The term “utility token” is a little like the term “crypto”: in today’s quickly evolving cryptoasset market, the term is so general that it does more harm than good.

The truth is that, while people are wont to identify cryptoassets as “utility tokens” to tacitly suggest they are exempt from certain regulatory burdens, cryptoassets have at least five distinct use cases, each of which comes with their own regulatory considerations — and a single cryptoasset may serve different use cases at different points in its development. Read on to learn more about each of these use cases, and about what’s at stake when we discuss the “utility” of cryptoassets.

Utility tokens: myth vs. reality

In order to understand what utility tokens are, we need to step back and consider why the term was coined — no pun intended — in the first place. This history lesson will allow us to see what a true utility token could possibly look like, and how most current conversations in crypto end up ignoring that reality.

The importance of “utility” in modern crypto discussions goes back all the way to 1946, when SEC v W.J. Howey Co. set the basis for determining whether or not a given asset constitutes a security.

SEC v Howey considered the case of a hotel operator in Florida that sold interests in a citrus grove to its guests. The operator claimed that it was selling real estate rather than securities. However, these sales also included service contracts for Howey-in-the-Hills Service, Inc., to manage the grove property on the new owner’s behalf — and these “optional” service contracts were heavily advertised as being a lucrative investment. In ruling that this did, in fact, constitute the sale of a security, the Supreme Court created the aptly named “Howey Test”: a set of jointly sufficient conditions required for a given asset to be considered a security.

There is some debate in the legal community as to what role a “common enterprise” plays, but as a very general summary under the Howey Test, the sale of an asset most likely constitutes the sale of a security if the following conditions are met:

- There is an investment of money.

- There is an expectation of profit.

- The expectation of profits derives largely from the efforts of others.

Where does “utility” come into the picture? Well, as Scott Kupor and Sonal Chokshi note in Andreessen Horowitz’s blog, the Supreme Court’s ruling implied that, while the contracts for buying and servicing orange groves were securities, the oranges themselves — i.e. the useful goods underlying those contracts — could not be regulated as securities.

The fundamental principle here is that the nature of an investment contract can be distinct from the nature of the object of that investment contract. This distinction matters when considering the developmental stages, or “lifecycle,” of crypto networks, too.

This seems to be the tacit argument at work when many crypto traders or network developers identify a certain cryptoasset as a “utility token”: if an asset is purchased in order to serve an actual function or “utility,” such as oranges, then the asset itself is not a security; Cryptoasset X is purchased in order to serve an actual function; therefore, Cryptoasset X is not a security.

The problem with that line of thinking is that, in an effort to preemptively avoid SEC regulation by calling cryptoassets “utility tokens,” crypto communities run the risk of oversimplifying the various functions of cryptocurrencies, many of which may ultimately be subject to regulation. When you buy the oranges to eat, they are not a security; when you buy them while on vacation as part of a service contract that doesn’t allow you access to your citrus grove, they probably are.

A true “utility token” in the sense that many crypto investors seem to have in mind, according to SEC Director of Corporation Finance William Hinman, is probably best represented by bitcoin itself: as he said at the Yahoo Finance All Markets Summit this past June, Bitcoin does not appear to have “a central third party whose efforts are a key determining factor in the enterprise. The network on which Bitcoin functions is operational and appears to have been decentralized for some time, perhaps from inception. Applying the disclosure regime of the federal securities laws to the offer and resale of Bitcoin would seem to add little value.”

Those who focused on that soundbyte may have missed the warning that Hinman went on to issue to those who focus on the label of “utility coins” rather than on the actual functions that cryptoassets serve:

I would like to emphasize that the analysis of whether something is a security is not static and does not strictly inhere to the instrument. Even digital assets with utility that function solely as a means of exchange in a decentralized network could be packaged and sold as an investment strategy that can be a security. […] simply labeling a digital asset a “utility token” does not turn the asset into something that is not a security. I recognize that the Supreme Court has acknowledged that if someone is purchasing an asset for consumption only, it is likely not a security. But, the economic substance of the transaction always determines the legal analysis, not the labels. The oranges in Howey had utility. […] But Howey was not selling oranges[:] They were selling investments, and the purchasers were expecting a return from the promoters’ efforts.

