Bitcoin is one of the most extraordinary developments of the last decade: a grassroots experiment in monetary policy played out on a global scale. As anonymous Bitcoin creator(s) Satoshi Nakamoto wrote it in the Bitcoin whitepaper:

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments… What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.

As a digital peer-to-peer currency, Bitcoin was created to allow the free flow of value without the intervention of centralized banking systems or trusted third-parties. Like many new technologies, Bitcoin is many things to many people. For an ideologist, the primary innovation of Bitcoin might be as a censorship-resistant currency that no one can take away from you. For an institutional investor, the value of Bitcoin might be as a store of value and a useful hedge against traditional equity markets, similar to gold.

Wherever you fall on the spectrum, Bitcoin has come a long way in the past ten years. Bitcoin was the first cryptocurrency and it remains the most valuable, with a market cap north of $70 billion. In this article, we’ll walk you through a brief history of Bitcoin, explain how it works, and dig into the key factors that may impact BTC’s price.

A brief history of Bitcoin

Bitcoin is the brainchild of the elusive Satoshi Nakamoto, an alias for the unknown person, persons, or organization who wrote the Bitcoin white paper and the initial version of its software. Satoshi mined the first block of bitcoins in early January 2009. By that October, the New Liberty Standard set the Bitcoin exchange rate at 1,309.03 BTC per USD.

In May 2010, the first-ever bitcoin-financed purchase took place when Laszlo Hanyecz paid 10,000 BTC for two pizzas. Later that same year, the first Bitcoin exchanges (Bitcoin Market and Mt. Gox) and the first Bitcoin mining pool (Slush Pool) surfaced.

As interest in the cryptocurrency grew, bitcoin’s price began to improve until, in early 2011, it finally passed the one-dollar mark. In December 2013, it passed the $1,000 price point — a 1,000x gain in three years.

Over the next few years, Bitcoin gradually began to gain public attention and, despite the growing number of altcoins, it remained firmly entrenched as the preeminent cryptocurrency. However, as its network grew, so did disagreements about the direction the coin should take. Finally, in August 2017, those disagreements came to a head, and the Bitcoin blockchain hard-forked into two blockchains: Bitcoin and Bitcoin Cash.

A 10-year Bitcoin timeline

Since Bitcoin launched ten years ago in January 2009, a lot has happened. Let’s look at how far Bitcoin’s come:

2008

- August: Bitcoin.org was registered as a domain name.

- October: Satoshi Nakamoto published the Bitcoin white paper.

2009

- January: Initial version of Bitcoin software was released; Nakamoto mined the Genesis Block; the first Bitcoin transaction occurred between Nakamoto and programmer Hal Finney.

- October: The first BTC/USD exchange rate was established.

- December: The second version of the Bitcoin software was released; mining difficulty was increased for the first time.

2010

- February: The first Bitcoin exchange, Bitcoin Market, started operations.

- May: First-ever use of bitcoins as currency.

- July: The third version of Bitcoin software was released; Mt. Gox exchange started operations.

- September: Slush Pool, the first BTC mining pool, started mining operations.

- October: First major Bitcoin exploit resulted in the fraudulent generation of 184 billion BTC; developers quickly reversed the transaction and patched the code.

- November: Bitcoin’s market capitalization exceeded $1 million USD.

2011

- January: The total number of generated bitcoins reached 5.25 million, exceeding 25% of the 21 million bitcoin cap enforced by the software.

- February: Silk Road, a dark web marketplace using bitcoins, debuted and quickly turned into a trading hub for drugs and other illegal products.

- April: Namecoin, the first altcoin, was introduced as an alternative domain name registry service; TIME Magazine published an article about Bitcoin.

- June: A security breach at Mt. Gox compromised thousands of accounts.

2012

- February: Bitcoin Magazine released its first issue.

- September: The Bitcoin Foundation was formed.

- November: The Bitcoin blockchain reached 210,000 total blocks and mining rewards were halved to 25 BTC.

2013

- February: Mt. Gox suspended trading and files for bankruptcy, revealing that it had lost 744,408 bitcoins due to a suspected hack.

- March: The first Bitcoin hard fork occurred due to an unexpected effect from a new protocol rule; BTC’s market cap passed $1 billion USD.

- August: A Texas judge ruled that BTC qualifies as a currency.

- October: Silk Road was shut down by the FBI and its BTC assets were seized by the government.

- December: China’s central bank banned bitcoin transactions.

2014

- January: The CEO of BitInstant, Charlie Shrem, was arrested and charged with money laundering.

