On January 3rd, 2018 (the 9th anniversary of the launch of Bitcoin), Ravencoin, an open-source project born from a fork of Bitcoin’s code, was born.

In a blog post about the project two months ahead of its release, the Ravencoin development team made a prescient observation about the future of asset management in the world of blockchain:

In the new global economy, borders and jurisdictions will be less relevant as more assets become tradable and trade across borders grows increasingly frictionless. In an age where people can move significant amounts of wealth instantly using Bitcoin, global consumers will likely demand the same efficiency for their securities and similar asset holdings.

Ravencoin was built to satisfy that demand by acting as a platform for simple and efficient asset creation, issuance, and management. As part of the launch of RVN trading on SFOX, we’ve put together this guide to help you understand the history of Ravencoin as a project and the history of RVN as a crypto asset.

The Bitcoin of Asset Issuance — Literally

Back in the ICO boom of 2017, the Ethereum blockchain made a name for itself as the home of the ERC-20 standard, which served as the de facto default option for the creation, issuance, and management of tokenized assets. However, as the Ravencoin developers observed in their 10/31/2017 blog post, a token standard is not the same thing as a blockchain that has been designed from the ground up for the purpose of tokenized asset creation, issuance, and management.

The Ethereum blockchain was designed to be extremely flexible in its programmability, and while that may have been desirable from the perspective of aiming to build a worldwide, blockchain-based supercomputer, it may have also potentially contributed to the regulatory troubles that some ICO-funded projects encountered: with few limits or compliance-oriented functions coded into the blockchain, it was relatively easy for people to create and sell tokens without even thinking about applicable regulation laws, let alone abiding by them.

Ravencoin aims to be a blockchain that was built from the ground up with asset management and compliance in mind. The original developers forked it from Bitcoin’s codebase because, as Ravencoin developer Tron Black told SFOX, “it seemed to have the most stable codebase” — but, whereas Bitcoin is designed to function as money and a store of value, Ravencoin is meant to function as an asset management platform.

