Customizable credit for maximum efficiency

sFOX Post-Trade Settlement (PTS) is a bespoke credit structure for select institutional clients that creates a seamless post-trade process of efficient capital deployment, delayed settlement, and risk management.

Hold positions longer, simplify settlement processes, and easily manage risk.

Enjoy extended settlement periods of up to T+28 days. Hold positions longer without immediate liquidity needs.

This eliminates manual intervention and reduces errors. Pre-trade, trade, and settlement activities are seamlessly integrated for maximum efficiency.

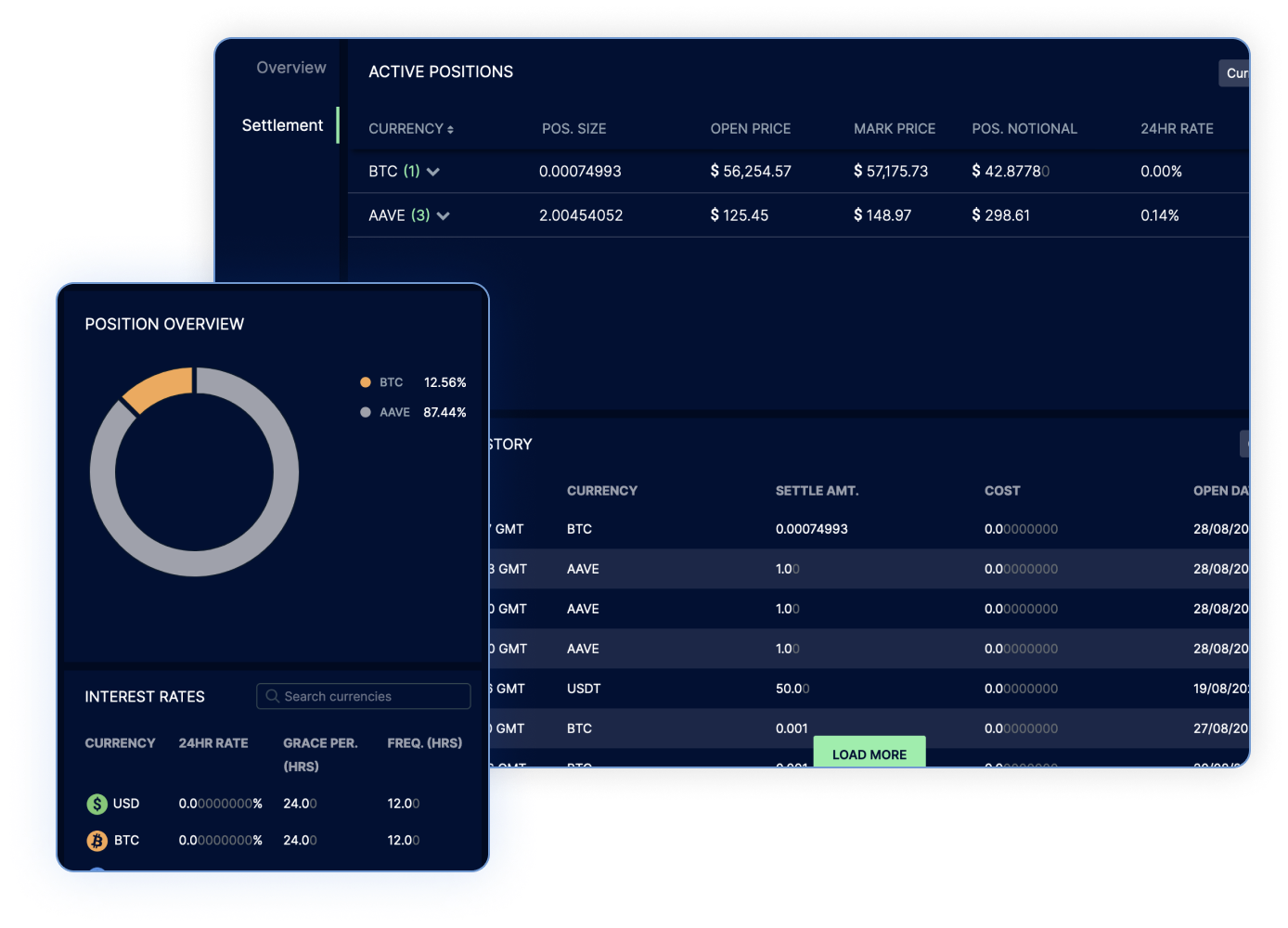

Access real-time data on active positions, settlement history, and interest charges through our intuitive user interface or API, ensuring complete transparency and control of risk.

Positions

Open long or short positions with ease–simply trade beyond your balance.

Funding

Competitive funding rates and flexible terms for intra-day and long-term positions.

Settlement

Positions settle automatically as you trade or transfer assets to/from your account.

Maximize balance sheet

Use our bespoke credit structure to capture market opportunities at lightning speed. Our integrated solution enables seamless credit deployment & streamlining of operations.

Cross-collateralize

Simplify risk management by offsetting gains and losses across your entire portfolio, including staked and bankruptcy protected custodial assets used as collateral.

Competitive funding

Enhance your capital efficiency with competitively priced credit aligned with short-term financing markets.

On demand access

Borrow to deploy a variety of assets within seconds seamlessly to empower your trading operations while reducing typical credit logistics.

Scale

Take advantage of scalable credit options that exceed the usual limits imposed by exchanges, allowing you to trade all USD, USDT, and BTC pairs.

Slow and steady wins nothing

Accelerate your advantage with access to more opportunities in the digital asset class.