- March: Newsweek published an article claiming it had identified one Dorian Nakamoto, a computer engineer in California, as the creator of Bitcoin. Nakamoto denied that he was Satoshi Nakamoto and said he had never been involved in Bitcoin.

- December: Microsoft started accepting BTC as a payment method for its marketplaces.

2015

- January: Bitcoin exchange Bitstamp was hacked to the tune of 18,866 bitcoins.

- June: New York City requires Bitcoin and digital currency companies to apply for a BitLicense.

- August: The CEO of Mt. Gox, Mark Karpeles, was arrested and charged with embezzlement.

2016

- April: Steam accepts Bitcoin as payment for video games along with other media.

- July: Uber switches to Bitcoin in Argentina as the government blocks Uber from accepting credit card payments in the country.

- August: Bitcoin exchange Bitfinex was hacked and around 120,000 BTC were stolen by the culprits.

2017

- March: The SEC rejects two applications proposing to establish Bitcoin ETFs — one from the Winklevoss twins, and another from the Intercontinental Exchange.

- April: Japan recognizes Bitcoin as a legal method of payment.

- August: The Bitcoin Cash fork occurred, splitting Bitcoin into Bitcoin and Bitcoin Cash.

- November: The price of 1 BTC exceeds $10,000 USD for the first time.

- September: China shuts down cryptocurrency exchanges.

- December: Bitcoin futures contracts became available on the Chicago Board Options Exchange (CBOE) and Chicago Mercantile Exchange (CME).

2018

- January: Facebook responded to the wave of cryptocurrency ICOs by banning all crypto-related adverts.

- March: Lightning Labs’ implementation of Lightning network launches in beta.

- May: Goldman Sachs launches a Bitcoin trading operation. The U.S. Justice Department launches a probe into potential cryptocurrency price manipulation.

- August: The owner of the NYSE announces the launch of Bakkt, a federally regulated market for Bitcoin. Square enables buying and selling Bitcoin in its Cash App across the U.S.

- October: 10-year anniversary of Bitcoin launch. Fidelity launches an institutional platform for trading cryptocurrencies.

- December: Second-largest difficulty drop in Bitcoin mining history.

2019

- January: Lightning Network grows to over 5,690 nodes with over 22,000 payment channels.

- March: The Chicago Board Options Exchange puts Bitcoin futures on hold, citing a need to assess its approach to digital asset derivatives. A Tokyo court finds Mark Karpelès not guilty of the most serious charges against him, including embezzlement and breach of trust, but finds him guilty of creating false records in the Mt. Gox system.

How Bitcoin works

In this paper, we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions. The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes. —Satoshi Nakamoto, Bitcoin Whitepaper

Bitcoin is a cryptographically-secured digital asset built on top of a type of database called a blockchain.

The age-old problem with building an electronic currency is called the double-spend problem, or the risk that digital currency can be spent twice. This isn’t a problem with traditional fiat currencies like the dollar, because it’s relatively difficult to forge a paper currency. But digital assets, at least before Bitcoin, were easily reproducible, which meant there wasn’t a good way to prevent people from making copies of the digital tokens that they owned and spending them like money.

Before Bitcoin, the only way to really solve this problem was to rely on a central administrator — a trusted authority who maintained the books and kept track of everyone’s balance and transaction history. Then, in 2008, the Bitcoin whitepaper by the anonymous Satoshi Nakamoto proposed an elegant solution to double-spending: use cryptography to secure a decentralized, trustless network for a digital currency.

