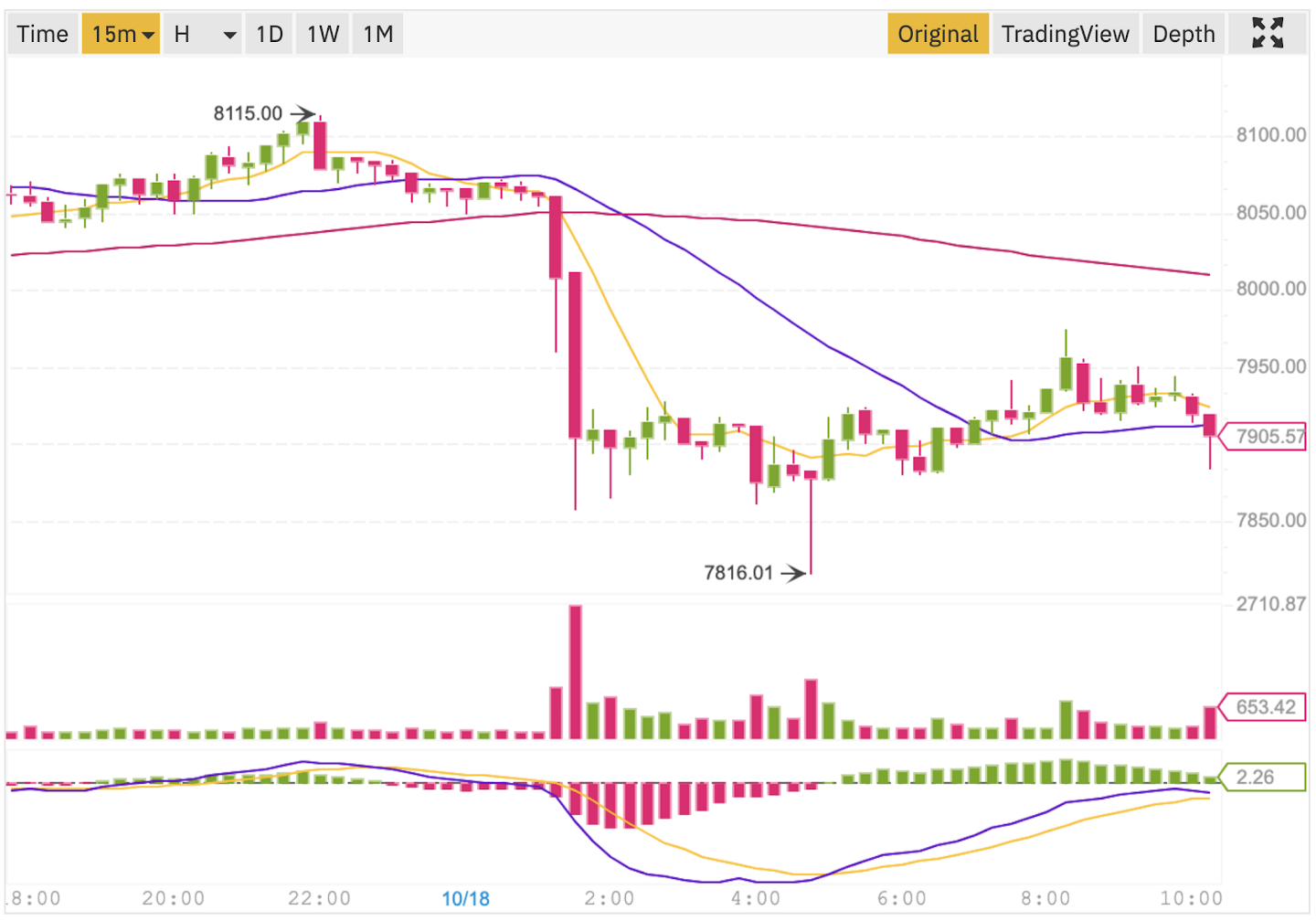

These same correlations between whale-sized events and market movements are visible today. Frank recalls how, on October 18th, 2019, Whale Alert tracked and revealed what appeared to be the market impact of the seizure and auction of BTC involved in a darknet child pornography ring: “In Korea, there was an illegal child porn website on the darknet; the Korean police confiscated a lot of Bitcoin from them. Those BTC were auctioned; one of the transactions we caught was ten thousand bitcoins that were part of that auction, and they likely went to Binance.