Especially because the “economic substance” of a cryptoasset can change over the course of its development, it’s misleading at best and meaningless at worst to simply identify a cryptoasset as either a utility token or a security — Hinman said as much when he suggested that the initial crowdsale of ETH probably constituted a security offering even though current ETH sales do not constitute security sales.

To that end, we’ve rounded up the five functions of cryptoassets that are most prominent today, with considerations about the potential regulatory ramifications for each function. The next time someone calls a cryptoasset a “utility token,” consult this list, among other things, and ask yourself whether that person is accurately representing that cryptoasset’s likely regulatory burdens.

Cryptoasset Function #1: Blockchain Access

The most basic function of cryptoassets, as exemplified in the case of Bitcoin, is to provide holders with access to the underlying blockchain itself. Bitcoin is a decentralized network for transactions, and BTC serves as the means by which people can access and use this network. ETH is a similar use case: it provides people with the ability to access and use the ecosystem of DApps and other utilities built on Ethereum.

The IRS has advised that such cryptocurrency is to be treated and reported as property for tax purposes, though — as Hinman said last June — they do not constitute securities. It’s also worth keeping in mind that prominent blockchains like Bitcoin and Ethereum are also public: even though it’s possible in principle to distance one’s identity from one’s transactions, blockchain forensics are becoming increasingly sophisticated and will probably play a regulatory role down the line. We saw the U.S. Treasury augur this future when it designated two Iran-based individuals and publicly identified two Bitcoin addresses associated with “Iran-based financial facilitators of malicious cyber activity” (149w62rY42aZBox8fGcmqNsXUzSStKeq8C and 1AjZPMsnmpdK2Rv9KQNfMurTXinscVro9V).

Cyptoasset Function #2: Digital Goods

Though the practice is in its infancy, the use of cryptoassets as digital goods is one of the most hotly anticipated functions of blockchain technology. This is what people have in mind when they discuss non-fungible assets: these are digital goods that, by virtue of blockchains’ cryptographic infrastructure, are uniquely owned and cannot be altered or reappropriated by any third party.

This function was behind the craze of CryptoKitties, the Beanie-Babies-esque digital cats that took Ethereum by storm at the end of November 2017.

If digital cats seem like a mere triviality, consider the following: Final Fantasy: Brave Exvius, a single mobile game, generates $2 million USD in revenue every month (as of November 2018). This gacha game generates its revenue from players paying for more chances to “pull” the characters they want from a pool of different characters, each with various probabilities of being pulled — much like one might purchase trading card packs for a trading card game like Magic: The Gathering.

Of course, there’s one major difference between digital gacha games and physical trading card games: players really own physical trading cards, whereas one’s digital assets in modern gacha games exist at the pleasure of the centralized companies that run those games: the company could (and often, in practice, really does) decide to modify the features of a particular digital asset or retract particular assets from players’ accounts, all with little notice or explanation. Blockchain-based games therefore have the competitive advantage of offering players genuine ownership over their assets, allowing them to not only feel secure that a centralized developer won’t change that asset, but also to freely buy, sell, and trade those assets within broader marketplaces. When a quality game capitalizes on this advantage, it could potentially end up cornering a substantial portion of the overall gaming market.

Regulators in various corners of the world have expressed renewed interest over the last few years in regulating these sorts of gaming practices that somewhat resemble gambling: “loot boxes,” in particular, have attracted attention for allegedly fostering the addictive behavior of gambling by offering low probabilities of pulling rare items. Cryptoassets will be especially worth watching in this regard: U.S. courts have previously ruled that “gambling with virtual currency within a video game is not illegal as long as there are no ties to real money,” and such ruling may warrant revision or clarification as cryptoassets and cryptocurrencies blur the lines between “virtual currencies” on the one hand and “real money” on the other hand.

Cryptoasset Function #3: Access to a Good or Service

Cryptoassets can also be used to provide access to a specific good or service. Imagine, as an example of this, a cryptoasset that functions like a uniquely identifying gym pass. Even though this cryptoasset is presumably built on a blockchain, its function (unlike Bitcoin and Ethereum, which we discussed above) is not to give holders access to that blockchain: its function is to give people access to the service of the gym.