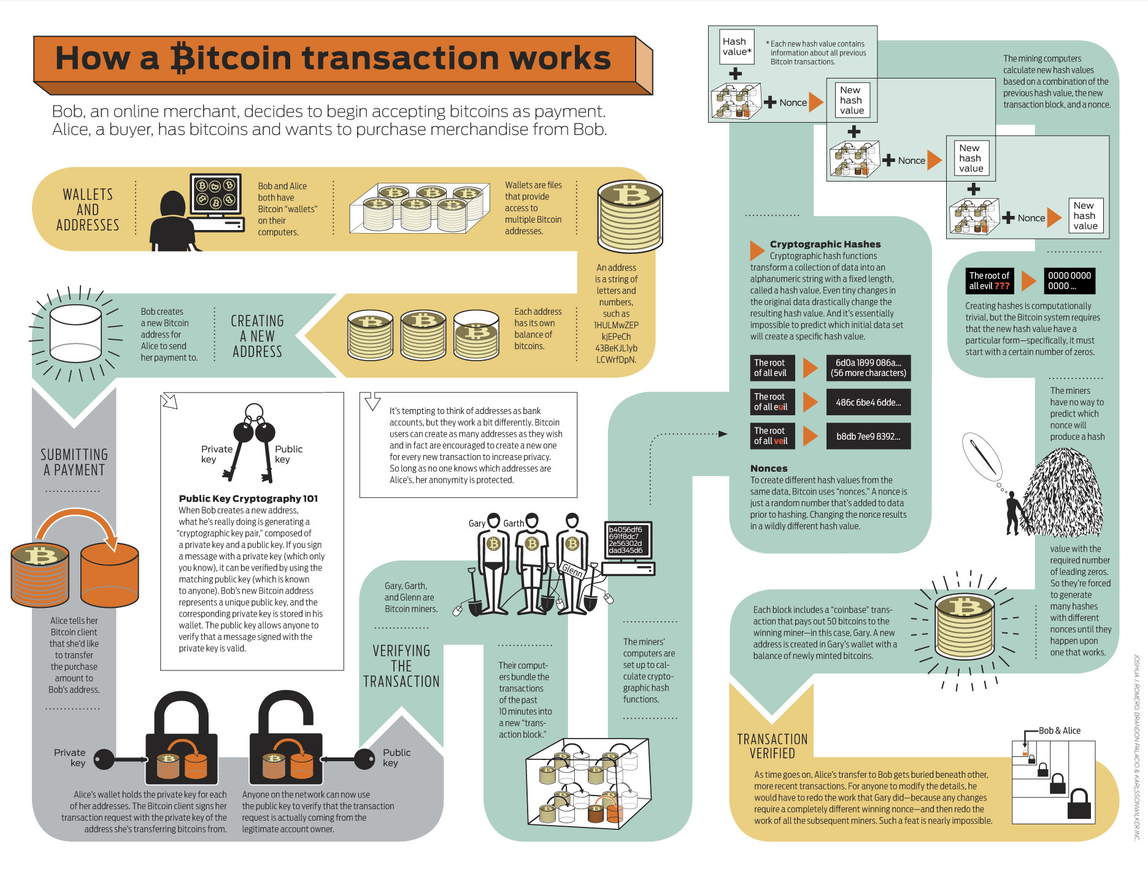

Bitcoin transactions are stored on a blockchain: a shared public ledger of transactions maintained by nodes, or computers on the network. Instead of trusting a centralized administrator to keep a ledger of transactions, on Bitcoin, every single node has a copy of the entire history of transactions on the network. Anyone can join this network and run a node.

Alice can’t send Bob bitcoins that she doesn’t have because that fraudulent transaction wouldn’t sync up with records that everybody else was maintaining on the system.