“Almost directly after that big transaction, the price of BTC dropped.” Indeed, Binance’s order book shows an influx of volume just a few hours later on the 18th, with a BTC selloff driving the BTC’s price on the exchange down from $8062.56 to $7856.89:

It’s worth noting that even on large exchanges like Binance, sudden large selloffs such as this have a larger impact on the one exchange in question than they do on the overall market. On SFOX’s integrated price charts, which aggregate trade data from all major cryptocurrency exchanges, the above selloff is still visible, but we can see that the marketwide volume-weighted average price settled at $7915.01, well above the drop on Binance’s order book to $7856.89:

Whale Alert acknowledges that it can be challenging to analyze the exact market impact of whales: while some sophisticated tools for analyzing whale identities exist, some analysis still comes from simply looking at forums and news articles and following the trail based on what other community members have uncovered. He also points out that market expectations could theoretically impact BTC’s price more than the whale movements themselves: “Whale Alert has such a large following at the moment,” he notes, “and it’s kind of hard to see what the effect is of us posting our transactions on our Twitter feed: that might actually influence the price in itself. And we haven’t done much research on that — on what our influence actually is.” He wonders whether issuances of USDT may have a similar effect, noting that high-volume USDT issuances were a defining feature of BTC’s price recovery in the first few months of 2019: “during that period — I think it was from $3500 per BTC to $4000 per BTC, somewhere like there — there had been an enormous amount of USDT issuances, and a lot of people see those as a positive market development: they assume those USDT are going to be used to buy BTC. Now, I don’t know if that assumption is correct, but a lot of people reacted to that, I think — to the issuance of Tether.”

The takeaway seems to be that the entire whale ecosystem —including both crypto whales and crypto whale-watchers — remains a key part of how crypto markets operate. In that context, it’s worth bearing in mind what cryptocurrency fund manager and SFOX client Tim Enneking observed in an interview with SFOX: “the crypto space is quite small, right: a quarter of a trillion dollars. What that means is there are tens, if not hundreds, of funds on the planet that — ignoring the fact that they’d drive the price up — could buy the entire crypto sector.” This means that, even as the sector’s infrastructure matures and more traders enter, the movements of whales are still large enough to theoretically be felt throughout the market.

The key next step in understanding whales is building better analytics to make their movements and market impact more transparent and less dependent on correlations or conjecture. That’s exactly what Whale Alert is working on next.

What’s next in crypto whale-watching

Whale Alert is currently hard at work building a new analytics system to provide exactly this kind of next-level insights into who whales are and what they’re doing, and they were kind enough to tease some of the new functionality that most excites him in his interview with SFOX.

“The first thing is that we’re going to include a lot more blockchains. Right now, we’re tracking eleven blockchains, and, unfortunately, we’re not doing Litecoin yet, we’re not doing Bitcoin Cash yet, we’re not doing Cardano yet… those are all blockchains that we really want to track, and the new system will allow us to easily include them as well.”

They’re also aiming to integrate price and whale transaction data from the very first block of every tracked blockchain in an easy-to-search and easy-to-analyze format: “We’re going to be able to collect data from the first moment, from the first block, for every chain, and start analyzing from there, both forward and backward, combining it with price data that we have and other data that we have. So it’s going to be a really complete set of the entire market, and it’s going to be a huge amount of data that we will be able to offer to people interested in it.”

And, when it comes to Twitter, they’re planning to provide richer information to their followers about exactly who are moving funds to where: “One of the things we want to do is to track wallets — like the one I was talking about before, the 2011 wallet with 80,000 BTC — and post a message on Twitter when those kinds of wallets come back to life again, if someone is transferring money from those wallets to somewhere else. I think that this, combined with other ideas that we have, will make for a lot more interesting data on our Twitter feed.”

Whale Alert hopes to launch its new platform within the next 2 months, marking the next evolution in our understanding of the biggest players’ impact on the crypto market.

Want to get real-time alerts about the biggest crypto movements? Follow Whale Alert on Twitter.

Want to see how SFOX’s trading platform breaks whale-sized orders into bite-sized orders and spreads them across multiple exchanges? Claim your account now.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.