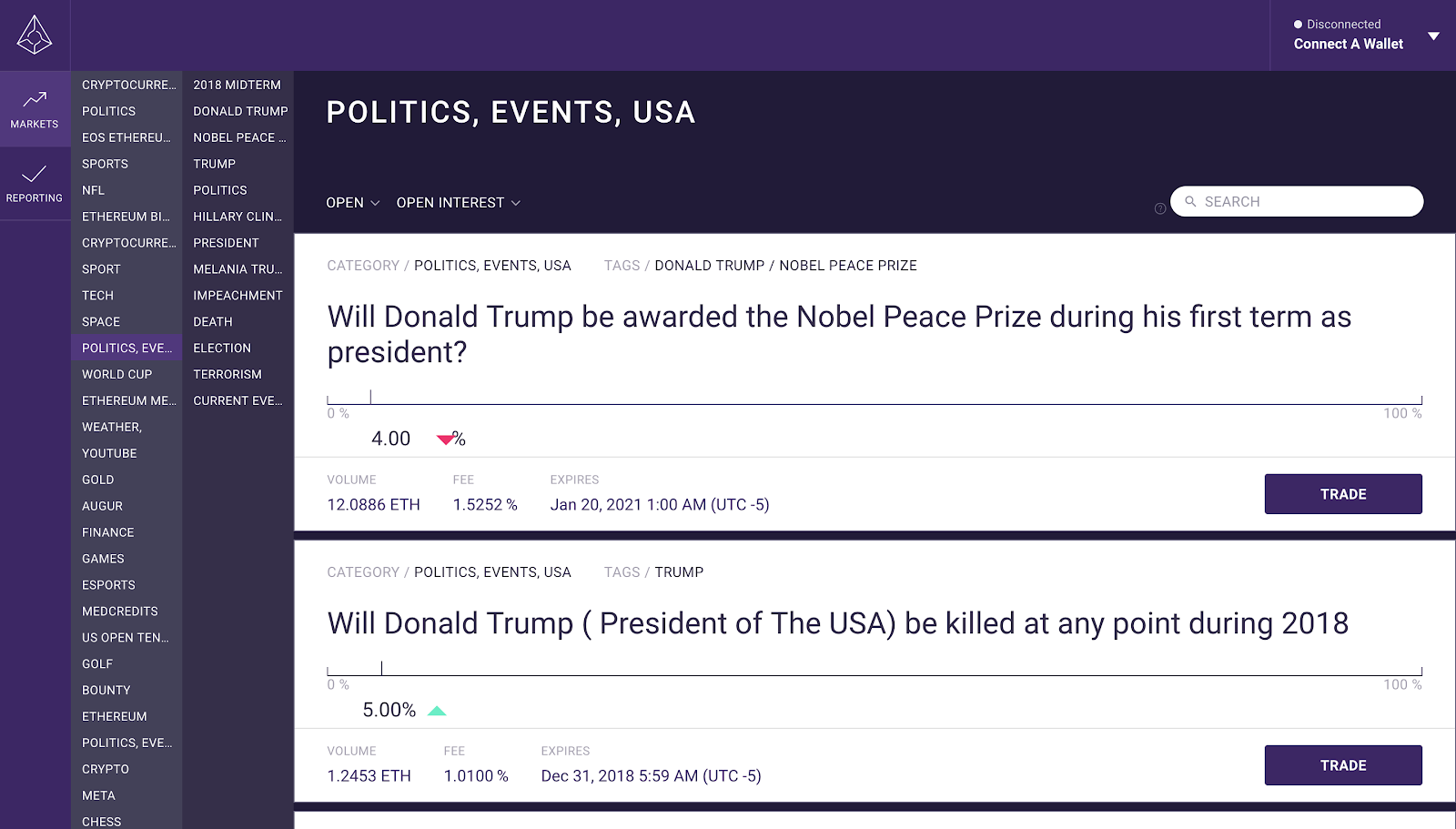

In practice, the tokens that currently fill this functional role function a little like an internal currency that can be used in the context of its corresponding good or service — some like the virtual copper of World of Warcraft. For example, take prediction network Augur. Augur hosts a token called Reputation (REP). Users can earn REP by honestly reporting on how various events in the world played out. They can also use REP to buy “stakes” in various predictions, earning REP or ETH for guessing correctly. Thus, REP is both a way to access Augur and a reward for participating.