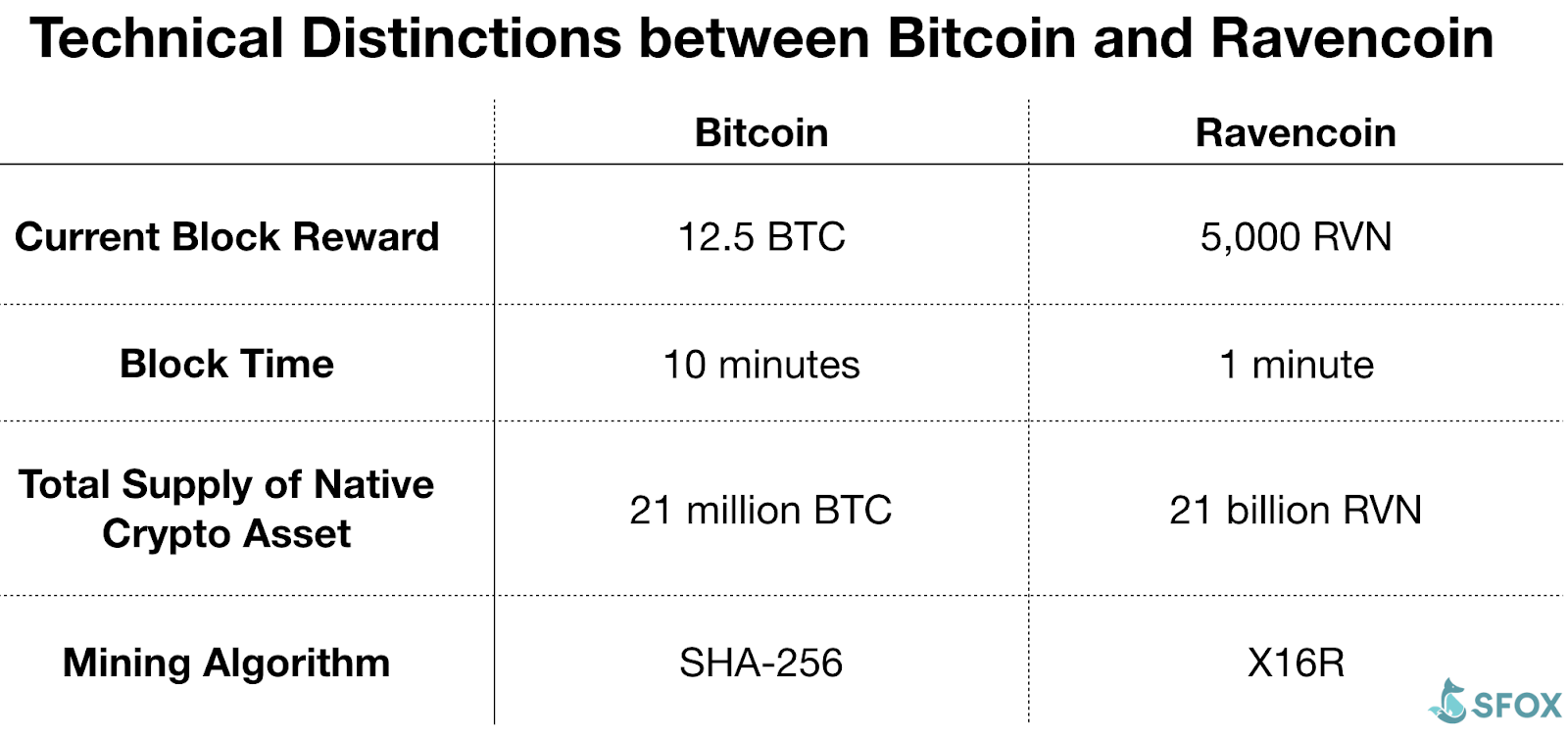

On a technical level, there are four key distinctions between the Bitcoin and Ravencoin blockchains:

On a philosophical level, Ravencoin as a project is self-consciously focused on running an open and equally accessible network: the open-source ravencoin.org, which serves as the central hub for the decentralized project, highlights that Ravencoin had no pre-mine, no ICO, no coins withheld for developer or founder rewards, and that its X16R mining algorithm is specifically designed to resist the development of ASICs in order to allow virtually anyone to mine RVN in perpetuity.

Ravencoin allows anyone to create assets that can be either fungible or non-fungible, scarce or unlimited, and unregulated or programmed to operate in accordance with applicable regulations (e.g., U.S. securities laws). It allows metadata to be attached to tokens identifying what it is that they represent; it allows users to append messages to asset transfers (e.g., to identify the reason behind the transfer or the intended use of the asset), and it also allows asset issuers to send announcements to asset holders to, for example, coordinate voting on issues pertinent to the asset in question.

Ravencoin maintains a list of supported projects and tokens on its wiki, but here is a selection to give readers a sense of the widely varying use-cases that the blockchain enables:

- Cap table management

- Wine trading and management

- Fund management for private investments

- Publishing rights and licensing administration

- Regulated security token issuance

- Tokenized water supply

And, given that Ravencoin is just two years old, there’s reason to believe that this is just the tip of the iceberg in terms of the potential range of projects possible on the network.

Where Does RVN Fit In?

In the case of a blockchain that focuses specifically on asset creation and issuance, it’s fair to ask how the blockchain’s native asset — in this case, RVN — fits into the equation. Tron Black told SFOX that RVN’s relationship to the Ravencoin blockchain is similar to gas’s relationship to the Ethereum network and ERC-20 tokens: it helps to fuel the network in the form of (1) RVN burned to create new assets (500 RVN must be burned to create a new asset, and a total of 3000 RVN must be burned to create a “restricted asset” compliant with specific regulatory burdens) and (2) fees paid for asset transfer. RVN can also be used as a method of value transfer like BTC or cash, but that isn’t its primary use-case.

