In 2015, Gavin Andresen, a prominent Bitcoin Core developer, published a Bitcoin Improvement Proposal (BIP) proposing a hard fork to the Bitcoin protocol that would double the maximum block size every two years. This struck at a fault line within the community.

A new block of transactions is added to the Bitcoin network every 10 minutes, which means that the throughput of the network — or the speed that it can process transactions — is limited by how big the block is, or, equivalently, how many transactions can fit inside each block. Andresen believed that bigger blocks would help the network scale. Many others disagreed, arguing that bigger blocks made it harder for people to run nodes on the network, compromising decentralization and potentially posing security risks. Without increasing the block size, however, it was hard to see how Bitcoin could scale.

In 2016, Joseph Poon and Thaddeus Dryja published a paper hoping to solve all of this by proposing a network of micropayment channels that could settle BTC transactions outside of the Bitcoin blockchain (a.k.a. “off-chain settlement”), thereby alleviating the load on the main Bitcoin chain. It’s what we refer to today as the Lightning Network.

In this article, we’ll dive into what the Lightning Network is, why it matters, and how far along it’s come today since the original 2016 white paper.

How Do Lightning’s Payment Channels Work?

Bitcoin is able to work as a decentralized peer-to-peer currency because it stores every single transaction ever made in the history of the network. The speed at which nodes and miners can validate transactions puts a bottleneck on the network’s scalability at roughly one megabyte of transaction data every 10 minutes. This is where the Lightning Network comes in.

When Satoshi Nakamoto created Bitcoin, his goal was to create a decentralized, peer-to-peer, digital cash. But with the current state of the network, there is no way that Bitcoin, on its own, can scale to compete with existing payment solutions — Visa, a commonly cited example, can process 65,000 transactions per second, while Bitcoin’s transaction throughput is currently closer to 4.6 transactions per second.

Lightning was originally designed to solve this problem for Bitcoin, but it can be implemented on other blockchains as well. The Lightning Network is built around two-way payment channels, which are a way of combining many small transactions into a single, large transaction through cryptography.