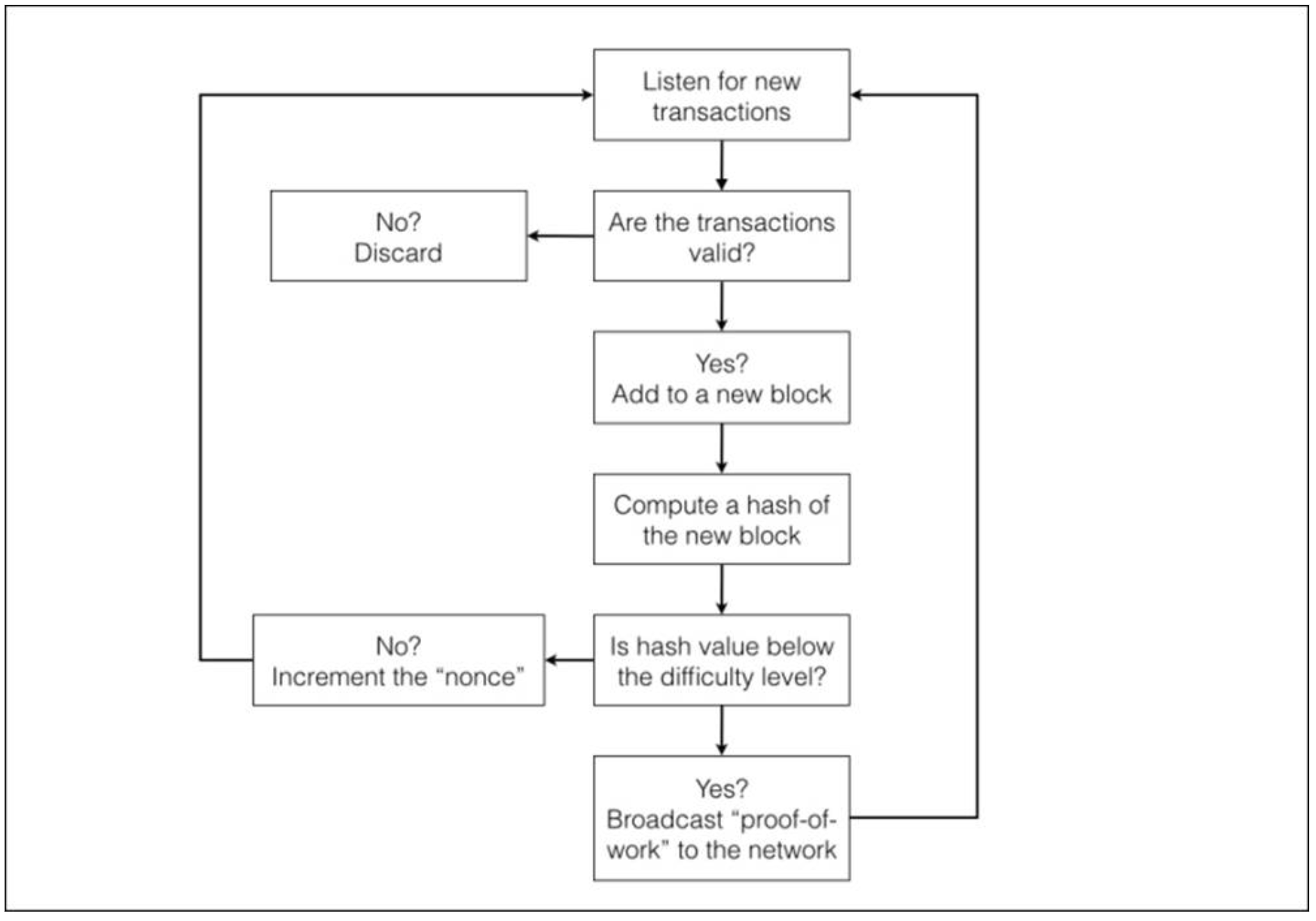

But if everyone on the network has a copy of all transactions, then there has to be a mechanism for adding new transactions to every node. This is where the key innovation behind Bitcoin kicks in: When you send a Bitcoin transaction, that transaction is broadcast to a node, which adds it to a new batch of unconfirmed transactions on the network, called a block. For a block to be finalized and added to the blockchain, a miner needs to validate the transaction and solve for a proof-of-work for the block.

Blocks are secured using cryptographic hash functions, which are mathematical functions used to map arbitrary lengths of data to a fixed size. Given the same input, a hash will always result in the same output — but it’s basically impossible to reverse-engineer the input of a hash from an output. On Bitcoin, for a miner to solve a block and add it to the network, they have to hash the new block of transactions and get an output lower than the current target difficulty of the network.

Because transaction data is hashed, if a single piece of that data is changed — say that an attacker is trying to double-spend a transaction — it would result in a completely different output. That means that to double-spend a transaction, an attacker would have to find a solution to the block and any subsequent blocks that have been added to the network — which would take over 51% of the computing power on the network.

We’ll dig more into how proof-of-work mining works in the next section, but the key insight here is that Bitcoin incentivizes miners economically to contribute their computing power to help secure the network and finalize transactions in blocks.

Because each block includes a hash of the transaction data along with a reference to the previous block, each new block added to the chain helps secure the entire network of transactions.