If someone earns a utility token like REP but doesn’t want to participate, they may have the option of selling the token. However, not all utility tokens have significant value and/or exchanges that support buying and selling that token. On the other hand, most blockchain projects set a maximum limit for the total amount of utility tokens they will ever issue. Thus, if a project is successful in achieving widespread adoption, its tokens could increase in price once the supply becomes more limited than the demand.

Some people are quick to identify cryptoassets in this functional category as “utility tokens,” insinuating that they are therefore free of regulatory restrictions. This isn’t the case, however: not only could a cryptoasset in this category theoretically satisfy the Howey Test (especially, for instance, if they are sold and traded before their corresponding good or service is publicly available), but they could also potentially qualify as a form of prepaid access, in which case they would be bound by further regulatory restrictions.

Prepaid access is defined by the FFIEC as “access to funds or the value of funds that have been paid in advance and can be retrieved or transferred at some point in the future through an electronic device or vehicle” If a given asset qualifies as pre-paid access, it faces a whole other regulatory burden.

FinCEN issued its “Final Rule — Definitions and Other Regulations Relating to Prepaid Access” in November 2011 as an amendment to the Bank Secrecy Act, designed to regulate prepaid gift cards — a medium whose high velocity and potential for anonymity made them an apt medium for money-laundering. The rule spells out the regulations applying to prepaid programs, which are defined as “an arrangement under which one or more persons acting together provide(s) a particular form of prepaid access.”

Anyone who qualifies as a provider of prepaid access generally must register as a Money Services Business (MSB) with FinCEN, implement an anti-money laundering program, report suspicious activity, and comply with the rigorous record-keeping standards. MSBs must also register in certain states in which their business model requires them to do so; for a blockchain-based project, this could possibly include all 50 states. This would put a heavy regulatory burden on new blockchain-based projects whose tokens qualified as prepaid access.

And keep in mind it’s theoretically possible that regulators could decide that a given token qualifies as both prepaid access and as a security — in which case the token would be subject to both sets of rules and regulations.

Cryptoasset Function #4: Representing Financial Asset

An increasingly hot topic in cryptoasset use cases is the advent of stablecoins: cryptoassets that are meant to digitally represent a different financial asset, such as the US dollar. There is a number of different ways in which a cryptoasset might try to serve this function:

- The entity controlling the stablecoin might “peg” its value to that of another financial asset by enforcing a stable exchange rate between the two.

- The stablecoin might have a controlling party that acts like a traditional “central bank,” governing the stablecoin’s various currency controls.

- Programming a kind of algorithmic “central bank” directly into the currency itself, as Basis recently tried (and failed) to do.

- The stablecoin might be “backed” by another financial asset — for instance, the controlling entity might hold a certain amount of USD in traditional bank accounts for every stablecoin in circulation.