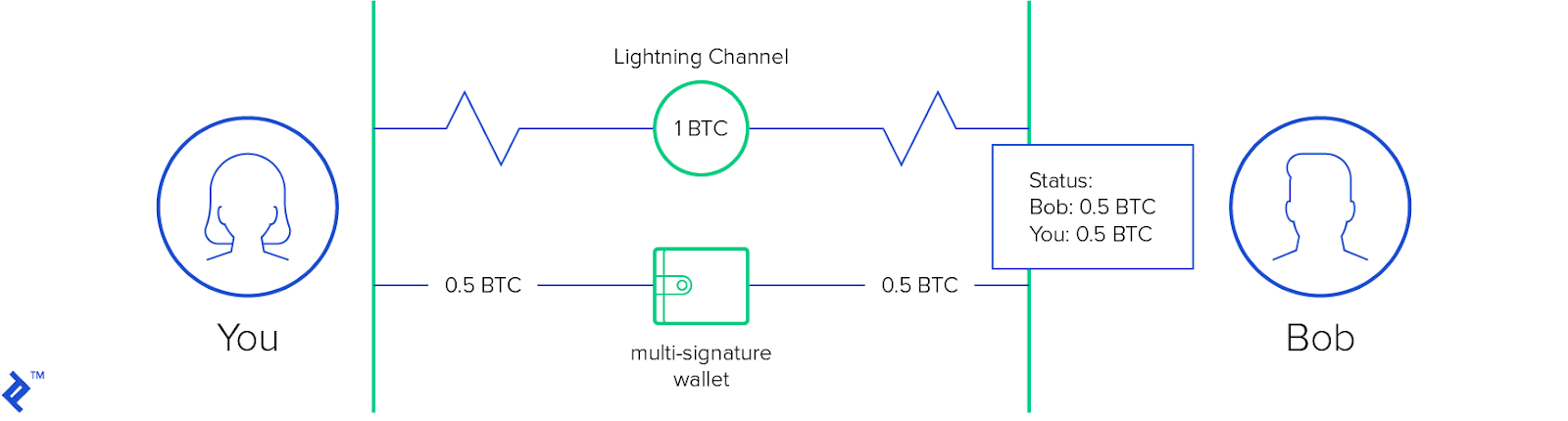

Let’s say that two parties know that they’re going to transact with each other frequently, so they don’t want to continually pay network fees or wait 10 minutes for a transaction to settle. Instead of broadcasting transactions on a node, a payment channel is created between the two parties (let’s call them Alice and Bob) using a multisignature address on the blockchain, which is signed by the private keys of both parties. At least one of the parties needs to deposit Bitcoin into the address. This address essentially works to put the funds in escrow, only allowing them to be unlocked once both parties agree. It operates as a balance sheet that will record future transactions.

Since the payment channel has been established, Bob can send Alice 0.01 BTC without needing to be validated by a miner on the main chain. Alice and Bob cryptographically sign each transaction, which works as a receipt against the funds in the wallet. As long as there are enough funds in the wallet, Alice and Bob can send thousands of transactions between them nearly instantly because these transactions are occurring off the main chain. Once Alice and Bob decide to close the channel, the payment history is calculated into a single transaction and settled onto the Bitcoin network.

Lightning Network is a bitcoin cache that allows you to delay settlement in order to save on fees and make instant payments. Bitcoin cache is Bitcoin. 😎

— Jameson Lopp (@lopp) December 29, 2017

In the example above, payment channels basically operate as nodes on the Lightning Network. Because each transaction is signed cryptographically, it’s not possible for Alice or Bob to cheat the system or steal funds. The Lightning Network also allows transactions between nodes: if Alice and Bob have a payment channel and Alice and Jason have a payment channel, then Bob and Jason can send each other lightning transactions. These transactions are a kind of unconfirmed Bitcoin transaction that is guaranteed by the funds put in escrow when the channel is opened.

Currently, the fee for a median transaction of .04 BTC is around 0.00011 BTC ($.08 today). On the Lightning Network, the median fee rate is a single satoshi, ($0.000071198 today). While the fees between networks are difficult to compare, as Lightning supports much smaller transaction sizes than the main network, and fees are set by node operators, fees remain substantially lower than they are on the main chain.

While Lightning enables faster and more scalable payments, ultimately, all of these transactions are settled back on Bitcoin’s main chain. The idea is that this will help Bitcoin to scale by decongesting the network and making more efficient usage of Bitcoin’s limited block size by taking small transactions off-chain. Lightning Network allows for fast, nearly instant transactions — while at the same time benefiting from the security provided by Bitcoin’s proof-of-work algorithm.

The Growth of Lightning

While the Lightning Network remains a new technology, it’s been growing rapidly since its inception — although there is still a ways to go to achieve its goal of cheap and fast payments on the Bitcoin network.