Bitcoin mining: like mining gold, but with computers

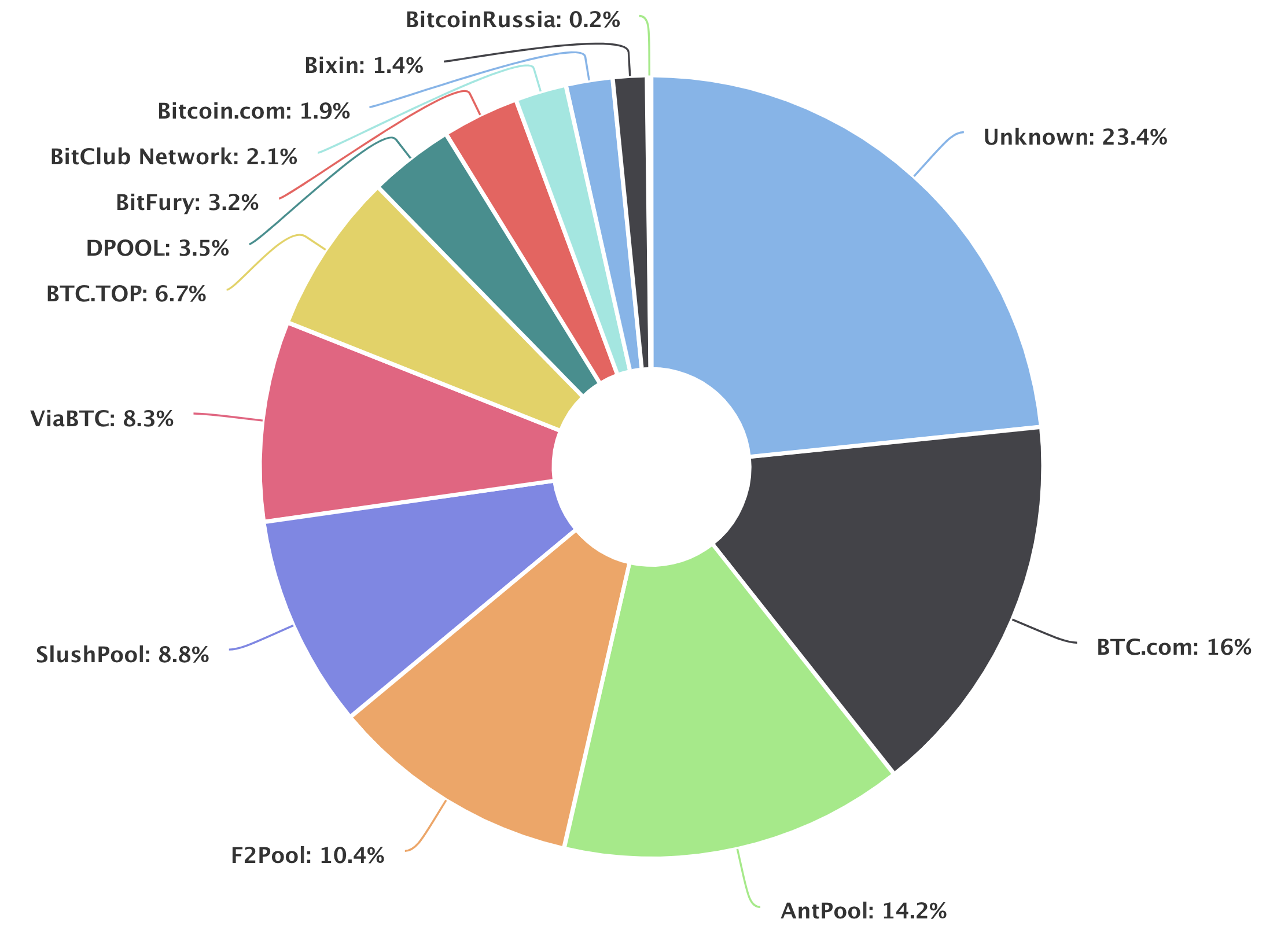

Mining Bitcoin blocks takes a considerable investment of computing power, more than many individuals are willing — or even able — to commit. The bulk of bitcoin mining is done by mining pools: a way for miners to collectively pool their resources and earn rewards proportional to the amount of hash power that they contribute.

BTC.com, Slush Pool, ViaBTC, and AntPool are currently the top four Bitcoin mining pools. Together, these four pools are processing over 50% of all bitcoin transactions.

Miners keep the gears of the Bitcoin network turning. Miners are responsible for adding new blocks of transactions to the blockchain, and, in the process, they help secure the network. In return, they’re given a block reward — a certain amount of BTC — for each block that they help mine.

Mining Bitcoins blocks is a competitive lottery. Miners process transactions by solving a computationally intensive mathematical problem, a process known formally as “proof of work.”

Miners solve for a proof of work by applying a cryptographic hash function to the transaction data along with a reference to the previous block, aiming to produce a hash under a specific target value.

The only way to find the correct value is to try a bunch of different combinations. At the current network difficulty, that means calculating 2.6 x 10²² different hashes. Because this value essentially proves the compute power contributed to finding it, it’s known as a proof of work.

Solving for proof of work is time-consuming and expensive, but once it’s produced, it’s easy for the rest of the network to verify it. In exchange for contributing compute resources to secure the network, miners are rewarded with a block reward — a fixed number of BTC — and any transaction fees associated with the transactions on the new block.