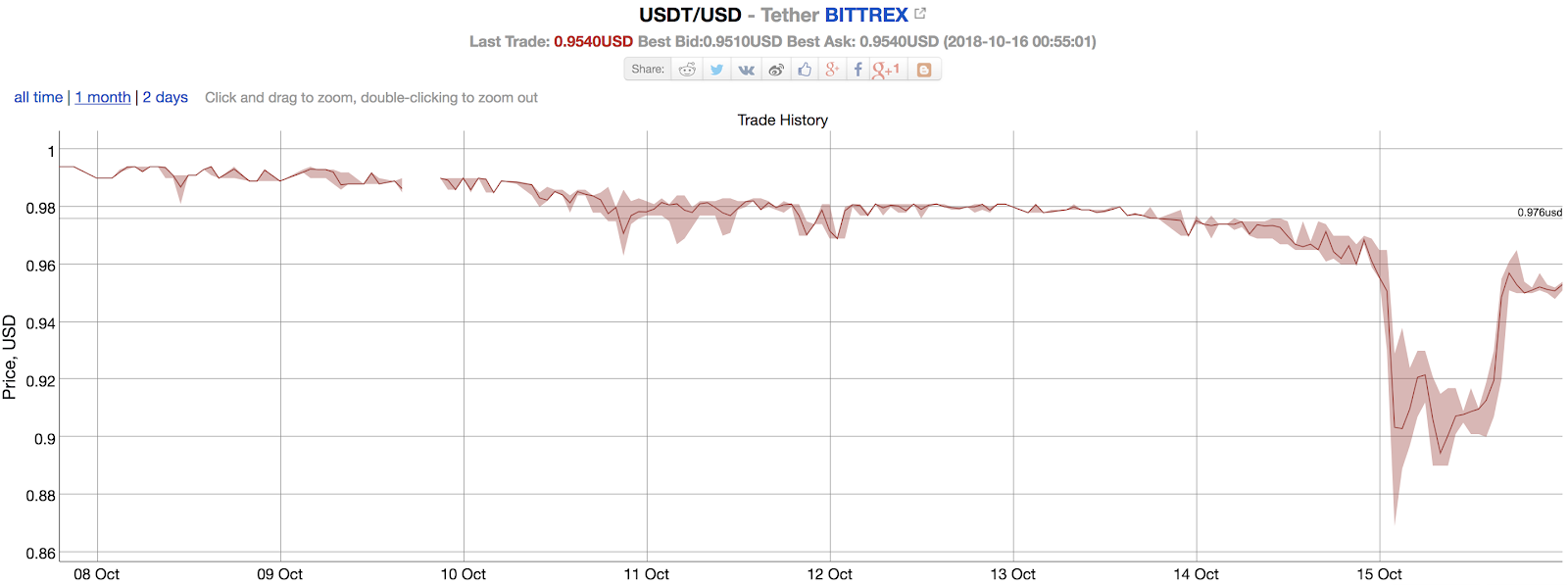

With stablecoins just now coming into vogue, it’s not yet clear precisely how financial regulations might be brought to bear on them. However, it’s interesting to see that this is one area where an increase in regulation seems to have been a positive thing thus far: the lack of regulation surrounding Tether’s stablecoin, the USDT, led bearish investors to push its price below $0.90 USD this past October, as some market participants questioned whether each USDT was in fact backed by a corresponding bank-secured US dollar.

Subsequently, stablecoins like PAX and GUSD have explicitly focused on getting approval from regulatory entities like the New York Department of Financial Services (NYDFS), which may have played a role in their USD exchange rates remaining more stable than that of USDT.

Cryptoasset Function #5: Fundraising

Perhaps the clearest case for cryptoasset regulation — despite being one that was far from the most obvious when Satoshi’s whitepaper first launched the industry in 2009 — is the case of cryptoassets that function as a method of fundraising for blockchain-related projects.

ICOs and other blockchain projects — including Ethereum itself — have used utility tokens to raise money and incentivize network participants. Here’s how that process worked for Ethereum, and for many ICOs since.

- The Ethereum development team announced its release of the new ether token associated with the Ethereum blockchain.

- People could invest in Ethereum by purchasing ETH prelaunch. Investors sent a quantity of bitcoin to a public address and received IOUs for a set amount of ETH in exchange.

- The ICO cashed in most, if not all, of the contributed BTC in exchange for fiat currency, which it can then use to fund its project.

- Once the Ethereum blockchain went live, the prelaunch investors received the ETH for which they paid in advance.

Once a blockchain project launches, investors who pre-purchased tokens can exchange those tokens for access to the project’s offerings. If a project fails completely, then the proprietary token is effectively worthless. However, if it succeeds, investors can either use the token or sell it to other would-be users.