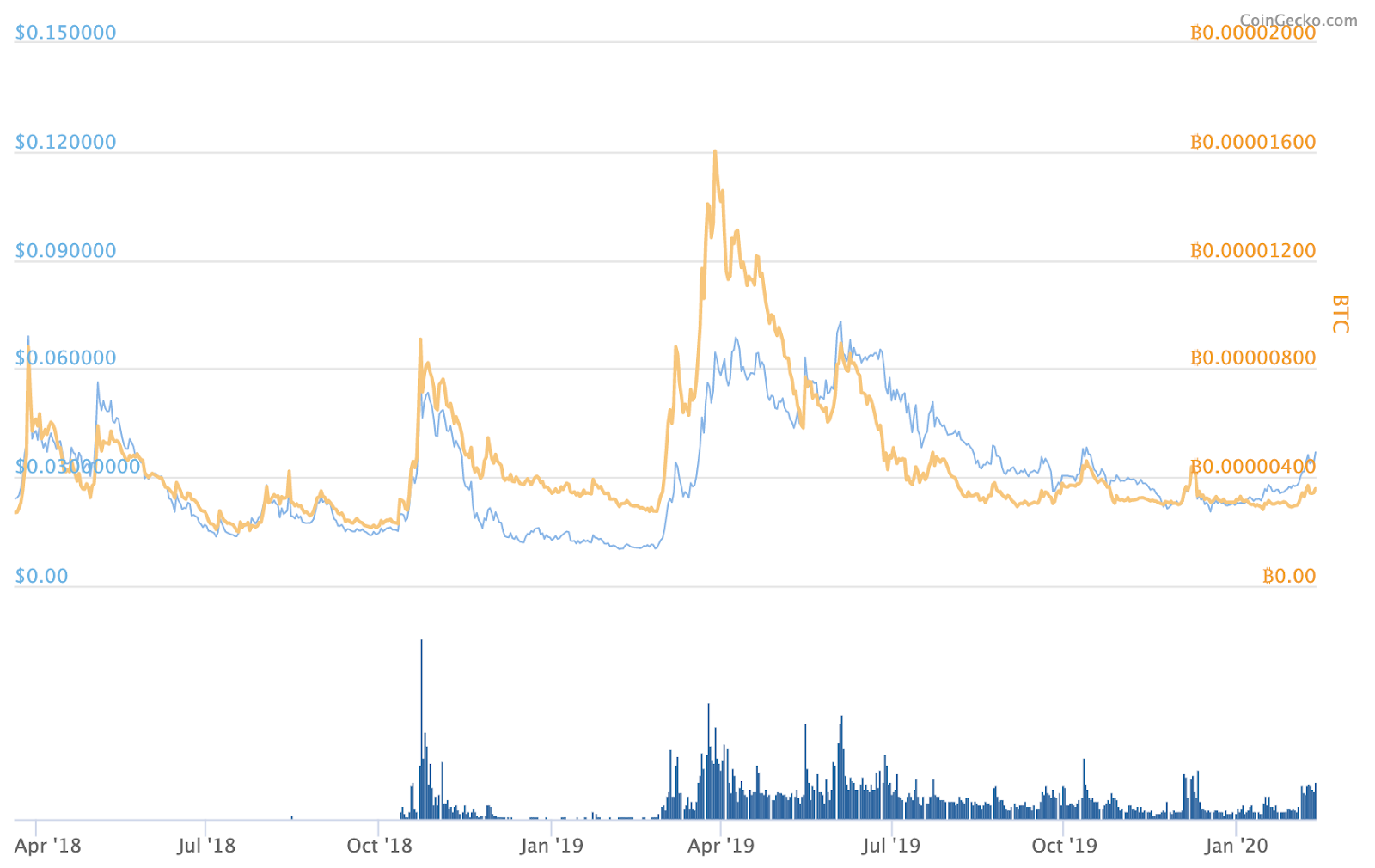

In the time from its launch through February 12th, 2020, the price of RVN has ranged between $0.0101 (on February 6th, 2019) and $0.0789 (June 3rd, 2019). Denominated in BTC (most RVN trading happens in the RVN/BTC pair), the price of RVN has ranged between 0.00000199 BTC (on July 17th, 2018) and 0.00001603 BTC (on March 28th, 2019). At the time of writing on February 12th, 2020, RVN has a market cap of $202,707,011 and a price of $0.037.