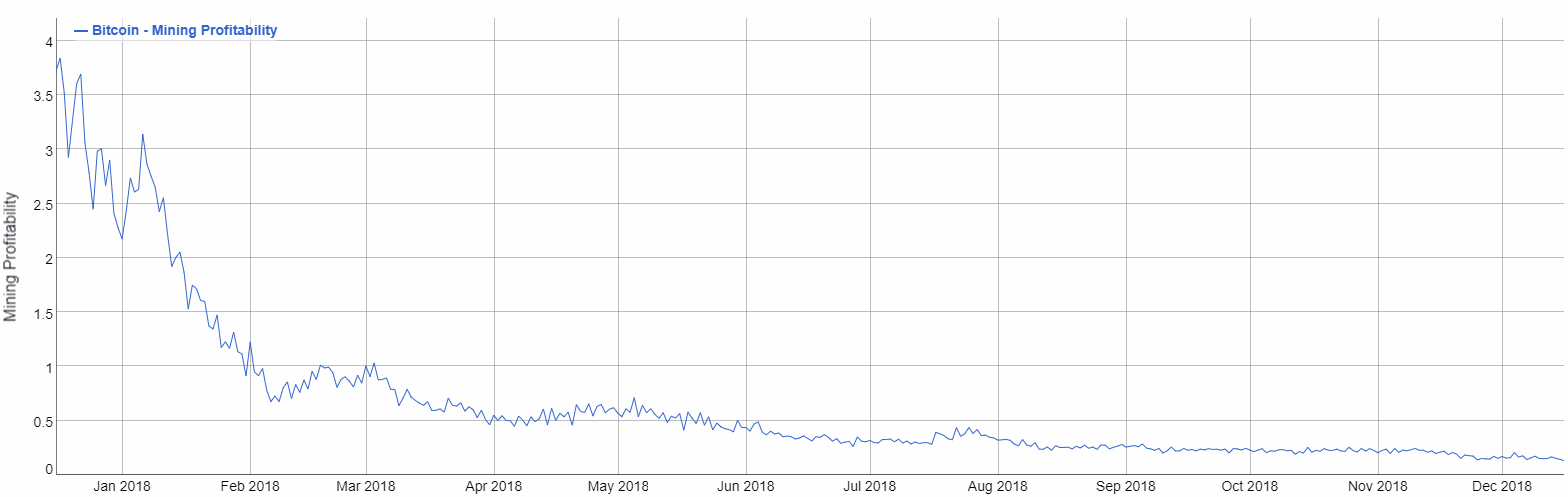

Mining profitability varies over time depending on the value of the mined coin, the difficulty level, and the offered transaction fee. Lately, Bitcoin mining profitability has dropped due to the steep decline in BTC prices.

The Bitcoin protocol sets a target to add a new block approximately every ten minutes. To achieve this, every 2016 blocks — or, roughly, every two weeks — the protocol calculates the average time it took to produce each block over the past two weeks. If it took less than ten minutes to produce each block, the mining difficulty increases in order to lengthen the time it takes to add a new block. On the other hand, if it took more than ten minutes, the difficulty decreases in order to shorten the time it takes to add a new block.

A valid hash has to have a certain number of zeros at the beginning to qualify. If blocks are coming in faster than once every ten minutes, the Bitcoin software makes the validation process harder by making a difficulty adjustment and requiring more zeros at the beginning of the hash; if blocks are coming in more slowly than desired, it makes the validation process easier by dropping some of the required zeros.

What impacts BTC’s price

Unlike fiat currencies, BTC isn’t backed by a government entity or central bank — nor is BTC supported by the value of a corporation, as stocks are.

Like any other asset, BTC’s price is generally determined by market supply and demand. Here are some of the factors that may impact that supply and demand:

- Protocol governance

- Government regulation

- Public opinion

We’ll walk through each of these below.

Protocol governance

Bitcoin is governed by majority rule rather than by a central authority. Although its original rules were set by Satoshi Nakamoto and other early Bitcoin developers, if users, miners, and developers reach a consensus about it, those rules can change. Any such changes — as is the case to foundational changes in any asset — could potentially impact price.