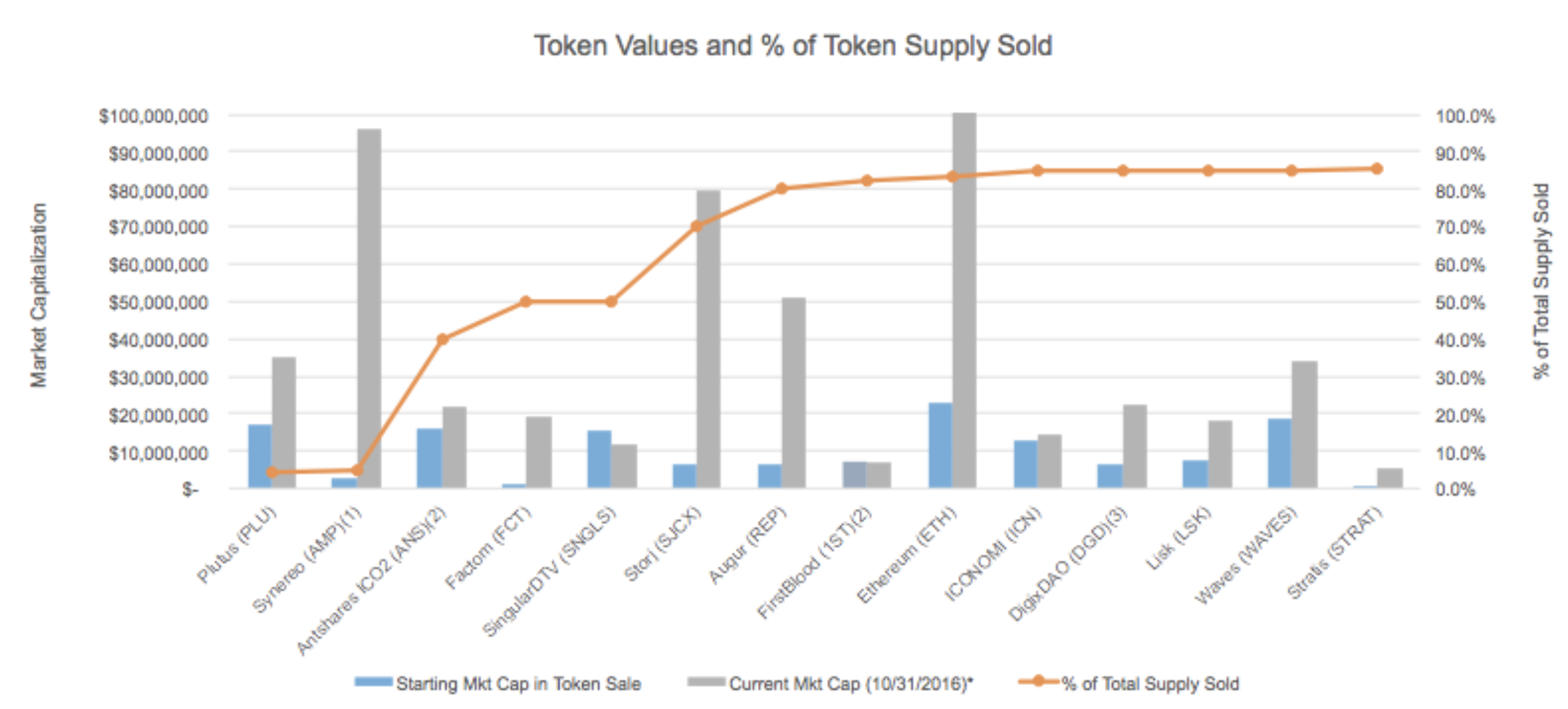

During prerelease token sales, most ICOs sell about 80% to 90% of their total token supply and hang onto the remaining tokens for future dispersal. The below graph shows examples of how some past ICOs chose to cap their token releases.

Notice that many different kinds of cryptoassets will fall into this category of “fundraising” even if they later serve a different function. Even though ETH now functions as a means of accessing the Ethereum blockchain, it was initially used as a fundraising tool for building that very network. The corollary is that some cryptoassets may end up constituting securities at one point in their lifecycle (e.g., during an ICO) even if they later end up not constituting securities (e.g., once their corresponding blockchain is fully operational).

The Swiss-Army-Knife Philosophy of Crypto

When someone talks about “utility tokens” in crypto, put yourself in mind of a swiss army knife: from the outside, a swiss army knife looks like a single tool. But, once you unpack it, you discover that it is actually many tools, each of which has its own use cases and warrants its own set of safety precautions.

Encourage those who discuss utility tokens to unpack what specific utility they actually have in mind: which of the five above functions is the cryptoasset in question serving — or is it serving an entirely new kind of function?

More often than not, there will be regulatory considerations attached to a cryptoasset’s utility. Understanding those regulations can help one to better understand the overall value and opportunity presented by that cryptoasset.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.