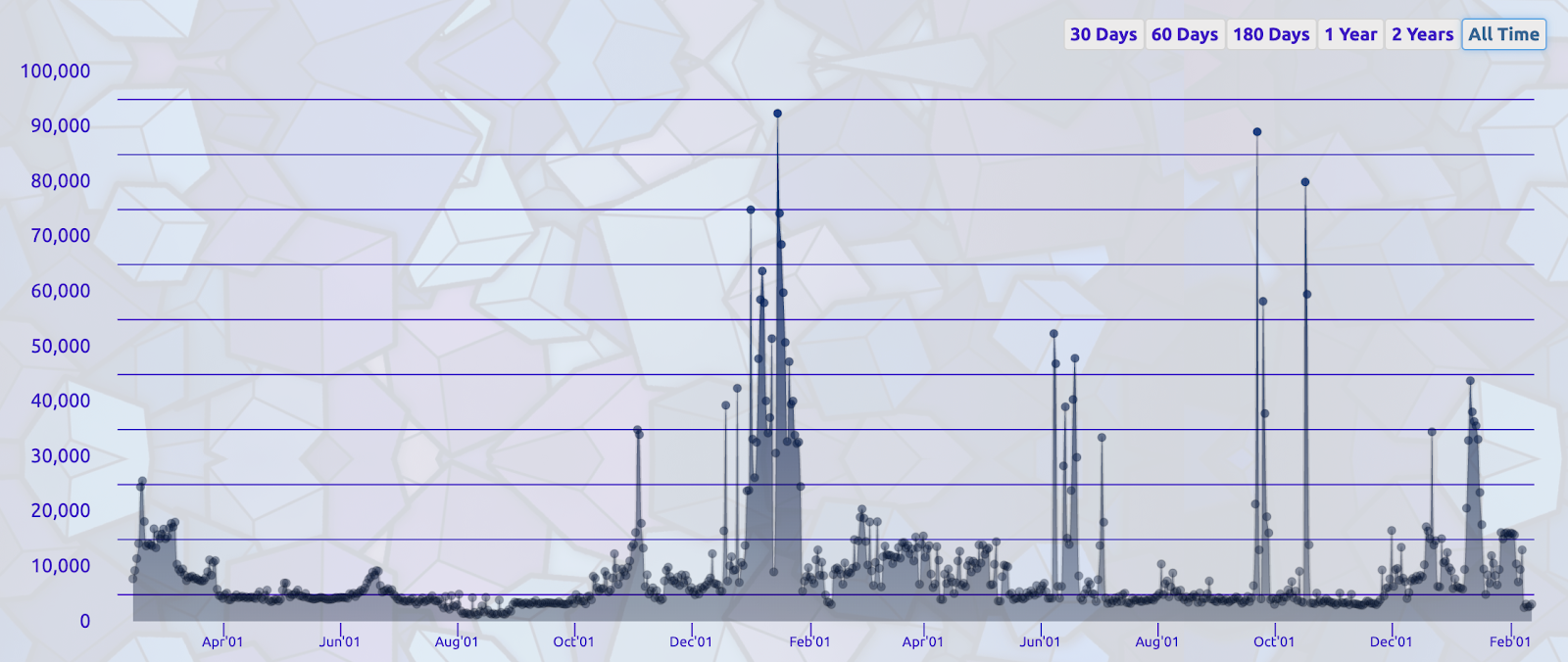

The number of daily RVN transactions in the network’s history has typically ranged between 3,000 and 5,000 transactions per day, with some significant periods of increased transaction volumes. Daily transactions peaked on January 15th, 2019, at 92,374 transactions in one day. Since the middle of last November, RVN has been seeing elevated transaction volume, with a local peak of 43,781 transactions on January 11th, 2020.

If the network continues to grow and RVN continues to be burned through asset creation and spent in transaction fees, it’s theoretically plausible that demand for RVN may increase. Time will tell how quickly that growth happens as new RVN-fueled projects are added to the network.

What will the future of assets look like?

The decentralized Ravencoin community has planted its flag in the sand claiming that the future of assets is decentralized tokens managed on a blockchain, and that’s the one thing their network was built to do. While many have discussed tokenization use-cases ranging from real estate to art to supply chain management, it remains to be seen whether asset tokenization will become the new norm, an essential aspect of just a handful of businesses, or something else entirely.

But no matter what the tokenized future looks like, a platform built around asset management will need reliable liquidity for its core crypto asset — and SFOX is proud to be providing traders, institutions, and service providers with that liquidity for RVN. When you’re looking to get the best price execution on your RVN trades by trading across all major RVN liquidity providers from one account, sign up for SFOX and get started.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.