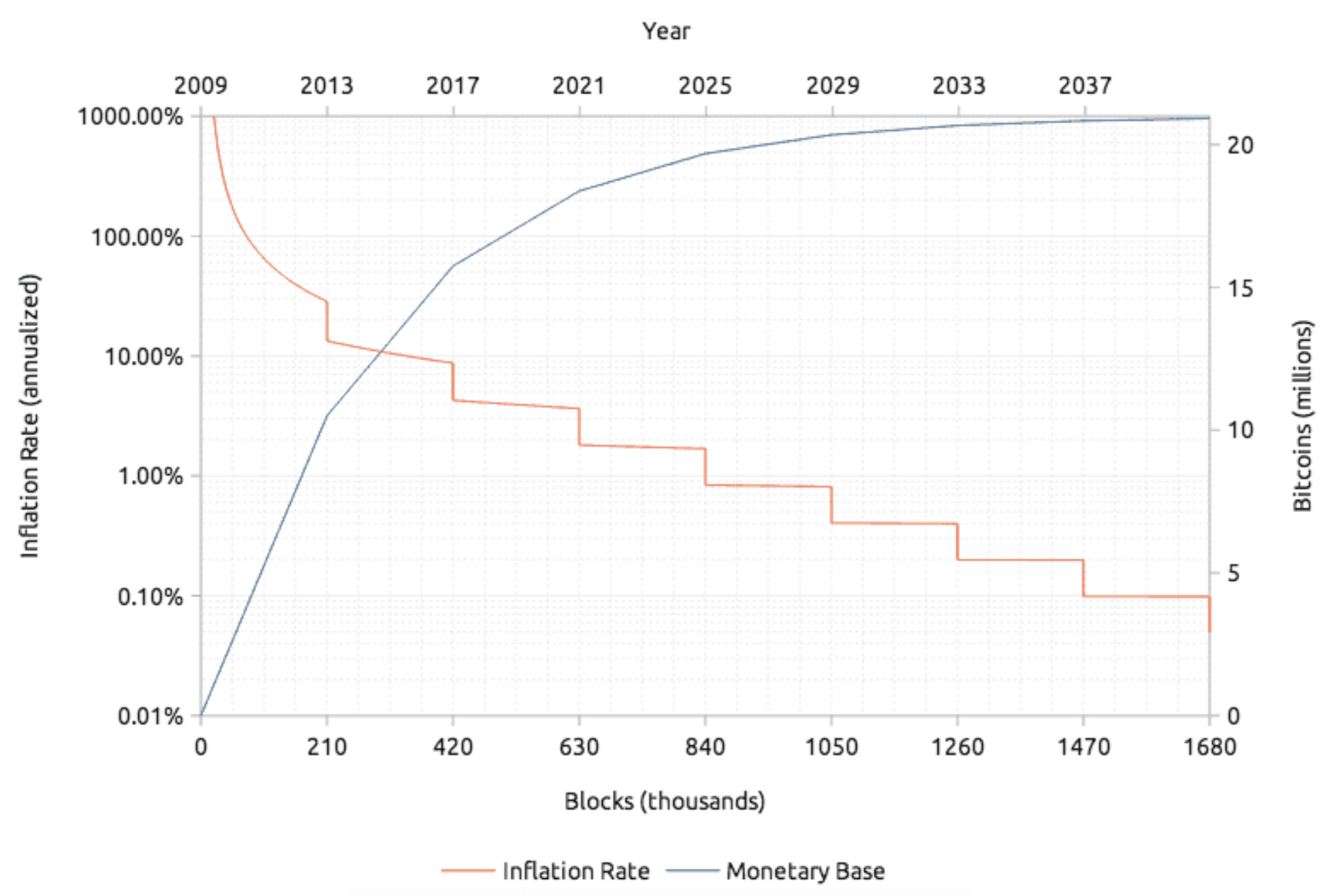

For example, the total number of BTC is capped at 21 million, which minimizes the effects of inflation. If Bitcoin changed this limit to increase the supply of Bitcoin, the increased supply would theoretically exert downward pressure on the price of BTC.