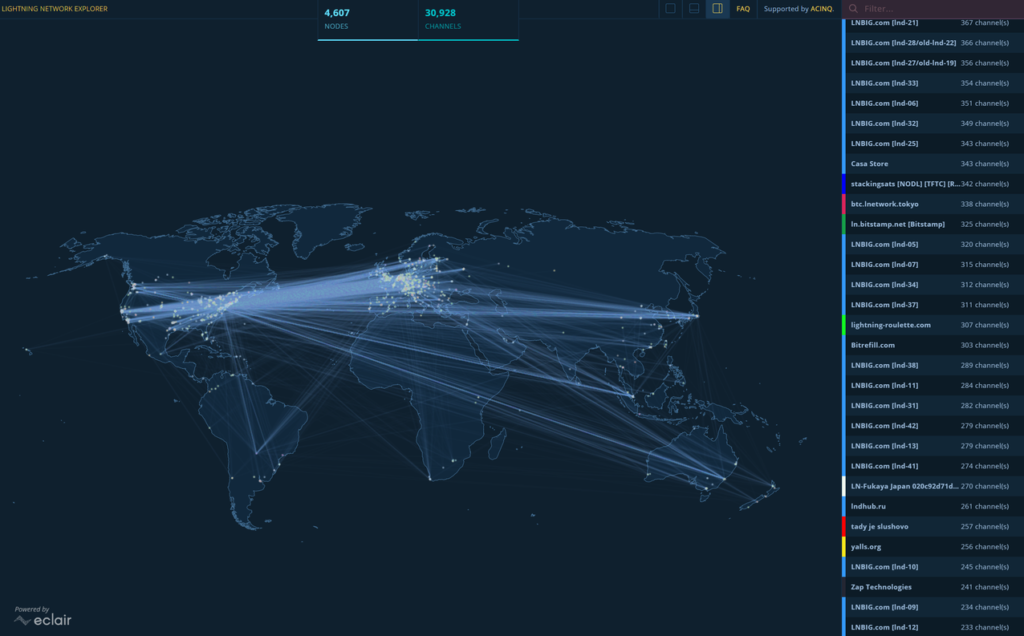

There are currently two core implementations of Lightning. In January 2018, Blockstream launched its c-lightning implementation, operating with 60 nodes written in the programming language C. In March 2018, Lightning Labs launched a beta version of its own Lightning implementation written in Go. Fast forward to today, and there are currently 10,254 nodes on the Lightning Network with over 35,000 channels.

As Blockstream’s Samson Mow told SFOX in an interview:

[Bitcoin’s] not good for everyday use because you shouldn’t be making payments with it: you should be making payments over the Lightning Network because that is instantaneous and almost free. That’s what it was designed for. Everything is designed for a different purpose. Bitcoin was designed for settlement and wealth transfer…..Lightning was designed for fast payments and cheap payments.

The technology behind the Lightning Network payment protocol can be implemented in sidechains, which allow for the transfer of digital assets between multiple blockchains. An example of this is Blockstream’s Liquid sidechain, which acts as a settlement network for Bitcoin between large exchanges. Liquid also recently launched Tether on the network, with plans to include more tokenized assets in the future. Blockstream’s implementation of c-lightning now supports the Liquid sidechain, which can allow for instant micropayments on the network.

While the technology behind Lightning is exciting, it still has a ways to go before mainstream adoption. Lightning on Bitcoin currently has a network capacity of only 824.72 BTC, or around $5.8 million at today’s prices. That’s only around .005% of Bitcoin’s current circulating supply. The Lightning Network is designed specifically for microtransactions, which can make it difficult for larger payments to go through. A 2018 study showed that there was only a 1% chance for a $200 payment to succeed on the network — although continued development of the Lightning Network should help with this.

While Lightning is off to a promising start, for it to succeed and become more widely adopted, it needs to continue to grow not only in terms of payment channels but also in the ecosystem of applications and businesses built around it.

A Long Road to Adoption

Lightning Network poses a solution to one of the most pressing issues facing Bitcoin and other proof-of-work blockchains: scalability. The problem of scalability was so contentious within the Bitcoin network that it led to the Bitcoin Cash hard fork, splitting the network in two.

The rise of the Lightning Network proposes to put that into the rear-view window and advance a way for Bitcoin to perform fast and cheap payments, reducing the load on the main chain while maintaining its security guarantees. Lightning still has a long way to go, and problems to solve around privacy, usability, and adoption — but it’s off to a promising start.

The above references an opinion and is for informational purposes only. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Seek a duly licensed professional for investment advice. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. or its affiliates to any registration requirement within such jurisdiction or country. Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. or its affiliates to buy or sell any cryptocurrencies, securities, futures, options or other financial instruments or provide any investment advice or service.