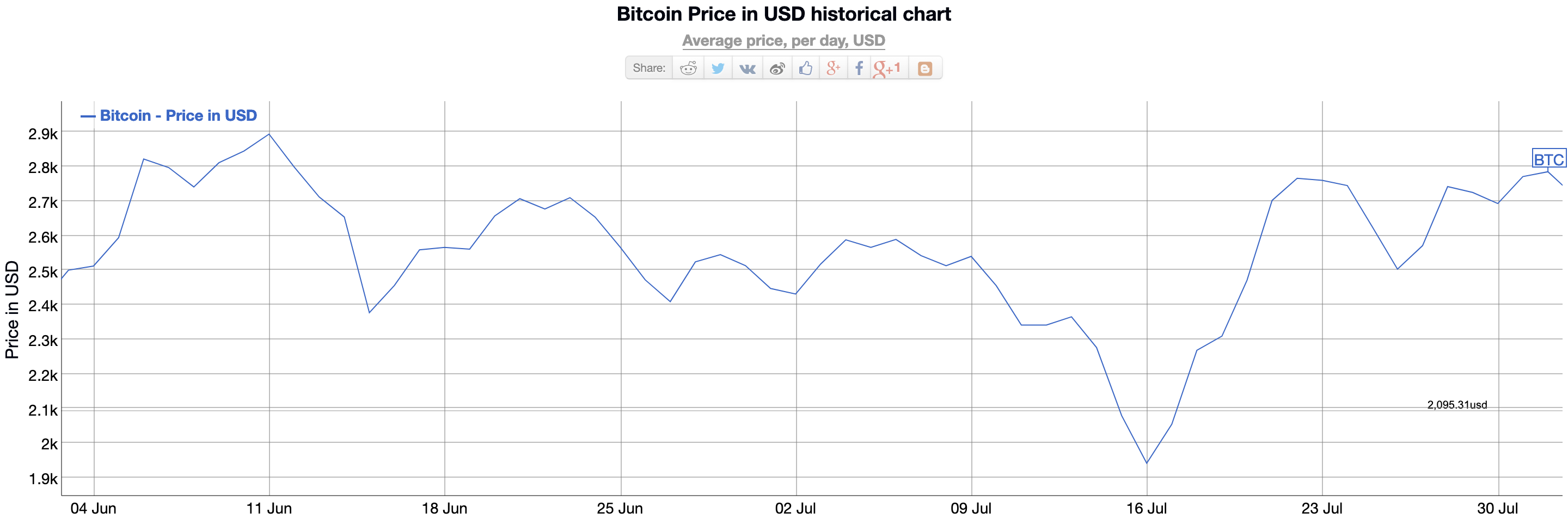

Hard forks from the Bitcoin protocol also have the potential to impact price. In anticipation of the August 1st 2017 Bitcoin Cash hard fork, BTC dropped from a high of $2,894 in June to $1,941 on July 16th — a 36% drop. After the hard fork furor died off, the price of BTC rebounded in August.

Public opinion

The general public tends to go through cycles of enthusiasm and discouragement about various assets and asset classes. As a digital currency where value is embedded into the protocol, Bitcoin is subject to extreme “hype cycles.” When the news cycle is awash with positive headlines and stories about Bitcoin’s potential, BTC’s price has the potential to swell as traders pile in afraid of missing out — for example, when the CME Group launched trading for Bitcoin futures. At the other end of the cycle, a negative public outlook could potentially lead some traders to sell their BTC holdings, negatively impacting BTC’s price due to increased supply — for example, following the Mt. Gox hack of 2014.

Government regulation

Regulatory agencies across the world are still in the process of deciding exactly how to classify BTC and other cryptoassets. This uncertainty has been a major driver of the volatility we’ve seen in BTC and other cryptoassets over the years. As various government agencies begin to provide regulatory guidance, the resulting rules could theoretically move the price of BTC in either direction, depending on how investors interpret those rules. China’s decision to ban the trading of Bitcoin and other cryptocurrencies in September 2017, for example, corresponded with a downward movement in price.

What’s next for Bitcoin

The developers of Bitcoin aren’t resting on their laurels. Bitcoin is both a currency and a technology, and the value of the protocol depends on its ability to improve that technology over time.

There are several improvements in the works to be implemented over the next couple of years, focusing on helping the network scale and improving privacy:

- Lightning Network — a secondary layer on top of a blockchain protocol that allows users to transact off-chain. The goal of the Lightning Network is to speed up transactions and make them a lot cheaper, allowing the blockchain to scale. Lightning Labs’ Lightning implementation launched on Bitcoin and Litecoin on March 15th, 2018 and performed well on a small scale. A larger rollout is underway in 2019.

- Bulletproofs — a method for concealing transaction information to add privacy for cryptocurrency users. Altcoin Monero added Bulletproofs in October 2018; if this update proves successful, Bitcoin may follow suit.

- Schnorr signatures — a new and improved digital signature algorithm that allows multiple hashes to be aggregated into a single signature. It’s intended to shrink transaction sizes and increase privacy for simultaneous transactions. Schnorr signatures have been under development for several years, and as yet, there is no release date.

Bitcoin has come a long way since its initial launch when Satoshi Nakamoto and Hal Finney were the only people active on the protocol. Today, Bitcoin remains the oldest and largest cryptocurrency by market cap, having survived and thrived over the past ten years. Active development is the key to propelling Bitcoin to greater heights and solving some of its challenges around scalability. With Bitcoin’s move into Layer-2 scaling solutions and more efficient transactions, one thing is certain: it’s an interesting road ahead for Bitcoin.

Looking to get the SFOX edge on your BTC trades? Sign up and start using our trade algorithms to buy and sell BTC across the leading crypto exchanges from a single account.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.